The current struggle

In 22 days, the current struggle for political leadership in Guyana will be over and the preference of Guyanese as to who must lead them would be known. The competition is primarily between the two major political groups of the ruling PPP/C and the opposition coalition of the APNU+AFC. It is often said that the electorate in Guyana is an unsophisticated one because the choice of leader is often submerged in banality and void of any serious thought about the type of society Guyanese want to live in. This writer disagrees that the common yardstick with which to predict the likely outcome of the upcoming elections should be the race factor.

To do otherwise is to succumb to the view that Guyanese do not care about each other and that the younger generation, the larger voting group, has gained nothing from its education and has been failed by its elders and leaders. The energy being displayed by young Guyanese in the campaigns supports the view that a thinking population and not a mindless one would be heading to the polls on May 11, 2015.

Amidst the clutter of advertisements (ads) and counterclaims about patriotism, there are two philosophical perspectives before the electorate. They offer distinctions as to what will constitute the foundation of economic and social action of the new government. From its Billboards and various ads, the PPP/C has chosen the path of the status quo with the expression of a “strong, stable and secure Guyana”. This means that, if reelected, it would continue to do the same things that it has done in the past 10 years. The opposition coalition has chosen the path of unity. In Guyana, that represents an insufficiently tested form of political cohesion though it has the potential to produce stronger, faster and more equitable economic and social progress. Because of its relative novelty, this article seeks to examine the undefined concept of the economics of unity. In order to do so, however, there is a need to situate the discourse in the context of the current state of Guyana’s development following which a discussion about what the economics of unity could look like would take place. Of necessity, it will take more than one post to do so.

The starting point for the background discussion would be 2006 and the endpoint would be 2014. The timeframe covers the social and economic work of two administrations of the incumbent party and some of what it considers key activities. The start period was chosen to coincide also with the official base year against which economic progress is measured. The rebasing of the national economy also helped to reveal changes in the economic structure of Guyana. The discourse on the economy must keep that in mind. The start of 2007 saw the introduction of the value-added tax (VAT). With an open economy that depends heavily on foreign investment and international trade, global developments are important. Towards the end of 2007, the early signs of a global financial crisis had begun to emerge also. These three things are important because they set the framework for an evaluation of the social and economic developments in Guyana that have occurred under the PPP/C.

One other point before an attempt to contrast the economics of unity with that of the status quo. The purpose of the upcoming electoral competition is to see which political group would get the

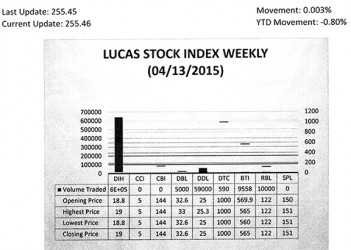

The Lucas Stock Index (LSI) rose slightly by 0.003 per cent in trading during the second period of April 2015. The stocks of six companies were traded with 726,555 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 1.06 per cent on the sale of 642,407 shares. The stocks of Guyana Bank for Trade and Industry (BTI) fell 0.86 per cent on the sale of 9,558 shares. In the meanwhile, the stocks of Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 5,000; 59,000; 590 and 10,000 shares respectively.

chance to control the resources of the country and direct how they must be managed and distributed for the next five years.

Knowing this is crucial to understanding how different the economics of unity would be from the status quo as it relates to stamping out corruption, and protecting people and their investments. Being aware of this factor also helps in understanding how important it is for competition to flourish and markets to function efficiently. Market failure determines the added role of government.

Resource allocation

Resource allocation in a country takes place in two ways and is often thought to be done in the best interest of the people of the country. One manner of allocation is through the market where price and consumer demand help to determine the type and quantity of goods and services that will be produced by society. Resource allocation through the market represents a form of participatory democracy since the decision about buying and selling rests solely with individuals who are the consumers and the producers.

The other manner of resource allocation is through the government. This form of resource allocation could be looked at in three ways. First, there is the allocation of resources between the private sector and the public sector. This is measured by the tax level or the amount of the national output that goes to the government and how much stays with households and businesses.

The average tax level for the period 2006 to 2013 was 21 percent. This figure is distorted by public entities like the National Industrial and Commercial Investments Limited (NICIL) and the Guyana Geology and Mines Commission (GGMC) which often fail to deposit monies into the Consolidated Fund. Second, there is the distribution of tax revenue among the various groups in the country.

This distribution is reflected in the way that the government spends or disposes of the tax revenue that it obtains. Some comes back to businesses and households in the form of subsidies and special allocations like the education grant, old age pension, school uniform vouchers and the like. These are transfer payments since the government gets nothing in return for the money that it gives out.

Tax distribution through government spending also comes in the form of the purchase of goods and services from businesses. This activity is known as public procurement and in this instance, the decision about what to buy and sell is made solely by the government. Even though there are two actors, the government and the contractor, the power with respect to resource allocation is in the hands of the government.

The distribution of resources in that sense is un-democratic and only becomes less so when there is fairness and equity in the public procurement process. One question that arises here is whether the spending by the government is focused on the right priority. Investment in public goods such as roads, bridges, schools, and so on are important to achieve economic growth. But there are times when such spending has to take second place to what is considered to be the most important function of government and that is the safety and security of the people.

Tax expenditure

A third way of distributing tax revenues is through a modality known as tax expenditure. This is the amount of tax revenue that is foregone by the government through the granting of tax concessions to private businesses, private sector and public sector employees, and to non-profit organizations. Though no actual cash is passed, the revenue that would have gone to the government stays with the private sector instead. The concessions granted are based on several factors. These factors include the ownership of the company, the activities of the company, the geographic location of the enterprise, and the likely economic impact on the company. Much controversy surrounds the use of this modality in foreign investments.

The impact

The bottom line of the resource allocation by government is the impact that it has on the four universally accepted goals of government. These goals are security, liberty, equity and efficiency. It is against the backdrop of these four public policy goals that the economics of unity will be discussed. As noted earlier, the discussion cannot take place without performing some assessment on the performance of the PPP/C government and ascertaining the implications of the campaign promises of each.

Abilene Paradox

Any political party that has only one person as the fountain of wisdom is doomed to failure. In the case where one person is considered to know everything and directs everything, decision-making becomes a victim of the Abilene Paradox. Dissent is withheld by group members for fear of not wanting to appear as bad team players. But as in the lesson of the Abilene Paradox, the outcome is often disastrous and of no benefit to anyone. By extension, any country that has one political party as the fountain of wisdom will inevitably suffer a similar fate. (To be continued)