No-nonsense programme

When a country runs into financial trouble, it turns to the IMF for help, and depending on its level of development and financial health, the IMF gives it a structural adjustment programme to suit. The structural adjustment programme (SAP) of the IMF is a straightforward no-nonsense programme that forces supplicant countries to face head on the financial realities of their operation and existence. The purpose of the programme is to make countries improve their way of doing business.

The institutions that are part of the productive structure have to operate differently. The SAP consists of myriad policy measures that a government has to undertake in order to put the economy on a growth path. The measures are generally applied to the spending of the government since there is the belief that the allocation of resources between the private sector and the public sector matters and too many resources in the government’s hand limits the private sector and hence the opportunities for economic growth.

Big and thorny

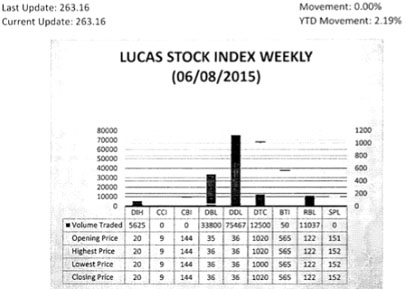

The Lucas Stock Index (LSI) remained unchanged in trading during the second period of June 2015. The stocks of six companies were traded with 138,479 shares changing hands. There were no Climbers and no Tumblers. In the meanwhile, the shares of Banks DIH (DIH), Demerara Bank Limited (DBL), Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 5,625; 33,800; 75,467; 12,500; 50 and 11,037 shares respectively.

The GuySuCo problem is a big and thorny one since it has financial and political effects. GuySuCo is a public enterprise which means that it is owned by the government. In addition to being owned by the government, GuySuCo is a monopoly. But GuySuCo is a monopoly with an interesting dilemma. While GuySuCo is the only sugar producer in Guyana, it sells the bulk of its sugar outside of Guyana. So, what happens to sugar output and price in Guyana is of very little interest to GuySuCo. In the foreign market, it is a price-taker and any analysis of GuySuCo’s problem should revolve around the foreign competition. But that was something GuySuCo did not have to worry about for many years because more than half of its sugar production and close to 80 per cent of its exports were sold in markets that were guaranteed and which offered it preferential prices. About five per cent of GuySuCo’s sugar exports went to the US market under the Caribbean Basin Trade Partnership Agreement (CBTPA) while 15 per cent was sold in the Caricom market.

The rest was sold in the European market under the ACP-EU Sugar Protocol. GuySuCo’s exports therefore were shielded from open market prices, and while its cost of production was comparatively high, it did not interfere with its ability to function.

Fall apart

Things began to fall apart when Australia, Brazil and Thailand brought a successful case against the EU under the rules of the World Trade Organization (WTO) which forced it to open its markets to all competing sugar producers. The ruling of the WTO against the EU eventually led the European Agricultural Council to cut the EU guaranteed price for sugar from which GuySuCo benefited by 36 per cent from around 2006. Though the implementation was gradual, the reduction of the price support expectedly had a big impact on GuySuCo’s revenues and the high cost of production became a reality that could no longer be ignored. Over the years, Dr Clive Thomas has written ad nauseam on GuySuCo and has repeatedly drawn attention to the poor performance of the industry and the uncompetitive structure of its operations.

Unsustainable debt levels

Close to one year ago, the Economic Services Committee of the National Assembly was informed that GuySuCo ow/ed over $58 billion to various creditors. Now Professor Thomas has placed the debt of the company at $90 billion. What is appalling is after more than 10 years of repeated warnings from Professor Thomas and others, insufficient effort was made to make GuySuCo a competitive entity. Instead, this uncompetitive company was allowed to rack up unsustainable levels of debt that it had a diminishing capacity to repay.

This story about sugar in Guyana is sad but not new. A perusal of the National Development Strategy (NDS) reveals that the problems that are manifesting themselves today were either known or anticipated since back in 1996. At that time, Guyana knew that GuySuCo’s production costs for sugar were two-thirds greater than the prevailing price on the world market. The magnitude of the problem that Guyana could face if it did not address the problem sensibly was further underscored by the realities existing in the export market at the time.

As a production entity, GuySuCo’s problems are consistent with the one thing that worries creditors and the IMF − too much debt and an inability to repay it from its earnings.

With production levels down and a unit cost that is way above world prices for sugar, GuySuCo, as a price-taker on the open market, has to depend on luck. It must pray for major sugar producers to suffer misfortunes with their crops so that world prices could rise high enough for it to cover its costs. That is an unacceptable business model that guarantees no one success, not even the gambler in the casino. Sugar workers and their families must not be placed in such an uncertain future forever. But, that is what the PPP/C government did to sugar workers. They kept misleading them into believing that the deep-seated problems of the industry were surmountable under current operating conditions when they were not.

Shipment of sugar

To overcome its debt problems, GuySuCo has to produce more sugar and lower its costs while doing so. While many have examined its field and factory operations and found several problems, there are challenges in other parts of the supply chain that cannot be resolved without improvements in production. One major problem is with the shipment of sugar.

Ships that come to collect sugar are encountering increasing delays and the incongruence between production and loading has caused GuySuCo to incur heavy costs at the expense of its workers and the Guyana economy as a whole. Some estimates suggest that GuySuCo is forfeiting as much as $2 million per day as it struggles to fill ships that come to carry its exports of sugar abroad. The losses which represent demurrage on account of the company’s inability to have the sugar in sufficient quantities to load the ships is obviously hurting the industry and its workers who remain in an uneasy relationship with management.

The incurrence of demurrage charges has repeated itself quite frequently and was unlikely to change if production levels at the corporation do not rise significantly. The difficulties experienced by GuySuCo stem in part from its inability to produce the quantity of sugar consistent with the level of export demand and the carrying capacity of the ships hired to transport the cargo. This capacity gap is another reflection of the inability of GuySuCo’s management to correct the labour and supply-chain problems afflicting the industry.

IMF-type remedy

Of all the IMF-type remedies that are thrown at developing countries, the two most painful ones − wage suppression and privatization of the industry − are staring at GuySuCo as a result of the proverbial ostrich-like posture of the PPP/C government on the industry. GuySuCo’s wages represent an unsustainable 60 per cent of its production cost. For sure, GuySuCo contributes about four per cent to the domestic economy. But with a debt of $58 billion, GuySuCo alone is claiming 10 per cent of the goods and services that the country produced last year. Using Professor Thomas’ estimate of $90 billion, the leakage from the economy reaches about 15 per cent of Guyana’s domestic output of 2014. These are resources that are unavailable for productive use.

Too big a burden

While GuySuCo might be too big to fail, it is also too big a burden. The nation cannot be held hostage to this kind of debt threat forever by one company. Because GuySuCo is a government enterprise, its debt threat is in effect a threat to private investors. The government must therefore create its own structural adjustment programme for GuySuCo if the sugar industry is to be saved. The formulation of this programme must involve the scaling down and diversification of operations. Since the workers are an integral part of the company, they must be included in the reform effort so as to ensure that the restructuring plan serves the interests of all stakeholders.