Reasons for trade deficit

As was noted in the first part of this article, trade remains a very important element of the Guyana economy. However, Guyana continues to incur deficits in its international exchange of goods and services. The trade deficit could partially be explained by a lack of comparative advantage and unfavourable movements in the terms of trade, especially in sugar, oil and capital equipment. Most of

A growing debt is not sustainable either and it is not something that Guyana wants to encourage. This truth comes up against another daunting reality of Guyana’s, that is, the expansion of production and trade requires technology that Guyana does not have. Most, if not all, of the capital equipment that Guyana needs for use in the mining, agricultural, construction, financial, transportation and distributive-trade industries, have to be imported. This is where foreign investment becomes a major factor in the production structure and trade of Guyana. It becomes both the alternative and foundation on which the future growth of the country depends. The economic security of the country also arises with the constant threat from Venezuela every time Guyana includes foreign investors in major economic initiatives in its Essequibo territory.

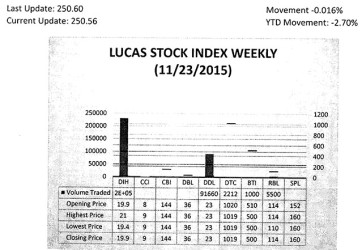

The Lucas Stock Index (LSI) fell 0.16 per cent during the fourth trading period of November 2015. The stocks of five companies were traded with 331,618 shares changing hands. There were no Climbers but one Tumbler. The stocks of Demerara Tobacco Company (DTC) fell 0.10 per cent on the sale of 2,212 shares. In the meanwhile, the stocks of Banks DIH (DIH), Demerara Distillers Limited (DDL), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL) remained unchanged on the sale of 231,246; 91,660; 1,000 and 5,500 shares respectively.

It goes without saying that the expansion of exports would depend on the ability of Guyana to produce the products that the regional and global markets require. Guyana is endowed with a vast array of natural resources. This includes bauxite, gold, diamonds, timber, fisheries, sand, rare earth metals, potential hydropower energy and now oil. Most of Guyana’s natural resources are found deep in the earth and require the use of technologies of which Guyana has limited capability to take advantage of its natural resources. The extraction and export of natural resources is one element of the investment strategy. The other is to develop value-added industries whose products can then enter the export markets. Both primary and value-added production could be concentrated in rice, fruits, vegetables and ground provisions. In both instances, for Guyana to broaden its production structure and deepen its trade relations, it has to attract foreign investment.

Financing structure

Combining the country’s interest in trade and investment necessitates considering the financial structure since trade and investment are supported by both short-term and long-term financing arrangements. The short-term financing arrangements involve the use of prepayment arrangements, bank credits, bills of exchange and balance-of-payments support. These are used typically to finance international trade. As a middle income country, Guyana is no longer eligible for concessionary loans from the World Bank and other financial institutions. It is not sufficiently creditworthy to be able to borrow large sums of money from the private capital markets. It would need to encourage the use of foreign investment to secure long-term financing for major investments. Undertaking this analysis helps with identifying the institutions with which Guyanese trade and investment promotion activities would need to coincide. The long-term financing arrangements involve the issuance of equity and debt securities, investment loans and foreign direct investment. In keeping with the philosophy of liberalism, the move towards the capital markets would have to come from the private sector.

The choice of financing and capital structure is left to the specific investor. Reliance on external equity and debt is something most of the private businesses in Guyana appear loathe to do. Most of the established companies in Guyana utilize internal equity financing to undertake long-term investments. A very few companies have been observed to use external debt financing to support their long-term investment strategies. The burden would fall to the foreign investors who have the ability to obtain loans from private markets and their parent companies to finance their operations. The involvement of the foreign investor in Guyana’s economy would depend on the strategy for attracting such investment. Whatever it does, this writer believes that the Granger administration should not close the door to the public-private-partnership method.

Security structure

As Guyana moves forward with its trade and investment promotion, it must keep the security concerns of the country in mind. That is hardly something that the President has to be told given his work and academic experience. But the economic security of Guyana is fundamental to the control over the economic resources and the trade and investment opportunities that Guyana has to offer the world. Guyana shares borders with three countries, namely Brazil to the south and south-west, Suriname to the east and Venezuela to the west. The course of its history has exposed the country to two border controversies. On the east, the triangle of territory called the New River Triangle is in dispute.

Guyana has an even bigger problem with its western neighbour, Venezuela. After accepting the award of a Tribunal in 1899 as a full, final and perfect settlement of the boundary between itself and Guyana, Venezuela decided to reject the arbitral award in 1962. This reversal of position followed also the marking of the boundaries early last century, the drawing of maps showing each other’s territory in 1905 and the marking of the tri-junction boundary of Brazil, Guyana and Venezuela in 1932. Venezuela is claiming the entire county of Essequibo, five-eighths of Guyana’s territory, and through a series of provocative military actions and decrees has attempted to assert sovereignty over the desired territory. As a consequence, Guyana’s economic security is tied up in its broader national security concerns.

Additional security concerns

The contiguous borders with the three countries expose Guyana to other risks and broaden its interest in the operation and use of the global security structure in its trade and investment promotion. US hemispheric reports cite Guyana as a major transit territory for the South American drug trade. While no major drug arrests have ever been made in Guyana, the frequent interception of shipping containers with large quantities of drugs that originate in Guyana suggests that Guyana is central to the supply chain for drugs reaching other parts of the world.

The capture of certain Guyanese business persons and the conviction of Guyanese nationals in foreign lands add further credence to the contention that Guyana plays an important role in the global drug trade. The money earned from the participation in the drug trade makes Guyana a target also of anti-money laundering enforcement. Further security concerns arise from the smuggling of goods into and out of Guyana through official and unofficial ports of entry.

Aligning the rationale and tasks

From the foregoing, the production structure, the finance structure and the security structure are important to the pursuit of Guyana’s foreign policy interests. There is a nexus between the three structures that Guyana cannot afford to ignore if its economic interests are to be achieved. Threats from Venezuela which undermine the security of Guyana have in the past discouraged foreign investors from investing in the Essequibo. Similar attempts have been made by Suriname in the east of the country. The experience of Beal Aerospace in 2000 and the Anadarko Petroleum Corporation in 2013 are two examples of the consequences of the hostile attitude of Venezuela towards Guyana. Suriname’s aggression has been tempered by the victory Guyana achieved with the favourable ruling of the International Tribunal for the Law of the Sea in the CGX case. The head-on collision of the production and security structures was witnessed further with the treatment of Guyana’s rice under the PetroCaribe deal. Venezuela told Guyana to cancel further rice shipments to that country and refused to allow boats with arriving rice to discharge the cargo.

Unrestrained sovereignty

This awareness must inform the attitude and disposition of the representatives of the country. The Ministry of Foreign Affairs should keep this need in mind as it attempts to attend to the President’s economic security interests. The internal structure of the ministry and the staffing of its missions become critical to the trade and investment enterprise. It would be important to staff the missions with officers who can prosecute the economic security policy of the President with success. Officers must be able at all times to explain why potential investors could successfully invest in all areas of Guyana. They must be ready with data to show that Guyana exercises unrestrained sovereignty over all of its territory and that its investment agreements with foreign investors are capable of global judicial scrutiny and protection. In addition, officers must show familiarity with the traditional products that Guyana exports and demonstrate awareness of current production trends and innovations. It should be noted further that the officers undertaking this responsibility would also be required to perform other duties pertaining to Guyana’s foreign policy. Without delving into its characteristics, it must be noted that knowledge assumes importance here.

Institutional investment

Together, the foregoing imposes a need to have the right institutional framework for getting the job done. It must have an operational structure that is capable of interfacing with domestic and foreign investment institutions, national and international regulators and domestic and foreign trade and investment associations. Guyana must make this institutional investment even though it could prove expensive initially. But the investment is necessary if Guyana is to change its structure, expand its global relations and strengthen its economic security.