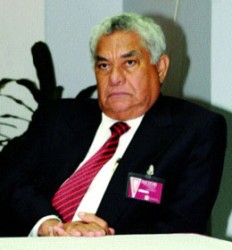

(Trinidad Express) Lawrence Duprey feels he was duped into disposing of his company, CL Financial (CLF), to the Government in January 2009.

Six years after the Government took over management of Duprey’s CLF to stem money problems in two subsidiaries—Colonial Life Insurance Company of Trinidad and Tobago (CLICO) and the CLICO Investment Bank (CIB)—Duprey wants the State to return it.

And he’s prepared to challenge the Government legally for it if the State does not submit a proposal plan to exit CLF to its shareholders by month’s end.

Duprey, 81, remains the main shareholder of CLF.

In March, Central Bank Governor Jwala Rambarran announced that CLICO had turned a profit and was able to satisfy its main creditor—the Government—with a $7 billion payment.

That $7 billion (which comprised $4 billion in cash and three CLICO assets—Angostura Holdings Ltd, CL World Brands Ltd and Home Construction Ltd), Rambarran had said, represented 40 per cent of the debt owed to Government, which works out to $17.5 billion.

But former attorney general Anand Ramlogan had pegged the bailout figure at $25 billion, while the country’s former and current finance ministers, Winston Dookeran and Larry Howai, had estimated it at about $22 billion.

“The company is easy to fix. The economy and the country need that company. I have unfinished business to take care of,” Duprey told the Sunday Express in a phone interview from his Florida, USA, home last week.

In a message to the Government, he said: “Hand me back my shares and I will come in and fix it.”

The Government has been managing the CLF conglomerate through a shareholders agreement originally signed in June 2009 and which has had multiple extensions as the Government seeks to exit the company.

Fired CLICO chairman Gerald Yetming remains the chairman of CLF, Angostura and HCL.

The Government will not exit CLF until its debt has been satisfied.

But Duprey said he was coerced into agreeing into the situation in the first place.

He provided the Sunday Express with a letter which he sent to then Central Bank Governor Ewart Williams to alert him of the liquidity situation.

The letter, he said, was drafted by his then adviser Ram Ramesh (the former chief executive of what used to be CLF subsidiary Caribbean Money Market Brokers).

The January 13 letter, said Duprey, did not call for a bailout, but liquidity support.

“CL Financial being a significant part of the financial sector has been disproportionately impacted by these adverse conditions. Many of our customers are also affected and are consequently calling on their reserve cash positions. Thus far, all our member companies have been able to deal with their commitments.

“However, we need to develop a comprehensive contingency plan to meet any further developments, if this were to follow a similar pattern to other countries. As a result, CL Financial is taking urgent and decisive action,” the letter said.

The letter outlined CLF’s assets for re-structuring—real estate, $2.5 billion; manufacturing, $6.3 billion; energy, $7 billion; and financial services at $8 billion, for a total of $23.9 billion.

A complex action plan

“We are in the process of realigning the asset-liability structure of the group to better meet the current liquidity situation. This is a complex action plan that we are embarking on immediately, including initiatives such as merger of certain entities within the group with strategic partners and/or sale of certain assets in order to raise liquidity.

“As you would appreciate, these initiatives would need some time before they yield the desired results. In the event that the financial crisis deepened in the local market, we may need urgent liquidity support to be made available to the group. In this regard, we would like to discuss the approach of the Central Bank toward supporting the financial sector and, by extension, the CL Financial Group, if conditions were to deteriorate,” the letter said.

This letter was submitted by the Central Bank to the commission of enquiry conducted by Sir Anthony Colman into the collapse of CLICO and related CLF subsidiaries. But Duprey used it to illustrate that the assets of CLF and CLICO had value, which the Government is now reaping, and that had the Government provided “liquidity support”, as requested, then he would still control his company.

“The whole essence of the letter was misguided by the powers that be. The CIB matter should have been handled by the Deposit Insurance Corporation (DIC). It was the Central Bank’s actions which caused a further run on the company and in Barbados,” he recalled.

He blames politics for how he eventually lost control of it.

“The Government came in and they wanted certain assets to satisfy the Statutory Fund. It was clear manipulation by the Government,” he said.

If Duprey’s words sound like those of a jilted chairman, at least they have been consistent.

In his witness statement provided to the commission of enquiry in October 2012, he said: “The global collapse coinciding with an ever impossible revamp of the regulatory framework and a refusal of Government-owned entities to back the group after all the years of benefit that they had received from the interest income that the group had generated led to the need for some ultimate Government support.

“I would have preferred, as I deal with further on in this statement of the intervention had not been so politically motivated and had been directed at protection for I believe had that been the position we would have fared great deal better.

“Losing all the intellectual capital as a condition of intervention was a bad decision and was not one replicated in the USA or the UK. It is of note in this regard that I was firmly of the view in January 2009 that the run on CIB and the resultant liquidity or cash flow issues was much inspired by the decision of State-owned or run entities making decisions at or about the same time to withdraw rolling deposits which had been previously rolled from maturity to maturity without question. The decision to seek funds back came in reality out of the blue and caused severe problems.”

Duprey told the Sunday Express he feels he was victimised because he was a friend of former United National Congress prime minister Basdeo Panday, so he left Trinidad immediately after the memorandum of understanding was signed.

“I thought they were about to put a pair of handcuffs on me and put me in jail. I thought that is the action John Jeremie (former attorney general) would have taken so I never came back,” he said.

Asked why he never commented before, he said: “I didn’t think it was a public matter. It was a private company.”

Duprey: I can fix CLICO

The disclosures at the CLICO commission were startling—million-dollar salaries paid to executives, companies created by executives and hiving off millions in contracts, and breaches in governance—all at the expense of policyholders.