Apprehension

This article offers some observations on the half-year economic report which are made from the perspective of the likely behaviour induced by movement of the monetary variables of credit, foreign reserves and the exchange rate. A full discourse on this subject would be too much for this article so it would only look at the implications for consumer and business spending. Before proceeding, a comment about the data is necessary. Stabroek News was able to produce figures from sources which cited the Guyana Forestry Commission and which contradicted those on timber production and exports supplied by the government in its mid-year report; an explanation for the discrepancy is still to be offered. This presentation thus notes that there are questions about the reliability of some of the data which exist and that in itself raises questions about the validity of the entire mid-year report. The trustworthiness of some public officials has been in doubt for several years now with a non-functioning Integrity Commission. Those doubts have been reinforced by Guyana’s low ranking in the perception of corruption that Transparency International publishes and the frequent qualified opinions of public accounts of the Auditor-General. This is in addition to the scepticism expressed periodically by Professor Clive Thomas and others for whom the reliability of public data has long been a sore point.

Some explanations about the performance of the economy are usually found in the half-year report of the Bank of Guyana (BOG). That report also provides information on how production, consumption and international trade activities behave in response to changes in the monetary variables. Unfortunately, the BOG’s half-year report has not been released as yet. Since there is a query about the reliability of official data in this article, one could wonder how beneficial it would be to use any information produced by Guyanese officials. This article makes the following assumptions about monetary data coming from the Bank of Guyana. Since there were Article IV consultations between Guyana and the IMF, an independent party, in December last year, the starting data on monetary variables for 2014 were reliable. In addition, this writer has to believe that most Guyanese have confidence in their commercial banks and would expect them to be doing the right thing. Since much of the monetary numbers are reported by commercial banks whose annual reports are audited also, this writer reposes confidence in them and the data that they provide.

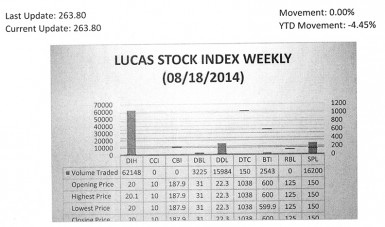

The Lucas Stock Index (LSI) remained unchanged in trading in the third period of August 2014. The stocks of six companies were traded with 100,250 shares changing hands. There were no Climbers or Tumblers. The value of the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC), Guyana Bank for Trade and Industry (BTI), and Sterling Products Limited (SPL) remained unchanged on the sale of 62,148; 3,225; 15,984; 150; 2,543 and 16,200 shares respectively.

Money

As in many other countries, monetary management in Guyana follows the aggregation theory of money. Here, government adds up the currency in circulation and all the relevant claims on financial institutions to determine the money supply. This also includes the money that depositors have with the banks and other non-bank financial institutions. Once the monetary authorities have set the target for the monetary base or what some refer to as high-powered money, everything, under their watchful eyes, is left to households, businesses, government and the lending institutions. Their interactions with each other with the use of cash and credit make the economy tick.

Money is important to one’s survival and economic well-being, and without it Guyanese cannot feed, clothe, house and entertain themselves. With health care and education highly monetized, good quality services in those areas too would be inaccessible without money. As everyone knows, the less money that people have, the less they can buy. Conversely, the more money that people have, the more they can buy. But if there were not enough things for everyone to buy, then prices would rise as people bid to get what they wanted. So, the movement in the money supply is very important in gauging the behaviour of several variables in the economy. These include consumption spending by households, investment spending by businesses, prices of goods and services, interest rates on money borrowed and of course employment.

To be able to make observations from its data is the value of the first quarter report of the BOG. Through the process of induction, it permits one to make a number of observations on what should have happened in the second quarter of the year where consumer behaviour was concerned. One has to keep in mind that economic activity is an ongoing process and events planned prior to the first quarter could take effect in the second or subsequent quarters of the year. Nonetheless, a review of the first quarter numbers indicates that the money supply had declined. The explanation provided by the central bank was that the authorities pulled money out of the system by issuing treasury bills to sap up excess liquidity.

Reduction in expenditure

The contraction in the money supply during the first quarter could have led to a reduction in expenditure with a possible spillover into the second quarter since there was an impact on credit creation. Consumer spending is one of the most important drivers of economic activity in Guyana. Households account for over 60 per cent of the expenditure in the country. The more consumers spend, the more businesses produce until the latter reaches its rational limit of marginal productivity. As both households and businesses seek liquidity to meet their needs, the expectation is that any expansion in economic activity should result in higher interest rates as a consequence of increased demand for credit. On the contrary, households were very reluctant to borrow. The first quarter report shows that households reduced their demand for liquidity by nearly three per cent.

One area in which the impact of the reduction in consumer demand would show up is the distribution trade as the fall in consumer spending would likely trigger a decline in retail sales. The distributive trade sector, which consists of wholesale and retail operations, is the single largest component of the Guyana economy. What happens there matters. According to the BOG, credit to the distribution sector also declined by nearly three per cent in the first quarter. Consequently, there must have been a heavy turnaround in household and business spending in the wholesale and retail sector for it to expand by six per cent by mid-year. It is hardly likely that consumer spending rose so significantly to make the distribution sector grow that fast. It should be noted however that inventory is counted as part of GDP. So, the more likely scenario regarding the six-per cent growth was that wholesalers and retailers have plenty inventory on their hands.

Foreign reserves

The Guyana economy is an open one and exports play an important part in expanding output and generating foreign reserves. Trade activities, consisting of the average between total exports and imports, represent about 42 per cent of Guyana’s output. Among the claims that make up the money supply are the foreign assets that Guyana holds as international reserves. These assets consist of a combination of foreign currency, balances with foreign banks, money market securities, gold, including that which is held with the IMF, and Special Drawing Rights (SDRs). The linkage of international reserves to the money supply and liquidity makes it a very important monetary variable whose behaviour has consequences for foreign trade and the performance of the economy as a whole.

Most of Guyana’s reserves come through remittances, exports and foreign investment. Foreign aid also contributes to the level of reserves. Where utilization is concerned, reserves pay for imports and other foreign debt. A reduction in international reserves indicates that imports and claims by foreigners on assets in Guyana exceeded exports and other current account revenues. With remittances and foreign investments down, exports had to surge for the second quarter to perform well and to reduce the accommodating flows required to bring the balance of payments into equilibrium. Rice, sugar and timber were identified as high performers. However, there is the belief that timber contributed more than was reported. The first quarter report of the BOG stated that forestry production rose nearly 100 per cent over the comparative period last year. This means that forestry output, exports and prices had to decline substantially in the second quarter for its foreign receipts to grow by only 31 per cent for the half-year. The jury is still out on that one as Guyanese await clarification of the reported data. Additionally, the reduction in the net foreign assets of the commercial banks might be a reflection of the political uncertainty facing Guyana as people move their money overseas for protection.

Exchange rate

The reduction in reserves carries with it another story. It suggests that foreigners might have found Guyana’s exports too expensive and decided to buy less. To increase export sales, Guyana had to find a way to make its exports relatively cheaper. This was done through an adjustment to the exchange rate. The value of the Guyana dollar vis-à-vis the US dollar declined by about one per cent in the first quarter. This depreciation of the exchange rate undoubtedly also helped exports to expand and the balance of payments to improve.

Reduced speed

This short discussion suggests that the Guyana economy could slow down in the second half of the year. Part of the reason stems from slow consumer spending with its adverse impact on the distributive sector. The concern about excessive forest destruction and lack of value-added production could also play a part in reducing the speed at which the economy expands during the rest of the year. Political uncertainty too could force changes in business plans and reductions in business investments which would limit spending.