Economic life

Guyana is not known as a major trading economy, though trade matters to its economic life. International trade looks like an innocent economic activity since participants and beneficiaries are not always as important as the product selections that become available in the shops, stores, night clubs and restaurants of choice. After all, international trade is praised for its ability to expand product choice and the wealth of a country. This movement in resources comes through the exchange of goods and services and the relocation of production facilities in host countries. It gives consumers in different countries access to goods and services that are not produced in their home country. As innocuous as it might seem, international trade can lead to a disadvantage of economic actors in society through the reallocation of resources from the public policy decisions of government. It could also lead to a redistribution of wealth among members of the economy while leaving important economic sectors out. This happens through the process of private investment and through conscious government policy as this article intends to show.

Losing battle

It appears as if Guyana has decided to stake its fortune on international trade notwithstanding the disadvantage that it has in the exchange with other countries. Since 2006, foreign trade has constituted about 40 per cent of the Guyana economy. This measure of the openness of the Guyana economy indicates that the export of goods and services remain important to economic expansion. Much economic activity is also dependent on imports which enter the consumption and production sectors of the economy. Data seems to suggest that only exporters are benefiting from the trade while consumers and local producers of goods might be having a hard time to make ends meet. As a result, for a nation that has placed much emphasis on international trade, consumers and local producers appear to be in a losing battle as the adverse movement of the exchange rate since 1991 would imply. The exchange rate has declined over 46 per cent since 1991 making exports cheaper and imports more expensive.

Adverse trade balance

Gold industry

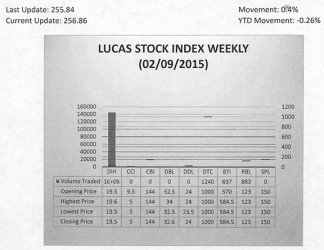

The Lucas Stock Index (LSI) rose 0.4 per cent in trading during the second period of February 2015. The stocks of four companies were traded with 147,915 shares changing hands. There was one Climber and no Tumblers. The lone Climber was Guyana Bank for Trade and Industry (BTI) whose stocks rose 2.54 per cent on the sale of 637 shares. In the meanwhile, the value of the stocks of Banks DIH (DIH) Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 145,155; 1,240 and 883 shares respectively.

International trade also plays an important role in resource allocation and distribution within a country and between countries. Sometimes this rearrangement of resources follows a logical pattern and sometimes it does not. Most times the logic is seen in the pursuit of investments driven by profits. This situation is most noticeable in the case of the gold industry where between 2006 and 2012 there were substantial investments in the gold industry by both local and foreign investors. The combined effect of the reallocation of local and foreign resources to the gold industry could be seen in the value of its contribution to gross domestic product (GDP). The combined resources that went to the sector rose from $28 billion in 2006 to $109 billion in 2012 before falling to $96 billion in 2013. Significant amounts of foreign investment also came to the sector even though the impact of this investment is yet to be fully felt.

While gold production represents a logical type of investment, the country has seen another type of investment which could only be described as illogical. The capital invested does not follow the profit motive, and despite the existence of a structure that alters the shoreline of Guyana, the investment, at this time, results in the redistribution of resources between Guyanese and foreigners. The investment in reference here is that of the Marriott. This is a classic example of the redistribution of resources without benefits to the people of Guyana. The structure of the investment contains the decision to transfer what amounts to the equivalent of US$40 million in resources from the Guyana economy to a foreign investor. The transfer of an ownership of two-thirds of a US$60 million investment for as little as US$8 million to a foreign investor is as baseless a decision as that of not seeking to resolve constructively the industrial conflict at the University of Guyana.

Beneficiary

This writer would be the beneficiary of any favourable outcome to the legitimate demands of the staff and students. But my interest in this matter exceeds any personal benefits that could accrue to me from a settlement. Here one is talking about the positive externalities that would come to the entire country from a better managed and more productive economy. One has to ask the question, which investment is more important: giving away US$32 million or investing it in the education of the people of Guyana with the knowledge that a better standard of living awaits us all? The errors of the government must not be the legacy that this nation looks forward to. This nation must look forward to the emergence of a people who could lift each other up and inspire the best in all of us through a good education. Consequently, the concerns of the staff and students of UG is no ordinary concern. The unwillingness of the government to understand this reality and to resolve the industrial dispute at the university in a constructive and timely manner is robbing this nation of that accomplishment.

The University of Guyana is a state-supported institution which has been in decay for years. The US$32 million from the Marriott which the government is giving to a foreign investor under no duress could have been used to increase the remuneration of the staff of the University of Guyana and to improve the facilities and conditions under which students have to learn and the staff has to work. The dispute between UG and its staff has a history. A useful point of departure for the current conflict is 2012 where the government refused to accede to the reasonable demands of the staff and students at that time. The government asked the staff to return to work with a promise to continue the negotiations. The staff returned to work only to find after three years, the government never fulfilled its side of the bargain. At that time too, the government had a choice between building a hotel that was not necessary and improving the learning experience of students. It chose the future benefits of the hotel over the future benefits to this nation that would be gotten from a better educated workforce. Despite all the talk about education, the decision then and the intransigence now of the government reflect the reality that it does not place much value on the human resources of this nation.

Conspicuous

One of the most conspicuous things about the Guyana economy is that very little of the output of the major sectors is consumed at home. The export story always starts with sugar. The production and export of sugar has had a long history in this country. Despite its lengthy history, sugar consumption in Guyana relative to its production is rather low. Its connection to the value added industries in Guyana is also very low. Given its long existence in the economy, in the general scheme of things, the very limited value-added contribution of sugar to the economy makes the complaints against Bai Shanlin and Vaitarna, Johnnies-come-lately, look very silly. The lack of initiative to integrate sugar more deeply into the domestic economy raises questions as to whether the government wants to solve the problems of this industry and increase the efficiency of the economy. Economic rationality says that a sugar industry, which is discounting its price to 50 per cent below cost in order to sell it, must begin to transform itself. Yet, we think that wasting over $40 billion is more prudent than investing that money in the human resources of this country. Even with a deserved increase of 60 per cent on their remuneration, that $40 billion wasted on GuySuCo could meet the needs of staff and students for over 20 years. However, the government is unable to see the long-term benefits of making a valid investment in the staff and students now.

It is hard to imagine that Guyana has reached the point where brinksmanship takes precedence over statesmanship. One must begin to wonder what it is within our culture that makes us feel that the human resources of this country should take a back seat to economic and social activities of lesser economic value. The government should not be left to believe that investing in the musical and sporting talent of this nation to meet the entertainment needs of Guyanese is good enough for the development of the human resources of the country. Not every student has the money to go to Gravity, Palm Court, Monaco or 704. The government must realize also that investing in the academic talent of this country, a public good, can yield just as good or even greater returns far into the future with greater positive externalities than other public goods.

Unprofitable investments

It is this understanding of the investment that the staff and students of the University of Guyana are seeking that is not forthcoming from the government. Students pay fees to the university which means that the government will not bear the cost of the investment alone. In this instance, taxpayers are not being asked to cede their money to unprofitable investments as in the case of the Marriott, GuySuCo or even the road to Amaila Falls, all of which amount to over $50 billion of waste. The redistribution of tax dollars for the sheer purpose of tolerating financial losses cannot compare to the extended future benefits that would come to this country from investing in the human resource needs. Confrontation with a lingering resentment between interlocutors should not be the final outcome of this dispute. Instead, we must be able to look forward to expanded trade and investment utilizing better equipped human resources.