Dear Editor,

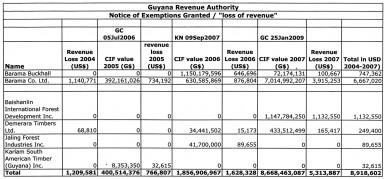

Mr Girwar Lalaram, former employee of Asian transnational loggers, Malaysian-owned Barama Company Limited and Chinese company Bai Shanlin, alleges that “their cost savings on concessions granted is about US$3000 per month” (‘Ensure level-playing field in local forest industry—Expert urges new Gov’t’, KN, June 4). The table below details annual “loss of revenue” – the term used by the Guyana Revenue Authority in its published report of tax exemptions granted. I was only able to get the GRA advertisement for financial years 2004-2007. As far as I could establish, the GRA only had this information published on one day per year in one national newspaper (Guyana Chronicle). In the four year period 2004-2007 the tax waivers granted to Barama Buckhall and Barama Company Ltd were US$7.4 million and to Bai Shanlin and its subsidiary companies US$1.5 million.

Given the commitment of the new political administration to implementation of the shared government approach in Article 13 of the National Constitution 1980/2003, may I request through you, Editor, and through Minister of Finance Winston Jordan, the set of annual statements from the GRA Commissioner for tax exemptions granted /‘loss of revenue’ for the forest sector companies for each year 1992-2003 and 2008-2014.

Yours faithfully,

Janette Bulkan