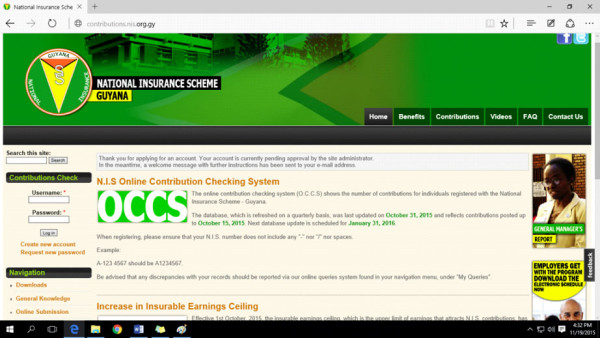

The National Insurance Scheme (NIS) has re-launched its Online Contribution Checking System (OCCS), which enables contributors to access the complete record of their contributions online.

NIS says the system is an innovative option for accessing contribution updates as well making contribution queries online. The online interface links to an offline version of the database used by the NIS.

The database, which will be updated on a quarterly basis, shows the number of contributions for individuals registered with the NIS. It was last updated on October 31st, 2015 and reflects contributions posted up to October 15th, 2015. The next database update is scheduled for January 31st, 2016.

At the launching yesterday, Chairman of the NIS board Dr Surendra Persaud described the system as “a simple, straightforward tool to ensure that our contribution record is accurate and up to date.”

“NIS accepts that their records are less than perfect and that the inconsistency in these records are a source of great dissatisfaction to all Guyanese but online checking of your contributions record gives you the opportunity to ensure accuracy. It is for that very reason that today we are launching the OCCS. Every contributor whether past or current will be able to obtain their contribution records,” he said.

Individuals who wish to access their records are asked to visit the webpage contributions.nis.org.gy and create a login account.

A new visitor to the site is asked to provide personal details, including a specific permanent NIS number. This information is then verified against the live database for legitimacy before the account is activated. The verification time, according to NIS, is between one to three working days.

Upon the activation of the account, the user can login and access their contribution records by selecting the “Check NIS Contributions” link. The contribution record is provided to the user in a read-only format; the user may not modify it in anyway.

Acknowledging that there will be inconsis-tencies in the information provided, Persaud urged users not to rush to the NIS offices.

“When you find the error, right there you can write your query and you will get a response and it stays in your profile, the history of your query and your responses will be there. The query generates a record and a history as a default,” he said.

Responses to queries submitted in this manner are expected to take no more than one working week. According to NIS General Manager Doreen Nelson, this is the relaunching of the programme. When it was first launched in April of this year, it was noted that more needed to be done to make the interface more secure and user friendly.

She noted that by putting their contribution records into the public domain, NIS is opening itself to criticism. “Our contributions records are open to the public; we are putting ourselves out there,” she said, while adding that the responsibility for accurate contribution records is threefold responsibility and rests with NIS, the employer and the employee.

While NIS has to ensure the timely and accurate updating of all those submitted records, the system, she explained, will show to the world the state of employers NIS contribution.

“Persons will now be able to see whether or not the employer has registered them as employees, has made deductions and has remitted these deductions to NIS. We need employees to ensure that their NIS records are accurate and confirm that the employers are making their payments. It’s not just you going there to see that your records are up to date, you must confirm that the employer has made payments rather than just deducted it and not made payments to NIS,” Nelson said.

Errant

Asked about its capacity to pursue errant employers who will be brought to their attention through the use of this system, Nelson noted that NIS is presently seeking to reinstate its legal unit, which will see lawyers on board to assist in any necessary prosecution of defaulting employers.

Nelson also explained that this system will assist NIS in cleaning its database and keeping it clean.

In the first instance, the system only recognises permanent NIS numbers starting with A or B. Temporary numbers, such as those in the GLO series, are not able to access the system. According to Nelson, this feature will force those individuals who still have temporary numbers to update their cards.

The system is also expected to provide a convenient means for overseas pensioners to access their accounts as well as those workers within the Caribbean who, under the Caricom social security agreement, wish to access the record of their contributions in Guyana.

According to Persaud, the system is supported by the new board’s efforts to place all relevant information, such as annual reports, within the public domain.

Persaud said when the new board began operation, only two annual reports—for 2002 and 2011—were available on the organisation’s website.

“NIS has been in existence since 1969. Management was instructed by the board to ensure that all annual reports that are in a digital form are published in a public manner for all the world to see before the year is out and that all those not in digital form should be scanned. I have been promised by the IT department that before 2016 is out, all the reports—1969 to current—will be there,” he shared.

Persaud explained that NIS is a safety net. “A contributor makes contributions to a fund and as a result they become eligible for benefits. [It] doesn’t matter if you are self-employed or employed, as long as you are between the ages of 16 and 60 and working, the law states you must contribute,” he noted.

He bemoaned the fact that according to the 2013 report the number of active self-employed persons was 9,000. “We have got to fix that,” he stressed, while adding that the NIS can be returned to financial viability if the law is followed. “From the taxi driver, to the rice farmer, to the conductor to the miner to the doctor to the lawyer, we all need to make our contributions. There are no excuses. We cannot expect to be beneficiaries if we do not contribute in accordance with the law,” he said.

“NIS touches every Guyanese, whether directly through employment or through the support of someone who is employed. This is our NIS; these are our revenues.

Thus, it is in our interest to ensure that the law is not breached and that employers meet their legal obligations and that we all collectively work to ensure the integrity of this system,” Persaud added.