This is the fourth part of a series of articles on public financial management in Guyana’s post-Independence period. We saw how the 1970s and the early 1980s were characterized by a marked decline and deterioration, resulting in significant delays in financial reporting and audit. Eventually, accountability was brought to a standstill at the end of 1981 following the collapse of the computerized system that was used to prepare the public accounts.

The Hoyte Administration made a sincere effort to retrieve the situation, and several years of backlogged public accounts were finalized. However, moving forward beyond 1981 posed an unsurmountable problem. Given this situation, the Audit Office made certain proposals in 1991 for a restart of the process. While the then Minister of Finance agreed in principle with these proposals, senior officials from his Ministry displayed fierce resistance. As a result, no progress was made in the run-up to the 1992 elections. When the new Administration took up office, it seized the opportunity to embrace the Audit Office’s proposals. Instructions were given, and public accountability was restored with effect from 1992. However, efforts to put together the accounts for the backlogged period from 1982 to 1991 proved futile and the effort had to be abandoned. This period would remain a significant blemish in Guyana’s history of public accountability.

- How much money do we have in the Treasury?

- How much money should we have had in the Treasury?

- What are our assets (other than cash) and liabilities?

- Is there a need to improve our budgetary processes?

5 Are we making full use of information technology in the recording and moni

toring of public revenues and expenditures?

- How satisfied are we in the assessment, collection and monitoring of all State

revenues to ensure that they are promptly paid over to the Treasury?

- Is there a need to revise our public accountability cycle (budget preparation,

incurrence of expenditure, financial reporting and audit, PAC examination, and

Treasury Memorandum) to provide for greater efficiency and effectiveness?

- Do we have suitably qualified and experienced accounting staff at Ministries,

Departments and Regions?

- Is there an organized and effective system of internal audit throughout the oper

ations of government?

- Are we using internationally recognized accounting standards for the

Government’s accounting and financial reporting?

- Have we implemented all laws, rules and regulations governing public procure

ment?

- Do we have an independent and professionally competent state audit institution

to provide the Legislature and the public with the necessary oversight, free of

political interference and influence?

- Is there an effective mechanism to help in eradicating corruption wherever it

exists?

- How can the system of parliamentary oversight of revenues and expenditures

be improved?

- How satisfied are we with the monitoring of the accountability arrangements

and performance of statutory bodies, public enterprises, other entities in which

controlling interest vests in the State, and local democratic organisations?

Cash resources and the Consolidated Fund

The latest available audited public accounts is in respect of 2012. An examination of these accounts revealed that the Consolidated Fund was overdrawn by $62.165 billion as at 31 December 2012. There were a number of other accounts belonging to Ministries and Departments which reflected balances totalling $16.559 billion. In addition, according to the Auditor General, of the several other special bank accounts, eleven reflected balances totalling $4.140 billion which appeared to be funds that are transferrable to the Consolidated Fund. Taking these into account, and excluding amounts totalling $4.481 billion representing proceeds from 90 days Treasury Bills, the accumulated balance on the Consolidated Fund reflected a deficiency of $45.947 billion as at 31 December 2012. If the transactions for 2013 and 2014 are taken into account, including the authorised withdrawals from the Consolidated Fund, the deficiency in the Consolidated Fund could exceed $60 billion!

The Government has been operating with a cash deficiency for the longest while, and relies on the proceeds from the issue of Treasury Bills to fund this deficiency. In particular, the Monetary Sterilisation Account, which captures the proceeds of the 180 and 360 days Treasury Bills, reflected a balance of $84.169 billion as at 31 December 2012. Because of the Bank of Guyana’s policy of computing overdraft on the accumulated balance on these accounts, including the Monetary Sterilisation Account, the Government is spared of paying interest on the overdraft on the Consolidated Fund. It would therefore be necessary for the new Government to reflect on its deficit financial position in the consideration of the next budget.

Since 2001, significant amounts of public revenues from the sale of State assets and dividends received from public enterprises were diverted away from the Consolidated Fund and into the coffers of NICIL. Similarly, since 1995, the Office of the President has been retaining the Government’s share of the proceeds from the Guyana Lotteries instead of paying it over to the Consolidated Fund. There are also funds that are surplus to the operational requirements of certain statutory bodies that are reflected in their bank accounts, or are used for unrelated purposes, most notable being the Guyana Geology and Mines Commission and the Guyana Forestry Commission.

Had all public revenues been paid over to the Consolidated Fund, as required by Article 216 of the Constitution, the Consolidated Fund might have reflected a healthy balance, instead of the deficiency referred to above. In addition, over the years more funds would have been available through the budget process to meet much needed public expenditure. Borrowings could have also been curtailed.

Other assets and liabilities

The value of assets other than cash, such as land, buildings, machinery and equipment, office furniture and equipment, as well as inventories, is not known as this is not reported in the public accounts because of the cash basis of accounting that the Government uses to record transactions. Our current liabilities amounted to $4.816 billion, and when the cash deficiency of $45.947 billion is taken into account, instead of net current assets, we have a net current liability of $50.763 billion as at the end of 2012!

Our long-term liabilities amounted to $306.301 billion, comprising internal debt of $45.539 billion and external debt of $260.762 billion. In equivalent US dollars, the external debt at the end of 2012 was to $1.275 billion, compared with US$2.1 billion at the end of 1992. However, if we deduct from the latter the accumulated interest and penalties of US$1.5 billion, our external debt at the end of 2012 has doubled that which prevailed at the end of 1992!

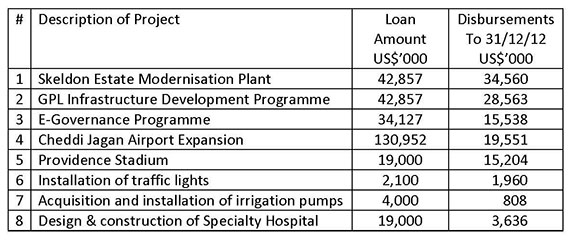

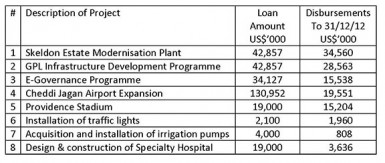

Included in the external debt were disbursements of loans from the Exim Bank of China and the Exim Bank of India for the following projects, all of which are shrouded in controversy.

Every so often, we bask in glory and celebration whenever we sign a loan agreement with an overseas lending institution, without realizing that we are leaving a huge debt burden for the future generation to repay. While some may argue that in some cases in order to own, one has to owe, where public funds are concerned, extreme caution has to be exercised to avoid reckless borrowing to meet public expenditure. It is relevant to note that the cost of servicing our debts in 2012 was $9.877 billion, of which amounts totalling $6.285 billion or US$30.732 million relate to our external debt. These are significant amounts which could be reduced if less debt is incurred.

Despite some US$200 million reportedly spent to construct the new Skeldon Estate sugar factory, the facility has been experiencing numerous problems and is unable to operate as intended since its commissioning in 2009. In relation to the GPL Infrastructure Development Loan, the Guyana Power and Light continues to be plagued with problems, especially as regards electricity generation losses amounting to about 33 per cent. This is despite the fact that since the early 1990s, the utility company has been the recipient of several loans and grants from the Inter-American Development. This is in addition to the massive amounts of financing that the Government has been injecting annually to assist the company to meet its day-to-day expenses.

Next week, we will continue our analysis of our public financial management systems in the hope of offering further suggestions for improvement.