Replacement

Some 33 years ago, global politics and economics combined to force Guyana into searching for a replacement for wheat flour. Guyana turned to rice because it produced the commodity and felt that it could turn some of its rice output into flour. It was a tall order because the technology to make flour from rice was still evolving, and therefore, the value-added food products that were made from rice flour were not as appealing as they became years later. In that scenario, rice was used as a tool for crisis management. Today, rice has re-emerged into the limelight of the economy as a consequence of another crisis of the global political and economic variety. Cross-border politics, in the form of aggression by Venezuela that threatens to disturb regional peace and that brought with it a diminution of the rice market in that country, have conspired again to bring rice to the forefront of Guyana’s economic management. This time rice is a victim of the crisis. This article seeks to determine if rice has any hope of emerging from its crisis without losing the stature that it has gained in the economy and destroying the many dreams that depended on it.

In 1982, when rice was asked to rescue the Guyana economy on account of the loss of wheat flour from the domestic market, it was a small part of the production structure of Guyana.

As Table 1 above below shows, the average annual production of rice was 150, 082 MT in the decade from 1982 to 1991. It contributed less than three per cent of gross domestic output (GDP). Sugar was king, controlling nearly 17 per cent of the economy and nearly half of the agricultural sector. Other economic activities such as those in manufacturing and mining contributed four times as much to the domestic economy than rice. Still rice was seen as one of the three commodities that was part of the commanding heights of the economy. The factor that gave it that stature was the role that it played in bringing foreign or hard currency into the country. At the level of exports shown above, there was room for lots of growth in the rice sector, but Guyana was unable to make use of the economic opportunity owing to domestic political disagreements.

Largest income earner

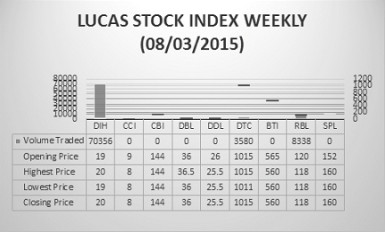

The Lucas Stock Index (LSI) rose 0.29 percent during the first trading period of August 2015. The stocks of three companies were traded with 82,274 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 5.26 percent on the sale of 70,356 shares. The stocks of Republic Bank Limited (RBL) fell 1.67 percent on the sale 8,338 shares. In the meanwhile the stocks of Demerara Tobacco Company (DTC) remained unchanged on the sale of 3,580 shares.

The situation of rice in the Guyana economy has changed within the last decade as Table 2 below shows. The average annual production of rice over the last 10 years was 392,462 MT, more than two and a half times the amount of rice produced in the decade of comparison.

Exports have also grown from about 36,000 MT in 1982 to 501,000 MT of rice in 2014, more than 14 times that of the base year. Exports averaged 76 per cent of production in that period. In 2008, rice became the single largest income earner in the agricultural sector, claiming nearly 35 per cent of the income that went to that sector in that year. Rice became the most important agricultural crop in 2013 when it surpassed sugar in the combined output of agriculture and manufacturing and pushed its share of the agricultural sector to nearly 40 per cent in 2014. Since 2008, rice, by itself, dwarfs the income generated by the entire manufacturing sector. Except for the mining sector and the combined activities of the transport and distributive trades, rice is a dominant factor in the productive sectors of the economy. Unlike in the early eighties when the significance of rice was its contribution to the foreign earnings of the country, rice is now a major factor in both the production and finance structures of Guyana. One therefore understands why President Granger would think of rice as being “too big to fail”.

Crisis

The crisis that has hit rice has come at a time when the domestic economy has begun to slow down and the agricultural sector is suffering the effects of a failing sugar industry. Like sugar the rice industry depends on foreign markets. Equally true is the fact that, though Guyana is an exporter of significant quantities of rice, like sugar, it remains a price-taker on the world market. Because of its significance to the economy, however, rice needs to get special attention sooner rather than later. Gold, rice and sugar are all suffering ill-effects of different sorts. What is abundantly clear from their combined experiences is that the over dependence on revenues from primary commodity production is too risky a strategy to depend on for sustainable economic growth.

Treatment

The treatment of rice, however, needs to be different from the treatment of sugar and dealing with it will not be easy. This writer does not have access to enough parts of the industry to offer a comprehensive solution to the problem of rice. After all the rice industry has a complex of relations among farmers, millers, industry representatives, creditors and the government. The attention to rice must take account of this structure of relations. It must also take account of the desperate need for Guyana to break out from the primary commodity mode in which it has been living for most of its life. The dependence on rice as a primary commodity alone is not going to cut it for Guyana. The current experience, where Guyana ended up running from the European Union frying pan into the Venezuelan fire, reinforces that need. Primary commodity markets fluctuate too much and can cause trouble even when sales are tied to special trading arrangements.

Consequently, the search for the current solution for rice must go also beyond the search for markets for the product as a primary commodity. Unlike the sugar industry, the bulk of which is owned by government, the rice industry is largely in private hands. Yet, the rice industry appears caught in the stranglehold of the overactive involvement of the government and a private sector which is not sufficiently competitive. The input of the government is substantial with support coming through expenditures on drainage and irrigation, research and development, extension services, marketing and financial support through the Ministry of Agriculture and the Guyana Rice Development Board. At the same time, millers have enough monopoly and oligopoly clout to hold farmers to ransom for payments for their paddy.

Loosen up the industry

The government needs to help loosen up the industry so that rice farmers could possess more leverage in their dealings with each other and the millers. The government should also seek to add greater value-added to the efforts of the farmers as was begun in 1982 and which utility the previous administration finally embraced in its push to produce rice-based cereals.

Unlike earlier times, there is greater appreciation for rice flour around the world. Persons who are seeking gluten free flour often see rice flour as a substitute. Countries like Japan and the USA embrace rice flour for its nutritional and flexible uses. The new administration therefore should seek to take advantage of these market opportunities by pushing the development of rice flour and greater national consensus for the downstream integration of the production of rice.