Important allies

When one thinks about Region 10, it is usually in terms of extremes. The assessment is made in either derogatory or complimentary terms. There seems to be no middle ground these days in talking about Region 10. Quite recently, Region 10 was featured in a Stabroek News article that discussed an ongoing dispute with the government over the status of the agreements signed two years ago following the Region’s struggle to prevent increases in electricity tariffs. There is strong disagreement as to what progress was made and who is to blame for the slow progress or stalemate. Members of the Region were also embroiled in an intense battle with leaders of the party to which many of them belong. And as if it is the focus of eye-pass, the story of Bai Shan Lin’s exploitative relationship with the Region keeps bubbling frequently to the top of the local news. Yet, in a contractual opportunity that involves the Guyana Defence Force (GDF), the farmers of Region 10 could emerge as important allies in the defence of Guyana.

The gateway

At risk

It always seems as if at no time are the conditions perfect to produce the most favourable outcome. That is because economic conditions are never stable, and more so in an agricultural market of perishable commodities. Economic actors have got to create the conditions of stability in which to make decisions by making assumptions based on available market data and their best instincts. Over the short term, such data and instincts might be useful. As time lengthens, the usefulness of market data and the best instincts fades away. Where economic cooperation or even collaboration is part of the process that risk is shared and that helps to increase the chance of a favourable outcome.

About choices

In private business, favourable outcomes are always measured by the commercial value and the cost-benefit of the investment. Despite how obvious it might seem, the decision is always about choices among alternatives and the most objective measure is the net present value of the future costs and revenues of each choice. Unless one is unduly careless, the cost of the investment is always known well ahead of any revenues. Quite often, a large portion of the cost has to be incurred before any future revenues could be claimed. The Amaila Falls and the Marriott hotel projects are examples of such realities. Future revenues do not have the same value as if those same revenues were available today. The project that returns the highest net present value therefore becomes the logical choice.

That is all well and good. But sometimes the choice is not between projects or products. Decision-makers are often faced with making a choice between markets, the choice of market in which to operate. This is not an academic exercise because farmers and other producers are confronted with such decisions daily. And so it is with farmers of Region 10. They must decide if to participate in a market that guarantees them prices for their farm produce for a specified period of time or if they prefer to participate in the open competitive market. This opportunity arises as a result of a collaborative arrangement between the Technology Cooperative Society Limited and the farmers of Region 10 and the award of a multimillion dollar contract to supply food to the Tacama location of the Guyana Defence Force (GDF). The farmers of Region 10 are price takers in their own market and must decide on the commercial value of a guaranteed market as against that of the open market. Both have advantages and disadvantages which must be considered in making the decision.

Interesting phenomenon

An interesting phenomenon of the guaranteed market is its structure. Usually such markets have the producers on the one hand and buyers, distributors or value-added producers on the other (agro-processors in the case of farmers). The more fragmented the market, the more difficult it is for the farmers. Anyone who deals with the production and sale of perishable commodities would know how valuable a guaranteed market is to its producers. Guyana has been the beneficiary of such guarantees for years for the export of its sugar. More recently, the export market for rice has been guaranteed with the PetroCaribe deal with Venezuela. Even before then, production of agricultural products was guaranteed with the use of marketing entities like the Guyana Rice Marketing Board for rice and the Guyana Marketing Corporation (GMC) for other agricultural products. They usually were under obligation to purchase all that the farmers were willing to sell. Floor prices, that point below which prices could not fall, served as a reassurance to farmers.

Such guarantees through artificial price setting are no longer available to farmers in Guyana. Guarantees are now gained through competitive bidding and the commercial value of the procurement contract. The most significant commercial value to the farmers is that it provides them with a ready market for their produce for a specified period of time. The other is that the price is also guaranteed for the same period of time. Because both the level of demand and the price are known, the risk to the farmers is significantly reduced. The farmer is therefore able to work with a predetermined and stable profit margin.

Cost-sharing

This market arrangement also has significant risks, and many rice farmers have been suffering under similar arrangements. They have guaranteed contracts with rice millers but these have not always been resulting in favourable outcomes for them. By the time many rice farmers are paid, their money has lost significant value and their creditworthiness shot as creditors become distrustful of them. Then there is the problem of input prices. If the price of inputs rises and becomes too close to the guaranteed price, the farmers would lose and the profit margin would become smaller. The key in this arrangement is for the farmers to keep the prices of their inputs as stable as possible during the contract period. In a case where the produce, transport and input supplier markets are all controlled by different groups, it is not an easy thing to do. The farmers would have to look for strategic ways to keep prices down. One way is to take advantage of bulk purchasing. This calls for warehousing services which would also necessitate sharing the cost of warehousing facilities.

Fractured market

In a fractured market, cooperation and collaboration become necessary. Despite the commitment to work together, there are risks that accompany such efforts at collaboration. One such risk factor is a misaligned vision. The vendor with a focus on market and logistics might miss the major preoccupation of the farmers. Similarly, the farmers with their preoccupation with price and output could miss the major preoccupations of the vendor. And it can easily to happen if there is insufficient conversation and insufficient attention to the details of the conversation. Both sides must agree on what is to be produced, when it is to be produced, the quantity to be produced, the date and time of delivery to ensure that the final consumer can get the goods on time and in the desired condition.

In working with the farmers of Region 10, the most interesting development in this arrangement is not so much the method of participation by the farmers but the perception of the role that they are playing in the process. Their produce in this contractual arrangement will go to the military. To them, it is not merely about producing food and then having it delivered to a location. They see their role as bigger than that. They see it as one in which if they fail then the security of Guyana is put at risk. Notwithstanding all the personal gains to be had from participating in the enterprise, the farmers of Region 10 see the importance of ensuring that the food security of our soldiers was met. They understand fully well that if the food security needs of the soldiers are not met then the physical security of Guyana would also be at risk. By tending their farms with that outlook, they were likely to be successful in fulfilling the guaranteed contract.

An eye-opener

This disposition was an eye-opener. For all the mistreatment that they receive as part of the Region 10 population, these Guyanese might have a broader and more patriotic vision of the country than the leaders who often shun them. By seeing themselves as part of the defence team of Guyana, the commitment of the farmers of Region 10 to the success of Guyana might be more indelible and rational than those of their national leaders.

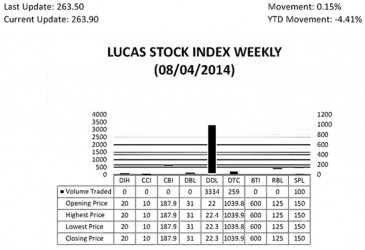

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose slightly by 0.15 percent in very light trading in the first period of August 2014. The stocks of three companies were traded with a handful of shares, 3,693, changing hands. There were two Climbers and no Tumblers. The value of the stocks of Demerara Distillers Limited (DDL) rose 1.36 percent on the sale of 3,334 shares while that of Demerara Tobacco Company (DTC) rose 0.01 percent on the sale of 259 shares. In the meanwhile, the value of the stocks of Sterling Products Limited (SPL) remained unchanged on the sale of 100 shares.