Public affairs

The government is responsible for several enterprises that are classified in the public accounts as public corporations. In the normal course of events, public corporations can be regarded as entities that are created to administer public affairs. Not all the affairs of public enterprises in Guyana would have the appearance of public affairs. One would hardly think that sugar was a public affair beyond the fact that the government owned it. The administration of the enterprise hardly responded to public scrutiny or concern. GPL, another public enterprise, has had its fair share of condemnation as well. GUYOIL pops up as a news item every time that global fuel prices take a dramatic turn upwards or downwards or when fuel smuggling becomes annoying. Then there is the National Insurance Scheme (NIS) which, like the Guyana Post Office Corporation (GPOC) and the Guyana National Newspapers Limited, has more of a public role than the other entities.

Categorisation

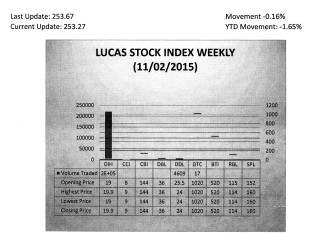

The Lucas Stock Index (LSI) fell 0.16 percent during the first trading period of November 2015. The stocks of three companies were traded with 225,375 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 4.74 percent on the sale of 220,749 shares while the stocks of Demerara Distillers Limited (DDL) fell 5.88 percent on the sale of 4,609 shares. In the meanwhile, the stocks of Demerara Tobacco Company (DTC) remained unchanged on the sale of 17 shares.

The 10 entities represent a variety of economic activities. While they straddle various economic sectors, their categorization in the budget estimates seems to follow a political and not an economic one. Two of the companies, GPL and GPOC are classified as utilities. Two others namely, GRDB and MARDS are classified as agricultural. Three public corporations, GNSC, GNPL and GUYOIL are classified as commercial. The remaining three of NIS, GuySuCo and GNNL are classified as independent companies. The classifications do not follow the national system of accounting.

Goods

A closer look at the 10 companies reveals that some of them produce goods while others produce services. For example, GuySuCo, MARDS and GUYOIL produce goods. Their products qualify as goods because they satisfy the three conditions on national accounting that allow them to be so classified. For example, they produce physical units for which demand exists. In addition, the ownership of the goods that they produce can be established. As the owner of the corporations, the government owns the goods. The third condition is that the ownership of the goods which are produced can be transferred through market exchange.

Services

The economic value of the other seven companies comes from the services that they provide. To be considered as enterprises that provide services, they must do one of two things. They must produce a change-effect or they must capture knowledge. For a business to produce a change-effect, it must be able to transform the condition of a consuming unit. So, for example, a person who goes to the hospital in a sick condition and comes out alive or healthy would have experienced a change effect. It is from this perspective that GPL and other corporations can be seen as providing a service by changing the condition of households. GPL enables the consuming households to change their environment from darkness to light with the use of the electricity delivered to their homes and businesses. GNSC and GPOC also provide services because they too are able to have a value-added effect on the consuming unit whether businesses or households. They enable people to move goods or letters and packages from locations where they are not useful to them to locations where they are useful to others.

The GRDB could be attached also to the group that provides a change-effect service. Its extension, research and quality control functions can be regarded as producing a change-effect on rice farmers. With access to improved varieties of rice seeds, the rice farmers are able to produce and export better quality rice. Following the logic of the change-effect, the NIS also is a service organization. It is supposed to change the condition of contributors from not being in a position to pay for or gain access to a service to being able to do so.

Fundamental component

A fundamental component of the service is that the ownership rights of the consuming units do not change when a service is performed. Very often people do not think of this factor when seeking a service, but somehow experts believe that it is important in defining a service. The only change that occurs is the condition of the consuming unit. For example, when a person takes a malfunctioning vehicle to the mechanic, the mechanic makes the vehicle functional again but the ownership remains with the person who brought the car if he or she was the registered owner. Similarly, when persons are able to use light in their houses, GPL does not own the home. Ownership remains with the person who has title to the house.

Knowledge capturing

The enterprise that has a knowledge-capturing effect is GNNL. GNNL is involved in the production, storage, communication, and dissemination of information and advice in ways in which the consuming public can access the information repeatedly. It also produces information for others. It should be noted that the work of GNNL has the features of goods in that ownership rights of some of what it produces can be established and the rights could be transferred to others. GNPL seems to straddle both the change-effect and knowledge-capturing effect of services as well.

Noting the aforementioned observations, one would think that the budget estimates would classify them according to their sectors as is done in the national accounts. Instead of having the four categories of utilities, agricultural, commercial and independent, they could have the two sectors of agricultural under which GuySuCo, MARDS and GRDB could fall and the services sector under which the rest of the enterprises would be grouped.

Conspicuous corporations

When one thinks of the more conspicuous corporations like GuySuCo and NIS and the stories about them, there is the belief that the public enterprises contribute nothing to the public purse. It might just be a case of one bad apple spoiling the entire bunch. When looked at from a financial perspective the public corporations as a whole seem to contribute some economic value, albeit small, to Guyana. From 2007 to 2014 which is the period examined, the public corporations contributed positively to the public finances of the country. They contributed an average of G$9 billion or G$1.1 billion per year to the public treasury. The contribution came primarily from taxes and dividends that were transferred to the government. The contribution was based on sales of G$886 billion and costs of G$852 billion over seven years. Much of it was driven by local sales which became progressively stronger over the last five years. Local sales grew at an annual average of eight percent while export sales only grew by one percent during the review period. On the whole, the average sales revenue was 53 percent of total sales.

A drop in the bucket

While the overall contribution to the national economy was positive, one cannot be pleased fully with the overall effort of the public enterprises. The size of the

contribution to the economy was nothing to write home about given the billions in assets that these companies possess. The combined profit margin was less than half of one percent of average sales, a mere drop in the bucket of total output of the country. Part of the reason was that the growth in expenses kept pace with the growth in sales. Both of them grew at an annual average of five percent. A significant component of expenses was maintenance and material costs. These two groups of items were responsible for nearly 80 percent of the total of all costs.

Another explanation might be the philosophical differences in the purposes of the corporations. Some of the service corporations might not be expected to produce profits even though they are expected to be efficient. The lumping of enterprises like GuySuCo, MARDS, GNPL and GUYOIL with service organizations with others that have no real profit motive could obscure the real challenges in the public corporations. For example, in the case of GuySuCo, the performance of other public corporations help to mask the true negative impact that it is having on public finances.

The public corporations represent an important source of employment in Guyana. They employed about 17,000 workers which represented an estimated seven per cent of the persons employed in 2013. They were employed at a recorded cost of G$26 billion. On average, employment costs accounted for 20 per cent of total expenses incurred by the public corporations. In looking at the national economy as a whole, employment costs represent about five percent of GDP. The share used to be higher at seven per cent but since 2009, the share has stabilized at five per cent. Without adjusting for the difference in rates of pay between senior and junior workers, the employees in the public corporations earn an average of G$1.5 million per year.

Fact from fiction

Collectively, the public corporations do not appear to be a drag on the economy. Each of the 10 corporations identified in the budget estimates play a useful role in the economy and their classification might not be a burning issue nor anything politically significant. However, the bunching of dissimilar industries might make it difficult for policymakers in Guyana to separate fact from fiction about the performance of public corporations.