Unique way

In what could be a unique way to focus attention on the issue of poverty and how it could be tackled, the World Bank in its World Development Report 2014 points to the need for risk management by all economic units in an economy. Risk is associated with uncertainty of the outcome of a decision. The outcome could be a success or a failure, but it is the possible loss from failure that is most devastating and tends to limit risk taking. That risk also has opportunity for success has prompted the Bank to see risk management as a “powerful instrument for development.” It feels that risk management is a tool that is capable of helping people to build resilience, thereby “reducing the effects of adverse events [and] allowing them to take advantage of opportunities for improvement.” This human-inclusive focus is a radical departure from the standard menu of concerns that have been previously served up by the Bank in trying to address poverty and development, and brings people closer to its centre of development focus.

Allocation of resources

Risk

While the efficiency and equity concerns remain important, the World Bank has now determined that allocation of resources is often dictated by the risk and size of the risk that a country faces. The Bank identifies two types of risk. One is called systemic risk while the other is called idiosyncratic risk. Systemic risk stems from factors beyond one’s control such as natural disasters and epidemics, and usually affects entire communities or is transmitted across the globe and affects multiple countries at the same time. This is the type of risk for which it is hard to prepare and is virtually impossible to avoid once it occurs. For example, a bad crop in a major rice producing country could lead to a spike in the price of rice across the world. Similarly, excess production of sugar could lead to a fall in the price of sugar across the world. Within the last six years, Guyana has been the beneficiary of systemic risk as a result of the economic and financial meltdown experienced by the USA and other countries in 2008. Nervous investors around the world have been using gold as a safe haven for their money since they had very little confidence in the value of other assets. Even though prices have fluctuated, gold prices have remained abnormally high for over five years.

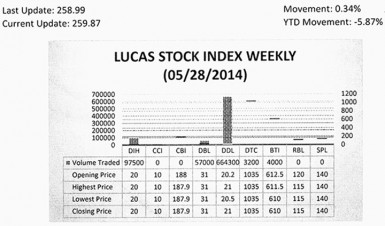

The Lucas Stock Index (LSI) rose 0.34 per cent during the final period of trading in May 2014. The stocks of five companies were traded with a total of 826,000 shares changing hands. There was one Climber and one Tumbler. The value of the stocks of Demerara Distillers Limited rose 3.96 per cent on the sale of 664,300 shares while the value of the stocks of Guyana Bank for Trade and Industry (BTI) fell 0.41 per cent on the sale of 4,000 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 97,500; 57,000 and 3,200 shares respectively.

Idiosyncratic risk occurs at the personal or household level and could come from many sources, including job loss or illness. A person has control over his or her behaviour, but there are still circumstances which cannot be controlled entirely. For example, a family with low income could do nothing to protect itself when there is a rise in the price of food. This concept of risk has significance for many Guyanese. Estimates indicate at least 25 per cent of Guyanese households could be in a vulnerable economic situation in which higher movement in food prices increases their vulnerability and pushes them further into poverty. Those are the ones who must share less than 8 per cent of the income earned in the country. From the reading of the report, the sum total of a country’s risk is made up of the risk facing each economic unit, namely households, businesses, civil society and the government.

It is not easy to aggregate risk into one total since risk means different things to different people. However, the Bank recognizes that the world is constantly changing and is producing shocks which affect individuals and whole communities. The shocks could be positive and negative. They could occur gradually or occur suddenly as with an earthquake. The impact of the shocks is influenced by factors in what it calls the risk chain. The risk chain comprises the shocks, the extent to which a household is exposed to the external environment, the internal conditions and the risk management. The external environment could be crucial for families in some countries, especially countries in which remittances from migrant workers make up a big chunk of the families’ disposable income. For example, a family which depends on remittances would be devastated by the death of the benefactor, the benefactor’s loss of job or war which displaces the benefactor.

Conditions

To the credit of the Bank, it acknowledges that the decision at the household level of how it would mitigate and manage risk is just as important as what happens elsewhere in the economy. So, it is not only the business unit that matters and how well private enterprise does. The focus on risk management is also about how well individuals are doing and whether the conditions under which they exist are helping or hurting their chances of economic progress. After all, the economic and social risks that businesses face are dictated often by what happens at the level of the household, and their combined impact determines how the government behaves.

Domino effect

Unemployment in the household from illiteracy or low education and loss of income from redundancy, disease or death reduce demand for goods and services and could produce a domino effect throughout the economy. Where spending by households falls precipitously, the stimulus spending by the government usually becomes important. Under the fresh perspective of risk management, an instrument that has been in existence for a long time, the Bank feels that economic growth and development would be made possible if the risk management efforts of each economic unit complemented the other and could be properly coordinated.

In making its case for better coordination of risk management, the Bank acknowledges that “risk management can save lives. It can avert damages and prevent development setbacks. Risk management can unleash opportunity. Risk management tools could help people mitigate risk.” The Bank also argues that focusing on the process of risk management allows it to consider the synergies, trade-offs, and priorities involved in addressing different risks in different contexts, with the single motivation of “boosting development.” Some of the solutions that it offers for managing risk might be beyond the individual household or may not be available to them. The acquisition of knowledge of risk events and figuring out how to handle the risk is one solution. Another is obtaining protection. Many in Guyana already rely on private insurance to mitigate risk of fire, health and even theft. Others are unable to take advantage of such private offerings, but might have access to the public insurance system of the National Insurance Scheme.

Biggest challenge

The task of coordinating the various inputs falls to the government, but this is the biggest challenge facing a country like Guyana. The focus on risk as a tool of development is a novel way of tackling issues of development and might finally be a step in the right direction of resolving many of the issues surrounding poverty. The risk management approach however does not have an answer for the destructive disposition that the government seems to have towards several issues of national concern. There appears to be reluctance to reform the National Insurance Scheme (NIS) despite the financial crisis in which it finds itself.

In addition, the government appears to have a bias against the local labour market. Too many projects which involve foreign companies are being undertaken with restricted amounts of local input. The Fiscal (Enactment) Amendment Act of 2008 grants tax concessions to foreign companies which invest in designated regions of Guyana and who hire local workers. Yet, tax concessions are being given to companies which bring their entire labour force with them at the expense of the domestic labour force. There have also been news reports where foreign companies are able to mistreat local workers without fear of reprisal from the government which is supposed to protect local workers from such abuse.

In the case of Guyana, the advice contained in the World Development Report might be like throwing pearls to swine.