Introduction

Perhaps a window on public sentiment is reflected in the surprising number of persons that responded to last Sunday’s column, which linked the recovery of stolen public assets initiative to not so discreet intimations of destabilization of the sugar and rice industries. This week’s column follows-up by firstly, reporting on the insight afforded by persons who contacted me, about their observances regarding the misuse of public power for private gain. Secondly, it reveals the pervasiveness of corruption in Guyana, not from the quantitative estimates offered so far, but from the perceptions of key players in the economy. Thirdly, I draw brief attention to the economic time-bomb on which sugar is presently perched.

Variations on corruption

Those who contacted me revealed a surprising number and range of corruption allegations. The public bodies they cited range from government departments, state-owned corporations, semi-autonomous and autonomous agencies to regulatory and oversight bodies, including those whose remit is guarding against corruption. Indeed, I cannot recall one public body which was spared from corruption allegations. While acknowledging that allegations are just that, allegations; it was painful nevertheless that not one public body emerged unscathed.

Another perspective

The corruption data offered thus far have been based on quantitative estimates of its monetary value; from this, its pervasiveness is inferred. However, corruption is a decidedly secret matter. Great steps are taken by those involved in it, to evade public notice. Given this feature, behavioural analysts argue, and with good reason, that quantitative measures should be complemented with targeted qualitative surveys, assessments, interviews, polls and other such instruments designed to assess perceptions of corruption from among important players/stakeholders in a country’s economy.

There are two well-known long-running measures of corruption perceptions in Guyana; both of which are undertaken as parts of global studies. First, there is the annual Corruption Perceptions Index (CPI), which has been developed by Transparency International, since 1995. This measure statistically scores and ranks perceptions of corruption of individual countries’ public sector. For 2014, Guyana scored 30 out of 100, and was ranked 124 out of 175 countries, on a scale where 0 represents the most corrupt and 100 the least corrupt. Guyana’s ranking was the worst in the English-speaking Caribbean.

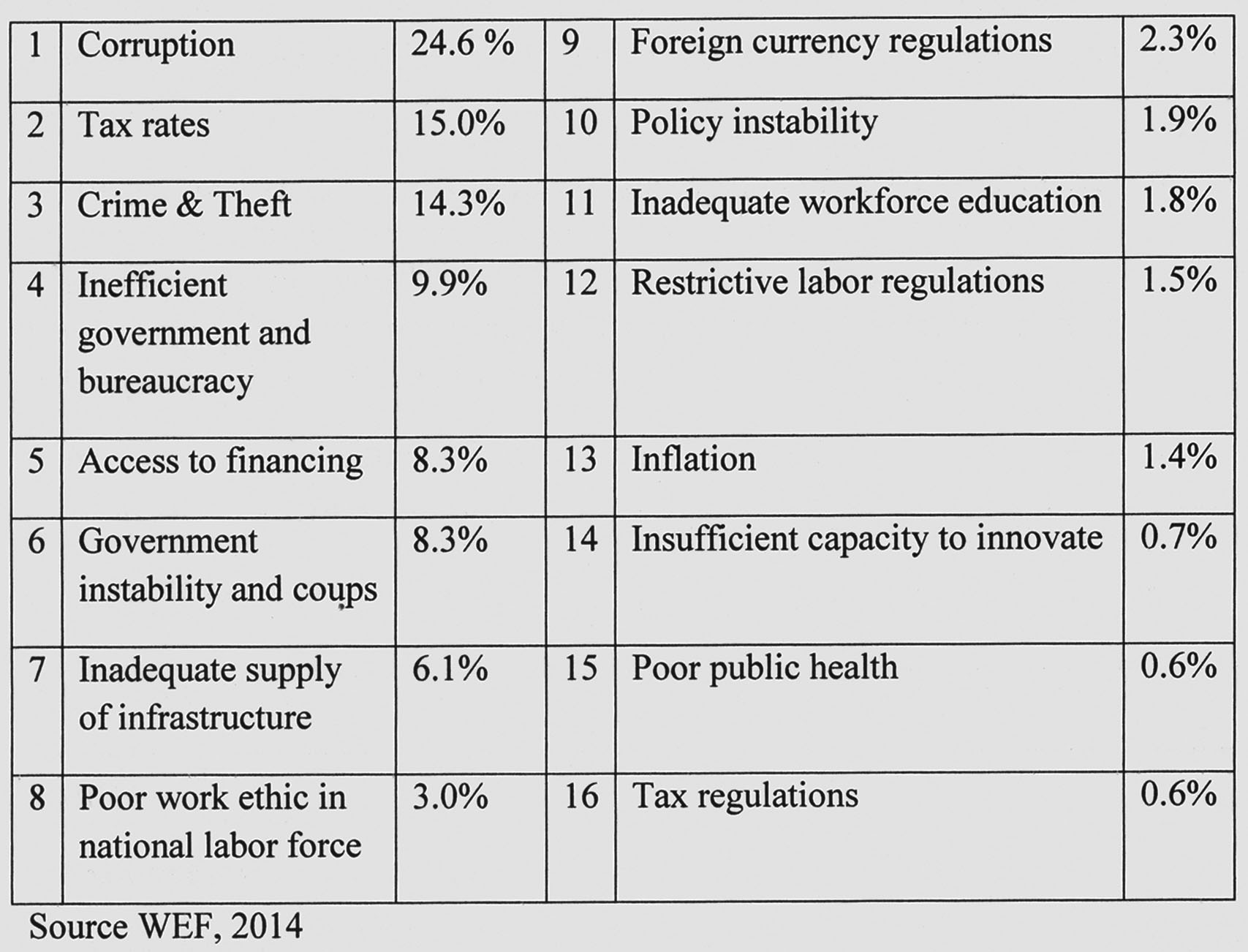

Second, there is the Executive Opinion Survey undertaken by the World Economic Forum since 1979 as an integral part of its annual reporting of the Global Competitiveness Index. This is the longest-running and most intensive measure of business leaders’ perceptions of corruption in their countries’ public sector. When surveyed on the most problematic factors for doing business in Guyana in 2014-15 the responses are presented in the Table below:

The Table lists the 16 rankings of the most problematic factors, as reported in the 2014-2015 Executive Opinion Survey. These reveal corruption, crime and theft were first and third on the list, accounting for approximately 40 per cent of the identified factors. Similar to the CPI considered above, the qualitative analysis conforms to the pervasiveness of corruption indicated by the quantitative estimates, previously provided.

Economic time-bomb: Sugar

Last week I counterpoised Guyana’s proposed stolen public assets recovery initiative to concerns many express concerning politically driven efforts seemingly designed to de-stabilize sugar and rice. In this final section I indicate the fragility of sugar at this particular conjuncture. I shall look at rice next week and present a fuller examination of both industries in later columns.

Guyanese are noted for short public memories. A year ago I contributed 25 consecutive columns (January 5 to June 26 2014) revealing that GuySuCo had reached “a point of no return.” This followed on 20 previous columns in 2011, dissecting the structural weaknesses of the sugar economy. Much media concern was displayed over my observation that the industry had passed its “tipping-point,” dashing hopes of its rational, considered and ordered reform and reconstruction. GuySuCo produces less and less sugar and it’s costing more and more, while the price of its sales declines. Manifestly, GuySuCo’s survival depends on 1) direct official bailouts and 2) increasing its indebtedness. This is unsustainable. There was much media debate on this.

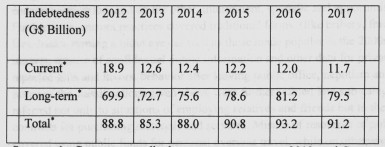

Those columns had revealed from GuySuCo’s accounts its extreme indebtedness. This was projected in excess of $90 billion for this year through to 2017 and just less than this for 2012-14. Since late 2014, GuySuCo has been presenting hitherto unchallenged, tendentious spin claiming otherwise. These data are presented yet again in the schedule below:

Schedule 1: Guysuco’s Indebtedness

Sources: *= GuySuCo unaudited management accounts 2012, and GuySuCo Strategic Plan (2013-17)

Next week I shall complete this discussion.