Conglomerates

The manufacturing sector is the smallest sector in the Guyana economy, accounting for a mere seven per cent of the total output of the country in 2013. The sector is largely dominated by sugar and rice which together accounted for 40 per cent of its output last year. But, within that sector lie two conglomerates of different sizes which play very important roles in the Guyana economy. The larger of the two companies when measured in terms of assets, revenue and output was incorporated in Guyana in September 1955 and trades under the name of Banks DIH Limited (DIH). The other company, Demerara Distillers Limited (DDL), was incorporated in November 1952 and trades under the name DDL. The two companies are in the same age group but have vastly different histories and evolution in their life cycles. This article compares the two companies (and not their entire Groups) in an attempt to see how their origins and history might be influencing the business strategies that the two companies pursue.

Banks DIH

Banks DIH, which is the principal company in its conglomerate, got its start as part of a family business. The year of incorporation (1955) which DIH now assumes was first associated with Banks Breweries Limited, a company that produced the now famous Banks Beer brand. The current trading name of Banks DIH was adopted in 1969 when Banks Breweries merged with the partnership enterprise, D’Aguiar Bros, which was established in 1896. When placed in the context of its evolution, the making of Banks DIH spans a period of nearly 175 years that includes the arrival of the D’Aguiar family in Guyana.

Today, Banks DIH operates in four distinct markets. Split into the company and three subsidiaries, the declining rum production and soaring beer and non-alcoholic beverage production imply that beer and the non-alcoholic beverages constitute the majority of the activities of the company. Consequently, the company is identified with beer, wine, liquor and assorted beverages. The Group however includes financial services notably Citizens Bank, long standing food and restaurant services, and the hotel and laundry business. The major operations of DIH are conducted through the company which deals with the brewing, blending and marketing of beverages. The data on the Group implies that the creation of the three subsidiaries is nothing more than a strategy to hedge the bet of the company and diversify its risk.

Demerara Distillers Limited

Demerara Distillers Limited (DDL), the principal company in its conglomerate, was incorporated three years earlier than DIH. At the time of its incorporation, the company possessed the name Guyana Distillers Limited (GDL). But in 1983, it changed it to Demerara Distillers Limited, even though it continued to carry an incorporation date of 1952. It is in the beverage business also where it produces liquors and assorted beverages. It is also able to diversify its risk by operating in the shipping and warehouse business, the distribution business, the contracting and engineering business, and the insurance market. Its diversification extends overseas in European, North American and Caribbean markets. With greater financial contributions coming from its subsidiaries, the diversification strategy of DDL seems more substantive than speculative.

Evolution

The evolution of the companies is distinguished also by how they came into being, and might be a big reason for the difference in market focus. One grew out of indigenous efforts while the other grew out of foreign initiative. DIH had its origins in post-emancipation Guyana with the arrival of the D’Aguiar family in Guyana in 1840. All the enterprises and activities associated with the D’Aguiar business grew out of the tangled web of class, privilege and access to resources that were developed in a colonial structure that attempted to restrain the village movement and the struggle by aspiring Afro-Guyanese to build a better life and create institutions that could help sustain their hard-won freedom.

Unlike DIH whose evolution could be traced from the creation of a brand new indigenous company, DDL was inherited from foreign owners and had a near 250-year head start over DIH. DDL reminds Guyanese from the history it shares in its annual reports that its origins could be found deep in the heart of pre-emancipation Guyana. It began at a time when labour was exploited in harsh and brutal ways and continued until bold political leadership and assertive economic policies broke the colonial stranglehold on many of the production structures in Guyana. DDL was therefore linked to the uncompetitive foreign investment of the time and had a ready local and foreign market long before its ownership and management came under the control of Guyanese in post-emancipation Guyana. Its diversification therefore is much broader than that of DIH since its market reach, virtually from the inception of rum production, went beyond national boundaries.

Notwithstanding their diversity, the principal focus of the two companies is essentially the same – beverage production. DDL emphasizes rum and non-alcoholic beverages. DIH, on the other hand, emphasizes beers, rum, wines, and non-alcoholic drinks. What these two companies do in the area of rum and non-alcoholic drinks represent the competition, if any, that exists between them. The two companies differ in the additional businesses that they operate as part of their risk protection strategy. DIH has diversified into three local markets and one foreign market while DDL had diversified into five local markets and five foreign markets before closing its operations in India last year.

Differences

Despite its head start and the operation of a larger quantity of businesses, DDL has fallen behind DIH when measured by market capitalization, assets, revenue, and output. In the fourth trading period of September 2014, DDL had a market value of $17 billion in contrast to DIH which had a market value of $20 billion. Differences also emerge in the revenues generated by the two companies. DDL had average revenues of $11 billion in 2012 and 2013 while DIH had average revenues of $22 billion over the same two year period. The asset base of the two companies is also very different. DDL had total assets of $22 billion in 2012 and 2013 while DIH had average assets of $28 billion over the period in reference. The output of the two companies gives an indication of the impact that each has on the Guyana economy. The output of DDL averages $3.3 billion. At $16 billion, the output of DIH is five times larger. Together, the two companies contribute about four per cent of the nominal GDP of Guyana. As could be expected, DIH with the larger output contributes the lion’s share. It contributes over three per cent of nominal GDP.

The production data of the two companies reveal some interesting characteristics as well. DDL uses an average of 70 per cent of its sales to recover intermediate consumption costs. These costs refer to the raw materials and other items used to produce the goods that are sold by the company. This high intermediate consumption cost is partly responsible for the lower output by DDL compared to DIH which uses about 40 per cent of its revenues to recover its intermediate costs. This cost difference says something also about the business strategy of the two companies. This very high intermediate consumption cost implies that DDL has decided to rely more on the contribution of others than on its own efforts in achieving its output. This strategy contrasts significantly with DIH which is much more self-reliant with only 30 to 40 per cent of its intermediate consumption cost going to outsiders. DIH therefore has far greater flexibility than DDL to take advantage of any investment opportunities that come along. It is also in a better position to withstand any challenges that emerge during its operating cycle.

One other thing of interest that emerges from the comparison of the two companies is the resource utilization. The asset distribution of the Group indicates that the DDL Company accounts for 81 per cent of the assets while the remaining five subsidiaries and foreign operations account for 19 per cent of the assets. In the case of Banks DIH, the company accounts for 44 per cent of the assets with the three subsidiaries responsible for 56 per cent of the assets of the Group. For both DDL and DIH, the dominance of the company is further seen in the contribution to sales revenues. For DDL, the company is responsible for 66 per cent of the revenues while in DIH’s case, the share is 89 per cent. This imbalance in contribution between the company and the rest of the Group exposes the likely inefficiencies in resource use and raise doubts about the efficacy of their product mix. Where DDL is concerned, about one-fifth of the assets account for one-third of the revenues. The outcome is even more skewed in the case of DIH where 56 per cent of the assets generate a mere 12 per cent of the revenues. With such small benefits accruing from the employ of the majority of assets, the diversification strategy of DIH appears highly questionable. For both companies, the product mix might require reconsideration.

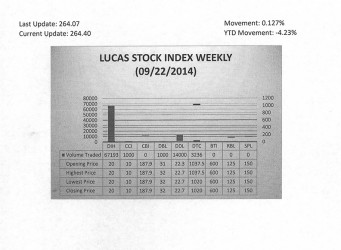

LUCAS STOCK INDEX28

The Lucas Stock Index (LSI) increased by 0.13 percent in trading during the final period of September 2014. The stocks of five companies were traded with 86,429 shares changing hands. There were two Climbers and one Tumbler. The value of the stocks of Demerara Bank Limited (DBL) rose 3.23 percent on the sale of 1,000 shares and that of Demerara Distillers Limited (DDL) rose 1.79 percent on the sale of 14,000 shares. The shares of Demerara Tobacco Company (DTC) fell 1.69 percent on the sale of 3,236 shares. In the meanwhile, the value of the shares of Banks DIH (DIH) and Caribbean Container Inc. remained unchanged on the sale of 67,193 and 1,000 shares respectively.

The future

While both companies seek to position themselves for the future, DIH seems much clearer about its intent than DDL. DIH acknowledges the role of science and technology in its progress, and sees opportunities in what it calls the New Frontier which lies ahead of it. Attitude, perseverance and knowledge are the ingredients that make for the correct blend of success in an era of unfolding scientific and technological progress. The technology with which it is most enamoured is the communication technology of the social media. It sees social media as a vital component of its sales and marketing force and strategy. Banks DIH recognizes that the attitude of customers is changing and that it has to respond appropriately to those changes as well. This reality might not be all that obvious in the case of DDL.