Banks DIH registered a profit of $2.265b for 2014, down by 10.7% from 2013.

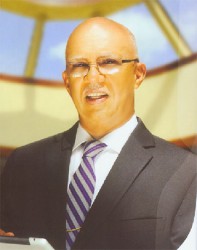

In his report Chairman Clifford Reis said that the year “was challenging for our company in many respects, but as a result of prudent decision-making and the implementation of cost saving measures and strict financial controls we have produced a result which even (though) down on the previous year’s results can be considered as acceptable”.

He said that while the economic data suggests that the global financial situation may be recovering in some respects “uncertainty and fear have now taken their place on the agenda of legitimate concerns which are affecting economic results across the globe and locally”. Reis, the long-serving Chairman of Banks DIH, said that fear and uncertainty had affected consumer spending and impacted on companies like Banks.

Profit before tax in 2014 was $3.47B and $2.265b after tax compared to $3.855b in and $2.538b in 2013. The Net Asset Value per share, he said, has increased from $21.55 to $23.20 or 8% and the company has maintained a dividend payment of $0.64 per share with the cost being $640m.

Reis, also Managing Director, said that during last year, Banks DIH continued its policy decision to replace and/or upgrade its production capacity.

During the year, the company was able to complete the Brewery and Cellars modernization programme and inaugurated its palletiser/depalletiser and a new pasteurizer for the beer plant.

He disclosed that in the new financial year major spending will focus on the acquisition and installation of a new Trisco biscuit oven, an online blow moulder for the water plant, the building of a new vehicle workshop, the completion of the Crème Select ice-cream outlet and replacement of trucks and forklifts.

During the year under review, two new products were launched: GT Beer and Rain Forest Water.

Banks’ 51% owned subsidiary, Citizens Bank Guyana Inc. increased its revenue from $3.010b to $3.217b but profit after tax fell from $1.004b in 2013 to $989.1m in 2014. Total assets of the bank increased from $40.7b in 2013 to $42.1b in 2014. Loan assets also rose by 22% from $23.7b to $28.9b. However, customer deposits dropped from $34.2b in 2013 to $33.2B last year. Interest income rose from $2.15b in 2013 to $2.37b last year.

Reis said that dividends received from Banks Holding Ltd, Barbados amounted to $31m and dividends paid to Banks Holdings Limited Barbados totalled $128.1m relative to the investments made with each other.

The company’s Annual General Meeting is set for Saturday, 24th January, 2015 at 5 pm.