Only comfort

The most recent report of Transparency International (TI) makes one feel that corruption remains endemic in the society and fighting it is a waste of time. Since arriving on the global body’s perception index in 2005, Guyana remains stubbornly at the lower end where more corrupt countries of the world could be found. It is not like Barbados, a sister Caricom country, which, with a rank of 17, sits among countries that are thought to have greater integrity in the conduct of public policy and the management of their economies. The feeling of pride which high placement brings could only be a dream right now for Guyanese. The single comfort Guyanese have is knowing that TI measures corruption in 175 countries and does not rank all the others, including many developed countries, at number one. This reality is proof that corruption is a global problem. It comes in many forms and exists in all countries. But for Guyanese, corruption is now a vexation and if it is not brought under control, the expenditure of their tax dollars will continue to bring them sub-optimal benefits. This distasteful conduct might not be a budget buster but could result in the delivery of substandard goods that leaves taxpayers worse off than before. The economic consequences of corruption are real and so is the growing inequality and insecurity stemming from it.

The comfort of knowing that others are corrupt too turns to despair when it is discovered that other countries are trying to get a grip of their problems. That is the way it appears in a study which was commissioned by the European Union and published in June 2013 in an attempt to identify and reduce corruption in public procurement in member countries of the European Union. China, often accused of such behaviour, has been actively engaged in going after corrupt politicians and celebrities. This article considers two issues raised in the EU study with readers in an effort to expand appreciation for the need to remove this scourge from the Guyanese society. These are the issues of lowballing and conflict of interest. Hopefully, the discussion on lowballing would help to provide additional evidence as to why the Public Procurement Commission (PPC) should be established with haste.

The study to which this article refers was done by PwC and Ecorys in collaboration with the University of Utrecht in the Netherlands. The purpose of the study was to develop methodologies and tools to fight corruption in the area of public procurement. The study provides some basis for increasing understanding of corruption and how it could occur. It also provides evidence of the ways in which corruption hurts a country. In addition to reminding us that corruption is a worldwide phenomenon, the study indicates that corruption is not an easy thing to pinpoint. Indeed, whenever the issue of corruption is raised, one’s mind often runs on acts of financial impropriety as the best examples of the crime. Words like fraud, embezzlement, misappropriation tend to stand out and catch our attention. It appears easy to identify such acts as corruption because one could separate victim from perpetrator and set up the contrast between gain and loss of the two parties quite easily.

Vertical corruption

Most Guyanese might already be aware of what constitutes corruption, but its pervasiveness in the society makes it worth repeating here. Corruption is defined as the abuse of power for private gain, and is concerned with the adverse consequences stemming from collusion between public and private conspirators. This collusion could be further divided into vertical and horizontal corruption. In the context of public procurement, vertical corruption refers to a dishonest relationship between a public official and bidders of contracts. It is a case in which a public official uses legitimate authority to grant an unfair advantage or benefit to one competitor at the expense of other competitors. Horizontal corruption, on the other hand, refers to collusion among bidders that results in restricting competition and ends up harming the public procurement process. This latter conduct is distinct from competitors forming a registered joint venture for the purpose of acquiring capacity to perform contracts.

One of the values of the EU study on corruption to Guyana is that it singles out items that qualify as corrupt acts. Guyanese most often speak of vertical corruption and hardly ever speak of horizontal corruption. In other words, there is greater awareness and concern about abuse of power by public officials for personal gain. The abuse of power is reflected in the use of mechanisms like conflict of interest, nepotism, cronyism, favouritism and market rigging. The preceding items represent mechanisms through which public officials are able to obtain personal gains. The issue of conflict of interest in which personal gain is obtained has arisen many times in Guyana’s context, particularly in the area of employment, and a comment will be made on this point later.

Bid rigging

Market rigging involves manipulating the tender process through acts of collusion. It could involve collusion between a public official and a bidder. For example, the tender process could be stage-managed in such a way that a preselected bidder wins the bid. Or, it could consist of conspiratorial acts among bidders alone. Additional forms of market rigging include bid suppression, bid rotation and lowballing. Bid suppression refers to a situation in which conspirators agree not to submit bids so that one of their own could get the contract. Bid rotation refers to bidders taking turns at being successful bidders. Lowballing refers to submitting the lowest bid with the understanding that once awarded the contract it would be modified so that the contract price could be increased.

According to the EU study, the consequences of corruption could be enormous. It contends that corruption leads to suboptimal decision-making on procurement and, as a consequence, to poor or suboptimal performance of projects. Performance has been conceptualized in three ways. These are efficiency considerations of cost overruns during the procurement stage or through additional costs in the implementation stage, and delays in implementation. The third measure is that of the effectiveness of the project. In the view of this writer, lowballing is perhaps the most dangerous of the market rigging techniques for the reasons given below and could produce the worst outcome.

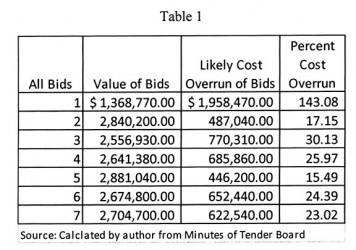

It is often not easy to detect the risk of cost overrun in the procurement stage, except where the variance between the lowest qualified bid and either the engineer’s estimate or the average of the unsuccessful bids is exceptionally large. An example of this situation appears in the table below. The data provided in the table below was taken from the minutes of a tender opening meeting. The use of this data does not imply information or knowledge about corruption. The data is merely being used to make the point about the dangerous effects of lowballing.

It could be seen from the data that the successful bid, the lowest, looks like an outlier when compared to the rest of bids. Further, if one took the engineer’s estimate (G$3,327,240) for the project as a realistic cost, the risk of cost overrun of the project is high and the cost overrun itself could be high. All the other estimates have a smaller variance from the engineer’s estimate as could be seen from the table above, suggesting that their costs might be more realistic than that of the winning bid. The only rationale for choosing such a bidder could be that he has superior technology that makes it possible for his cost to be as low as it is. Otherwise, this means that Guyanese taxpayers could be fooled into believing that they would receive a whopping savings of 143 per cent when in fact they could lose 143 per cent on the contract. Further, there could be delays in the delivery of the project and the production of substandard work at such a low cost. That the public official is willing to take such a large risk on this project is what often raises suspicions that a kickback might be involved in the procurement process. The only mechanism that could help to dispel that notion is the PPC which in the normal course of its work could obtain all the facts about any sample of contracts and use appropriate investigative techniques to assess their validity, efficiency and effectiveness.

Conflict of interest

Returning to the issue of conflict of interest, one should recall that it should be avoided at all costs, including in situations of employment. To avoid such an appearance in the area of employment, the preference is not to have closely related family members working in the same organization. However, if that were to be the case there must be no direct reporting line between the family members.

Smaller benefits

From the foregoing, the issue of corruption in Guyana therefore also could be about incompetence and poor leadership. Whether true or false, this scourge on the society is practised too openly and with little regard for the benefits to taxpayers and the image of the country. These problems could easily be solved with greater transparency, accountability and integrity. Such desired changes in attitude were unlikely to occur under a PPP/C administration. Nevertheless, one way to achieve those goals is to establish the Public Procurement Commission.