Conclusion

Alter the production structure

Last week, this writer took a look at the financial profile of NICIL and its links to the long-term investment policies of the government. Such a public policy analysis of NICIL enabled one to develop a balanced perspective of the performance of the company. It also enabled the analysis to start from the point of view of the government and to rely on the data of the entity to form judgements about its performance and the rationality of its investments. The data revealed also that NICIL was holding much more money than it needed to conduct its business. This week an attempt is made to discuss how the financial resources kept by the company are used to alter the production structure of the country and how it is helping to skew the foreign policy of Guyana in favour of one or two countries. The people of Guyana were never prepared for this additional role of NICIL and must wonder about the implications of this trend for them.

Own and control

It is important to know that NICIL owns and controls several companies in Guyana. According to the 2012 annual report, for example, NICIL owns outright the Kwakwani Utilities Company, the Lethem Power Company, the Linden Electric Company, and the Madhia/Matthews Ridge/Port Kaituma Electric Company. None of the foregoing companies is a household name, but given the areas that they serve, they appear to meet an important economic need. NICIL also owns 100 per cent of the National Communications Network (NCN), 90 per cent of Guyana National Newspapers Limited (GNNL) and 99.6 per cent of Guyana National Printers Limited (GNPL). In contrast, these companies often frustrate the free flow of information, a critical ingredient for free-market competition. Two of the remaining five companies, the Guyana World Cup Inc and Atlantic Hotel Inc (AHI), attract the critical eyes of the public while a third, Property Holdings Inc (PHI), remains a curiosity. The remaining two companies, Guyana National Shipping Corporation (GNSCL) and the Guyana Oil Company Limited (GUYOIL), seem to escape the gaze of Guyanese.

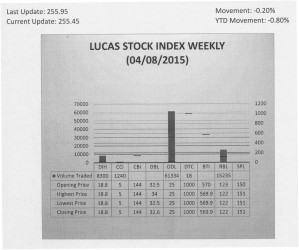

The Lucas Stock Index (LSI) fell 0.2 per cent in trading during the first period of April 2015. The stocks of five companies were traded with 86,127 shares changing hands. There were no Climbers and one Tumbler. The stocks of Republic Bank Limited fell 0.81 per cent on the sale of 15,235 shares. In the meanwhile, the stocks of Banks DIH (DIH), Caribbean Container Inc. (CCI), Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 8,300; 1,240; 61,334; and 18 shares respectively.

Market failure

The ownership and control of the aforementioned companies raise a number of issues of public policy interest and concern. First, up until recently, one would have thought that NICIL’s ownership in the energy sector signified an interest on the part of the government to confront market failure in the generation and distribution of electricity. The recent creation of the Skeldon Energy entity dispels that notion since the formation of the company does not seek to solve an energy crisis or meet an energy need. Instead, the establishment of the company appears as a convenient way to reallocate resources to perpetuate inefficiency in production in an industry that needs a radical overhaul.

Access to state media

Second, the size of its ownership of the various companies means that NICIL controls what these companies do. Also, it determines the policies and business strategies of the various entities. For the three media and media-related companies of NCN, GNNL and GNPL that are under its control, NICIL decides how they treat prospective customers. To the extent that the government does not like the position or point of view of a contributor to the newspapers, radio or television show, NICIL can deny that contributor access to the media. NICIL therefore is at the centre of determining who gets access to state media resources and who does not get access. A company that was set up to facilitate the liberalization of the economy is capable of denying private citizens their constitutional right to free speech and their ability to contribute to the economic and social advancement of the country.

Stock exchange

A third matter of policy interest stemming from NICIL’s ownership of a variety of companies is its link to the Guyana Stock Exchange. PHI is the only company owned by NICIL that is registered with the Guyana Stock Exchange. This in itself is a contradiction since PHI, for all intents and purposes, is a state-owned company. Besides, PHI serves no economic purpose. It was set up 15 years ago to sell a finite number of properties already in existence. Since PHI makes no new investment in the properties that it holds, the entity generates no value-added activity in the economy and contributes absolutely nothing to the gross domestic product (GDP) of Guyana. Despite this reality and over 73 per cent government ownership, PHI remains on the Guyana Stock Exchange masquerading as a private company with economic value.

Causing damage

With such extensive influence, NICIL is capable of causing damage to the economy of Guyana. Part of the reason is linked to the way it is managed. Though NICIL has a Board of Directors, it often appears to operate as a one-man show. This means that important policy issues that affect the efficient operation of the market in Guyana and equity in access to public goods are in the hands of a single individual. Even if the few board members join the decision, substantive matters of policy involving billions of dollars are still being determined by a handful of individuals. When compared to parliamentary decision-making, the cabal of board members might reach a decision faster. However, decisions by the cabal are often kept secret and often suffer from inadequate consideration of the economic, financial and social costs and benefits of the expenditure that the government undertakes or plans to undertake. Instead of correcting for market failure and achieving efficiency in resource allocation – important public policy goals –poor decisions by NICIL end up costing Guyana billions of dollars.

Internal equity

The internal equity of NICIL is the source of many problems. At the end of 2012, NICIL had $15.3 billion in internal equity. About 60 per cent of it or $9.4 billion was made up of exemption of taxes that otherwise should have gone to the Consolidated Fund, and provisions to write-off inventory. This manner of handling NICIL revenues disguises the revenue levels available to the government for spending on public policy matters. The tax level when measured without the resources of NICIL is given as 23 per cent of the GDP of 2012. When the money held by NICIL is included in government revenues, the tax level exceeds 26 per cent.

As NICIL’s internal equity increases so does the tax level. Increases in the tax level reduces money available to the private sector. The risk of such occurrence is real as could be seen from the comparison of private and public investment from 2007 to 2012. The total money spent by the private sector on investment during the review period was $338 billion while that spent by the government was $336 billion. NICIL has within the last five years used its internal equity to create three companies, and there was no prior debate about the public policy value of these companies even though it was the money of taxpayers that was involved. It created two companies in 2010, Atlantic Hotel Inc to build the Marriott Hotel and the Mahdia/Matthews Ridge/Port Kaituma Electric Utility. Less than two weeks ago, NICIL, in collaboration with Guyana Power and Light (GPL) created a third company, the Skeldon Energy Inc. NICIL already influences the market for electricity, fuel, and shipping, and is now in a position to influence market conditions in the private hotel industry.

Impact on foreign policy

Quite revealing from examining the influence of NICIL is the extent to which NICIL’s actions impact the foreign policy of Guyana. International political economy which is about relations between countries is evaluated in a number of ways, but most people utilize the four structures of production, finance, security and access to knowledge to assess the content and impact of those relations. From an economic standpoint, important to the relations that develop among states is the functioning of the global production and finance structures. These structures are made up of the actions and agreements between states. The global production structure is about who produces what, where, and under what conditions. It is also about how it is sold, to whom and under what terms. The finance structure concerns itself with how debts are created, honoured and paid between and among countries.

NICIL has been very active in promoting production with foreign participation through the construction industry in Guyana. The question must be asked who benefits from the way NICIL structures its production and financial relationships. Several of NICIL’s production activities in Guyana have gone to companies from China and to a lesser extent India. These foreign contractors finance the production in many cases. In one instance at least, World Bank money was involved. This happened in the case of the Skeldon Sugar factory. Many of these projects contain a trade and labour component. The producers from China and India have tended to rely on their own resources, including human resources to undertake production in Guyana. Two years ago, the government itself identified several projects where this production practice occurred to justify the construction of the Marriott Hotel without Guyanese labour.

Where private investment is concerned, the trade component involves the importation of equipment and the export of raw materials. In some cases, they resemble trade under colonial rule. Under colonial rule for example, sugar was produced by a British company primarily for the British market and bauxite was produced by a Canadian company for the Canadian market. Now bauxite and timber are being produced by Chinese companies for the market in China.

Original mandate

Further, when it is considered that NICIL is heavily involved in trade and finance structures and that NICIL is controlled by the Minister of Finance, one realizes that a substantial portion of Guyana’s foreign policy is being driven by the decisions of NICIL. The people of Guyana were never prepared for this role by NICIL and should therefore seek a full debate on the matter so that NICIL remains faithful to its original mandate.