Government’s holding company NICIL acted as an agent for the sale of Guyana Sugar Corporation (GuySuCo) properties, and in 2010 sold properties to then Prime Minister Sam Hinds and then Housing Minister Irfaan Ali, among others, and in some cases, this was without competitive bidding.

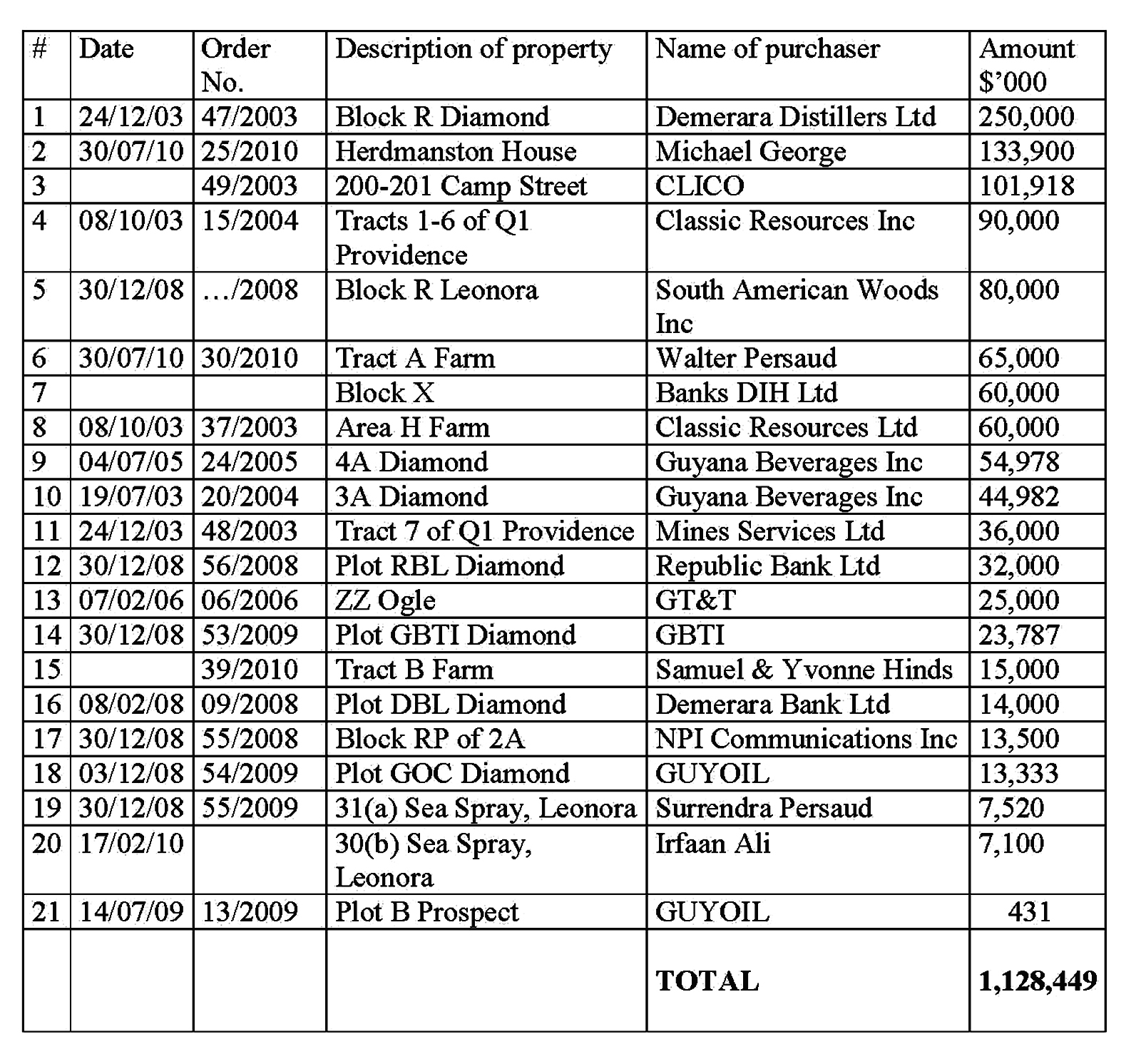

According to the forensic audit into NICIL, 21 properties were sold for $1.128 billion, as shown in the table below:

The report noted that on December 12, 2008, 13.3098 acres of land at Plantation Groenveldt, West Coast Demerara (Block R Leonora) were transferred to South American Woods Inc for the construction and operations of a wood processing facility with the option of future development in manufacturing, industrial and commercial activities including the construction and operations of a shopping mall, providing the wood processing facility is constructed first.

“Construction was to commence one year later. The purchase price was $80 million. However, at the time of reporting, there was no evidence that the wood processing facility was constructed,” the report pointed out.

Further, it said that by Order No 45 of 2008 dated December 29, 2008, 209.343 acres of land at Block LPT lettered XXX were transferred from GuySuCo to the Government of Guyana. Of this amount, 103.88 acres were transferred to NICIL via Order No 4/2010 dated March 12, 2010. Three months later, on June 17, 2010, NICIL sold the said land to National Hardware for $510 million via Order No 43 of 2010. This works out to $4.9 million per acre, the report said.

On December 29, 2008, there was a further transfer by way of gift of 400.340 acres of land at Cummings Lodge, Industry and Ogle from GuySuCo to the Government of Guyana.

There is no evidence that any of these lands have been vested in NICIL and whether they have been disposed by way of sale, the report said.

It further revealed that by Order No 47/2008 dated December 30, 2008, 4.7 acres of land at RU Plantation Liliendaal was transferred from the Government of Guyana to NICIL. NICIL in turn sold the property on January 2, 2009, a mere two days later, for $115 million to Scady Business Corporation, an overseas company based in Tortola, British Virgin Islands.

“This is further evidence of the sale of land without any form of competitive bidding,” the report declared.

It also highlighted the sale of land to Queens Atlantic Investments Inc (QAII). It revealed that by Order No 40/2010 dated November 29, 2010, NICIL sold 18.871 acres of land and buildings and erections at Plantation Ruimveldt (Sanata Textiles) to QAII for $689 million.

According to the report, the note in NICIL’s publication reads: “After being advertised for sale but no proposals were received. In mid-2007, a proposal was received from QAII for the development of the compound with a US$27 million investment plan. The proposal was for a lease with an option to purchase. At the time of the proposal NICIL was facing continued vandalism and destruction to the property despite the presence of security. In 2007, following the requisite approvals a lease was issued and in 2010 having satisfied all the conditions precedent to exercise the option to purchase, the property was sold at the current market valuation of the property before the improvements were implemented.”

Meanwhile, the report said that in 1999 and 2011, NICIL sold 60% and 30% of government’s interest in the Guyana Pharmaceutical Corporation to QAII for $458 million and $200 million respectively. The note in the publication explained:

“The determination of the price of $200 million for 30% of the shares in the New GPC was based on the approval of the Privatisation Board and Cabinet; the price was determined after considering a loss in 2000 and the assumption by New GPC of $81 million more in liabilities than anticipated at privatization; the pro-rated price of the shares to the original sale price was $238 million, however, when adjusted for the pro-rated loss of 2000 and the increase in liabilities, a downward reduction of $45 million was arrived at yielding a price of $192 million for the 30% share value; the sale price was set at $200 million…”