Illicit activities

The recent disclosure in local print and online media that gold was being smuggled out of Guyana in significant quantities is a blow to the integrity of Guyana’s revenue collection system and an apparent indictment of all aspects of port security ‒ land, sea and air. In addition, both the GGMC and the GRA are responsible for revenue collection and both might be missing key signs of law-breaking that enables illicit activities to flourish. The Guyana Gold Board has a responsibility here too which could control the illicit outflow of gold. The mining industry of which gold is a part however is policed by the Guyana Geology and Mines Commission (GGMC). The system of control therefore starts there. It is the body that is supposed to have a reasonably good idea of the level of activity of the mining sector and therefore should be able to report how much gold is produced in Guyana. It should be the one discovering at source any discrepancies between production and declarations made to the Guyana Gold Board.

Alarm

To many Guyanese, Guyana is a country of ‘runnings’. Consequently, some people believe that the alarm over the massive smuggling of gold would blow over soon and things would be back to normal, except for those who lost their US visas and the foreign earnings which they were unable to put their hands on. But the concern over the revenue losses from gold smuggling should not be treated as a run-of-the mill matter because of what gold means to the Guyana economy and the seemingly inordinate amount of influence exercised by the smugglers over the regulatory authorities of this country. Anyone who has been following the industry for the last seven years would realize that gold production and exports have assumed a special place in the economy of Guyana.

Largest contributor

Gold is by far the largest contributor to the mining sector and the Guyana economy. According to a 2010 Mineral Report produced by the GGMC, gold accounts for about 75 per cent of the value of the output of the mining sector. Bauxite contributes about 19 per cent while diamonds account for an estimated two per cent. The gold industry’s share of employment represented 91 per cent of the total direct employees in the mining sector. For several years now, gold has been the single largest earner of foreign exchange for Guyana. Its foreign receipts dwarf those of sugar, rice, timber, fisheries and bauxite, the other major exports of Guyana. Reports put the size of the illicit outflow at $42 billion between the months of December 2014 to March 2015. Other estimates suggest that Guyana could be losing as much as $10 billion in public revenues and $146 billion in foreign exchange earnings per year. The lost revenue is an amount almost equivalent to what Guyana earned in export revenues in 2012.

One gets the impression from the massive amount of smuggling reported in the daily and online sources that the variance and risk analysis of the GGMC is weak. This is an important metric that ought to be tightened if losses from gold production are to be reduced significantly. GGMC has been in business for over 35 years. Its failure to recognize that gold production did not match gold declarations to the Guyana Gold Board or reported export sales in a timely manner calls into question the integrity and effectiveness with which that body conducts its work. As such, the leakage of the precious metal from the Guyana economy is not only a big blow to the people of the country who have come to depend on the spending by operators of the mining sector, but an indictment of the performance of GGMC as a regulator. Divergent data published in works done by Professor Clive Thomas and the GGMC on employment and output suggest that there is too much uncertainty about the data emanating from the mining industry. Illicit activities are not meant to be detected, but even the reported losses from the latest round of smuggling cannot be reasonably estimated because the predictive production models of GGMC, if they have any, are mightily flawed.

Capital flight

The story of the massive outflow of gold from Guyana is also a story about the flight of capital from the country. Capital flight involves the outflow of financial assets or capital on a large scale and at a rapid pace. Capital flight could be legal as in the case of repatriated profits by a foreign company or the transfer of investments to more lucrative investment pastures. In the latter case, the expectation is that if all goes well, then money will flow back into the source country. In most cases, however, the talk about capital flight is a talk about a really bad event. It is a situation in which people are trying to get money out of the country as quickly as they can so as to protect it from some type of economic crisis, political uncertainty or foreign exchange controls.

It is a natural tendency on the part of people to want to protect their hard earned money. Given the rough terrain of Guyana and the many risks to which miners are exposed, one could understand the desire to get the most money out of the effort and to protect whatever money has been earned. The failure by the miners to declare and sell gold to the Guyana Gold Board or declare their export sales is a breach of the law. The undisclosed export of the gold amounts to smuggling and illegal capital flight. However, the movement of the gold through unorthodox channels has taken place in an era of heightened concern about the movement of money to hide illicit proceeds and to finance terrorist activities. This covert activity might have continued uninterruptedly had it not been for the possibility that the exorbitant amount of gold leaving Guyana with such rapidity apparently worried US officials who concluded that it was money laundering.

Capital flight has plagued many countries around the world. Only recently that was a major fact of life among Greeks, many of whom took their money out of Greek banks and placed it for safe keeping in foreign banks as a result of the economic crisis facing the country. Another country which has been experiencing significant capital flight recently is Russia. The Russian crisis was triggered by a series of factors including that of corruption and the hostilities between itself and the Ukraine.

Economic implications

Capital flight has serious economic implications for a country. It robs countries of tax revenues. Based on the numbers reported in the print and online media and averred to by a senior official of the Ministry of Natural Resource and the Environment, Guyana is suffering massive losses in tax revenues and investment opportunities from the reported gold smuggling. An estimated 12,500 ounces of gold is reported to have left Guyana weekly over the last year. This transfer of resources from Guyana to other countries is huge in terms of the losses that hit the country. Relying on the reported numbers, it means that the government has lost about $8 to $12 billion in royalties and taxes over the last year. Not to speak of the amounts that have been lost to savings and investments.

The staggering amount of the outflow represents between 26 to 32 per cent of nominal gross domestic product (GDP) of 2014. On average, legal transfers measured as a stock at the end of the year amount to about 10 per cent of GDP. The illicit capital outflow is staggering for an economy of Guyana’s size. It is not clear what is happening to the money that has left Guyana as a result of the smuggling of gold out of the country. If the estimated $146 billion was flowing back to the economy, then the commercial banks would not have to worry about the loss of $60 billion that the government withdraws from the banking system. This writer expects to hear a condemnation of this malpractice by the private sector bodies which felt that the removal of $60 billion, chicken feed to what the dishonest goldminers have robbed the country, was a retrograde economic act.

The GGDMA had conducted a study which suggested that the lower declarations were driven by a decline in production. The disclosure about smuggling comes at a time when the government saw it as prudent to assist small-scale miners who were struggling to meet expenses for their operations. The belief that the tax-free concessions would help to stimulate production and discourage underreporting might be mistaken. Many thought the concessions might be the answer to the downward trend of gold declarations. Now Guyana knows that that was only part of the problem.

Loss of integrity

The story is not only about the loss of money and the economic opportunities such large sums of cash represent. It is also about the loss of the integrity in the revenue collection system. This aspect of the story is more troubling than the lost revenue. The complaints by the PPP/C government last year should have led to heightened surveillance of the industry. This action apparently was not taken by the two agencies, GGMC and the Guyana Gold Board, closely charged with this responsibility. One must wonder if either of the two is doing a good job at managing the industry.

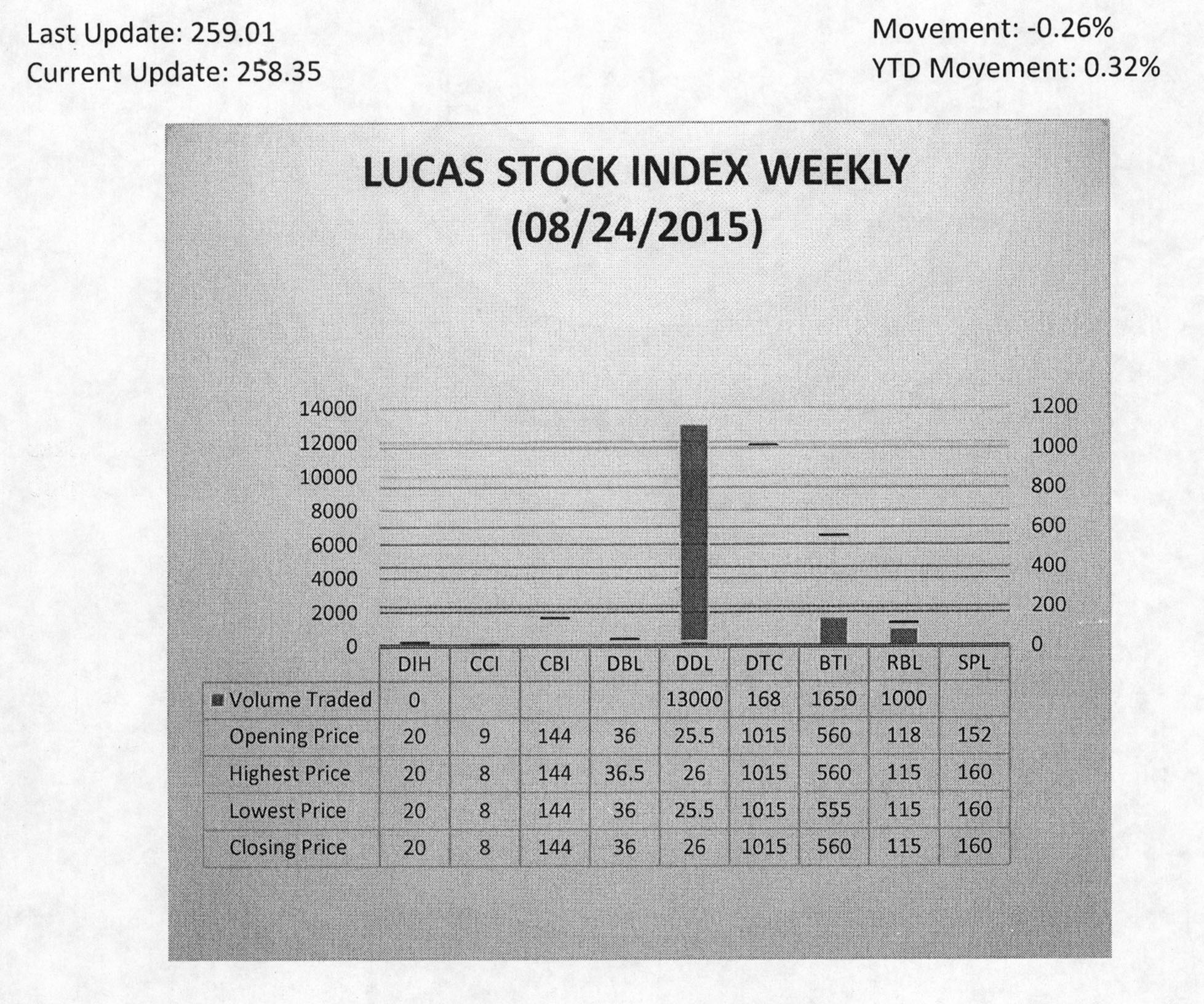

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) declined 0.26 percent during the fourth trading period of August 2015. The stocks of four companies were traded with 15,818 shares changing hands. There was no Climber and one Tumbler. The stocks of Demerara Distillers Limited (DDL) fell 1.92 percent on the sale of 13,000 shares. In the meanwhile, the stocks of Demerara Tobacco Company (DTC), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 168; 1,650 and 1,000 shares respectively.