Early concerns

The early concerns that the Guyana economy has slowed down and that the growth for 2015 would at best be sluggish remain valid even after a round of salary increases. Countries experience a slowdown in economic activity when there is a reduction in spending by the major economic actors. The macroeconomic lessons tell the interested that there are three principal categories of economic agents in the economy. These are households, businesses (direct investors) and government. While spending by all categories is important, in tough economic times, and in an economy like Guyana’s, the spending by the government and households matter the most. In the case of Guyana, the combined spending by government and households amount to about 90 percent of all spending done in the economy. This implies that the behaviour of the government has significant impact on what happens to households and businesses, and the general welfare of the people. A government therefore should pay keen attention to its spending and that of households. They are important in any attempt to give the economy a boost. Nonetheless, Guyana’s traditional heavy dependence on foreign financial inflows and the falloff in the rate of foreign investment vis-à-vis local investment draw one’s attention to the behaviour of business spending in 2014. This article examines the combined effect of the foreign private investment and remittance inflows on the Guyana economy from 2007 to 2014.

Natural thing to do

The economic consequence of substantially higher salaries for a few high-income earners as against substantially higher salaries for lower income workers is to keep the economy in a sluggish state. There is no advantage in watching the Guyana economy meander along an obstacle-strewn path. The obstacles must be removed so that the economy could go at a faster pace.

Third group

This is where the third group of economic agents, investors, becomes important. They take their cue from households and governments and the signal to them in 2015 to spend more might not be sufficiently strong given the comparatively inverse rates of salary increases for lower-income workers and higher-income workers.

Private investors are the ones who take money that is not being spent either by the government or households and spend it. By acting that way, investors ensure that a significant share of the money generated in the economy gets to remain in circulation. But, they must feel confident that the demand for the goods and services that they produce will be there. More money in the pockets of low-income workers provides that confidence.

Small

In Guyana, the contribution of private investors is small compared to the spending by the government and households. Private investment averages about 10 percent of the spending that takes place in the economy. It is small but important and when it enlarges as significantly as it did-by 118 percent- in 2014, it piques the curiosity of people. Part of the investment spending constitutes foreign direct investment.

This component of foreign inflows, along with workers’ remittances, plays a major role in the expansion of the Guyana economy. There is no empirical study of Guyana in recent years that one could point to that shows a causal relationship between foreign direct investment and economic growth of the past seven years in the Guyana economy. However, there are other ways to demonstrate the impact that FDI has on the economic condition of the country.

The Table below shows the share of foreign investment in total private investment in Guyana.

The importance of foreign investment to the Guyana economy could be seen from the share of the total investment that it occupies. From 2007 to 2013, foreign investment was responsible for an estimated 72 percent of the total private investment in Guyana. In monetary terms, Guyana attracted 93 percent more foreign investment dollars in 2012 than it did in 2007 and 67 percent more in 2014. The source of the investment is not available to this writer, but whether it came from inter-company loans, re-invested profits or new equity capital, the economy benefitted from the investment. Any stimulus spending by the government that gets into the hands of the people will provide the income to be spent on the goods and services that are produced in the economy with both foreign and local private money. Most of the investment went into the telecommunications, the mining and forestry sectors. Quite recently, some amount of the foreign investment went into the energy sector and into tourism.

Stable and positive

environment

So far, the best year for foreign financial inflows was 2012 which saw G$60 billion invested in the country. Foreign investors are usually attracted to a stable and positive environment in the host country. Guyana has been plagued by allegations and perceptions of corruption for several years.

The crime situation has also haunted the country and continues to do so even under a new administration. The flow of foreign investment into Guyana shrank dramatically in 2014 from an average high of 72 percent to a low of 42 percent of total investment in Guyana. Even though it was the second highest level of foreign investment spending in Guyana during the period in review, the volume was no match for domestic spending.

The high level of domestic private spending last year has caught the attention of this writer and many others. It was the first time in the review period that domestic investment had outpaced foreign investment. According to the Bank of Guyana, the private spending in the domestic economy was driven by the money poured into construction and manufacturing activities. While all industries in the manufacturing sector recorded positive growth, none had as enormous an impact as investment in the construction industry. Output of the construction sector grew by 18 percent leading this writer to the conclusion that it was the main driver of domestic investment spending in 2014.

Major source of

financial inflows

While it is important on its own, when joined with remittances, another major source of financial inflows the combined effect is even more significant. These two financial inflows contribute significantly to the domestic output and the money supply.

The significance of this financial inflow to the Guyana economy could be seen also in its share of the money supply. During the review period, the combined foreign inflows accounted for about 20 percent of gross domestic product and 46 percent of the money supply in the country. Remittances will come at a much faster pace than foreign investment. The government will want to ensure that nothing happens to discourage that inflow at this point in time.

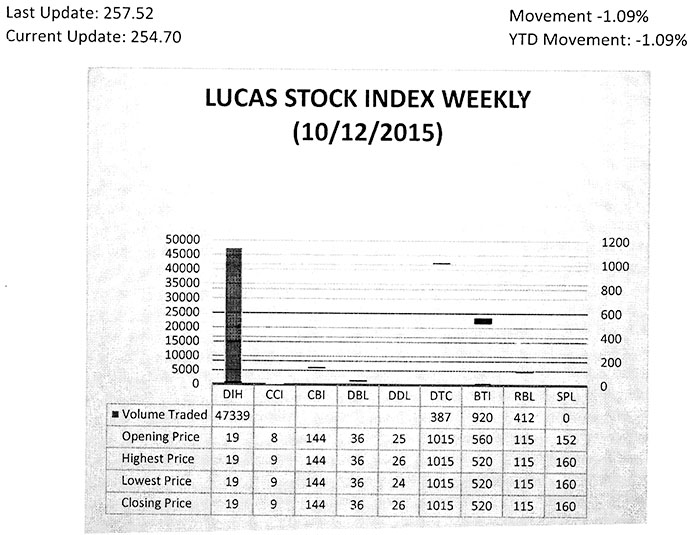

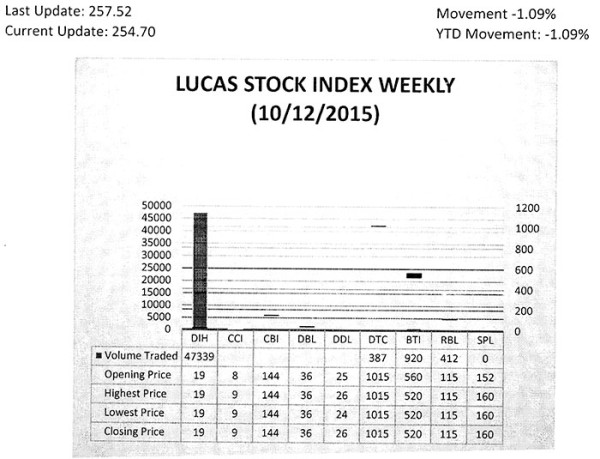

The Lucas Stock Index (LSI) declined 1.09 per cent during the second trading period of October 2015. The stocks of four companies were traded with 49,058 shares changing hands. There were no Climbers but there was one Tumbler. The stocks of Guyana Bank for Trade and Industry fell 7.14 per cent on the sale of 920 shares. In the meanwhile, the stocks of Banks DIH (DIH), Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 47,339; 387 and 412 shares respectively.