New board

As many Guyanese would be aware, a new governing board of the Guyana Revenue Authority (GRA) was established in June of last year to execute the mandates expressed in Section 12 of the Revenue Authority Act regarding the approval of policy, monitoring of the performance of the GRA and the discipline and control of the staff. Given the interest that Guyanese have shown in the efforts and conduct of the GRA in revenue collection, I have decided to make an exception this week and present some issues that were discussed with the local media at a press conference that was held recently. The principal issues discussed were the reasons for the existence of GRA, the importance of voluntary compliance and the risks of non-compliance with the tax laws. Of necessity, reference is also made to the nature of the relationship that the tax authority has with taxpayers. The following paragraphs contain some of those views.

Context

The Board of the GRA is conscious that the GRA is perhaps the only public institution in this country that knows or is required to know all of a taxpayer’s financial business. Information is knowledge and knowledge is power. The knowledge is one-sided in favour of GRA because it gets to know more about taxpayers than they of it. As a consequence, GRA has inordinate power over taxpayers. The Board further understands that that power is not to be used for anything other than revenue collection. It is not intended to embarrass, ridicule, frustrate, torment or politicize the legitimate economic, social or political aspirations of Guyanese taxpayers. Taxpayers are required to give up virtually all of their privacy to the GRA. It is important for taxpayers to know that, in return, GRA has no right giving up their privacy to anyone, unless it is required to do so in the public interest, and in accordance with the relevant laws. This is the power that taxpayers have which, limited as it is, must be protected at all times. Anyone who has the taxpayers’ interests at heart would have no difficulty seeing the reasonableness of such a position. Therefore, the Board appreciates the need to impose high standards for securing, gaining access to and sharing taxpayers’ information, and the Board has moved to do so.

Voluntary

compliance

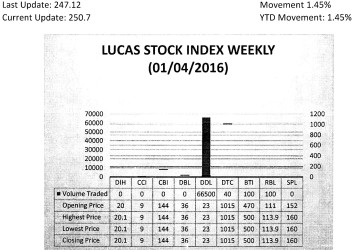

The Lucas Stock Index (LSI) rose 1.45 per cent during the first period of trading in January 2016. The stocks of four companies were traded with 66,740 shares changing hands. There were two Climbers and no Tumblers. The stocks of Guyana Bank for Trade and Industry (BTI) rose fell 6.38 per cent on the sale of 100 shares and the stocks of Republic Bank Limited (RBL) rose 2.61 per cent on the sale of 100 shares also. In the meanwhile, the stocks of Demerara Distillers Limited (DDL) and Demerara Tobacco Company (DTC) remained unchanged on the sale of 66,500 and 40 shares respectively.

It should be noted too that revenue collection operates on a principle of voluntary compliance. Voluntary compliance implies giving information willingly or without pressure to those who must have it. The onus is on the taxpayers to demonstrate compliance. Guyanese are given that opportunity by the government and usually have a reasonable period of time to do so. Voluntary compliance is of immense value to the country because it helps to reduce the cost of administering tax collection. This writer believes that it can lead to a reduction in the tax rate as well. It is for this reason that the Board cherishes the view that taxpayers who comply voluntarily with the law should have a legitimate expectation that they would be treated with courtesy and respect when they present themselves before the staff of GRA.

Supporting those who voluntarily comply with their tax obligations goes beyond mere courtesies. It must encompass the provision of accurate and timely information to taxpayers. This means that the staff must be knowledgeable and must have access to the technology that makes the delivery of the service effective and efficient. In this regard, staff training is considered a matter of priority. The focus will be on areas of customer service, tax analysis, tax planning and policy, human resource management and legal services in order to make the taxpayer experience better. Efforts will be made also to ensure that GRA has the right type of technology application that can help to increase voluntary compliance, while at the same time increasing the flexibility and comfort with which taxpayers are able to conduct their business. The GRA is currently pursuing e-services capability similar to that which obtains internationally. While we are aspiring to make that available for use during this year’s tax season, we are mindful of the unforeseen risks which may delay that process.

Among the initiatives being taken are giving employers the capability of submitting PAYE data of staff members electronically and implementing a Performance Management System (PMS) for employees of the GRA. The implementation of the electronic PAYE system will yield important savings in time and cost within the organization. Additionally, the PMS will assist in strengthening staff capability through the evaluation process and hence the quality of service delivered to taxpayers.

Non-compliance

While we remain ambitious and hopeful, one must also acknowledge the sad reality of tax non-compliance in Guyana. We took the time to examine some economic data over the period 2006 to 2014 to establish some preliminary estimates of the tax base. Our methodology relied in part on that used by the Bank of Guyana to establish the resource gap. We then relied on the definition of our gross domestic product (GDP) to which was added our import spending to get a true sense of our resource shortfall. The question that arose from the numbers that emerged was how could we spend so much on such little money?

We looked in the usual places like borrowing, remittances from abroad and foreign investment and foreign aid for answers. This methodology is a very simple one and suffers from the effects of ignoring important behavioural variables. That the reconciling items could not help us fully reconcile our spending with the reported revenues with our income, even after making room for unsold inventory, nevertheless helped confirm for us that our tax base was distorted and was in need of urgent refinement. Consequently, an important goal is to gain a more accurate measurement of our tax base for future tax planning.

Further, an inaccurate tax base leads to revenue losses. Revenue leaks through all of our tax structures. But, the ones that concern us most are the losses through self-employed income tax, property taxes, value-added taxes and import duties. One of the troubling things that we have seen so far is the inverse relationship between the total number of registered taxpayers and those paying taxes. In an economy that was growing at an average annual rate of 4.5 per cent, the number of persons paying taxes was declining. We intend to study this phenomenon some more to understand the behaviour of these variables and to reverse this unconfirmed, yet troubling trend.

Concerns about non-compliance have led Board members to call for disaggregated data about tax collection to gain more insight into the issue of non-compliance. At the moment, the monitoring of tax performance is done at the level of the tax structure.

The desire is to have data disaggregated by sector, by industry, by regions and by important economic hubs or centres. At this particular point in time, we have begun to disaggregate the data by important economic hubs or centres. The work done so far excludes Georgetown which is by far the most important economic centre.

The data covers Anna Regina, Bartica, Corriverton, Lethem, Linden, New Amsterdam, Ogle and Parika. What we see is of both interest and concern. Those eight economic centres are contributing only two per cent to revenues given the way revenues are collected and reported by the GRA. This is as much a surprise to me as it is to others.

One would have thought that an area like Corriverton situated in Region 6 with its multi-sectoral economy and border trade would be making a larger contribution to tax revenues than $1.3 billion and substantially more than an area like Linden, which brings in an amount of $1.1 billion in tax revenues on a much narrower economic base. One is surprised too that areas like Anna Regina and Bartica combined cannot do as well as or even better than the relatively depressed economic area of New Amsterdam.

Enforcement

It is under circumstances like these where revenue collection does not match observed levels of economic activity that inquiries become necessary to facilitate a proper understanding of the problem. Typically, GRA would use its enforcement authority to ensure that it obtains the correct status of revenue collection where anomalies appear.

When tax collection reaches the stage of enforcement, the demands of GRA become more onerous for the taxpayer. At this stage, one could expect some level of confrontation with taxpayers. This enforcement responsibility of GRA is demanded by laws governing revenue collection and is executed primarily by the Law Enforcement and Investigative Division (LEID), the Debt Management Division and the Tax Audit Division.

Their efforts are eventually backed up by the Legal Services where necessary. Taxpayers must understand that GRA’s employees are required by law to enforce revenue laws where voluntary compliance is lacking. One therefore must not view GRA officers as villains, for they are not. They are humans with an interest in success at their work like every other Guyanese.

At the same time, one understands how intimidated taxpayers can become by the power vested in GRA enforcement officers. Anxiety, desperation and inconvenience could all add up to a state of vulnerability that forces taxpayers into engaging in what they might believe are transactions of relief. Taxpayers who succumb to frustration and harassment and engage in illicit transactions are themselves breaking the law and expose themselves to prosecution.

The Board has asked officers to be measured and considerate, and to act always with the view of achieving the best outcome for taxpayers while protecting the interest of the government. The Board is also asking enforcement officers to be mindful of the laws and avoid forcing taxpayers into compromising positions. As much as one expects the GRA management to stand behind its staff, the Board expects GRA officers to conduct themselves with the utmost professionalism and will exercise zero tolerance if that directive is ignored. It means that anyone found violating the employee code of conduct will be dealt with condignly.

Protection of

taxpayers’ information

It might be an understatement to say that GRA is an organization which does not enjoy a good reputation among the general public of Guyana and in the press. The word organization brings to mind the interrelationship between positions and functions and the persons who are required to carry out those functions. These relationships and people carry both structural power and relational power. The structures connect people to the work that is done in, and by, the organization and to the relationships that they have with co-workers and the customers or taxpayers that they serve.

Over the years, these power structures were exhibited in various forms, including forms of mistreatment of staff and taxpayers.

One of the things that the Board wants Guyanese to understand is that it recognized from the outset that it had to pay attention to the interests and concerns of the people that it serves. The Board, on behalf of the executive branch of government, serves both the taxpayers of Guyana and the staff of the GRA. Board members recognized that they had a duty to both sets of constituents and needed to give them equal attention.

In seeking to come to grips with this reality, it became apparent that there were concerns surrounding the relationship between the staff of the GRA and taxpayers, particularly as it related to the protection of taxpayers’ data and information. In that regard, the policy with respect to the protection of taxpayers’ information was examined and gaps in the policy were addressed.

Reassurance

A major lacuna was the lack of sufficient reassurance of the soundness and completeness of the protection of taxpayers’ information, particularly in the case of staff members who were on a very long sojourn from the organization. It also found there was no confidence that all information about taxpayers was in the place that was considered the most secure. This secure place refers to the authorized central storage and retrieval system or facilities of the GRA. The holding of information away from the official sites particularly when one is not expected or required to be using that information for an extended period of time, did not constitute adequate security regarding taxpayers’ data and information. The law also provides for a statute of limitation with respect to the retention and use of taxpayers’ information. We must be satisfied that all taxpayers’ information is where it should be at all times so that it could be subject to the full and proper implementation of the various statutes of limitation.

Rawle Lucas is the Chairman of the Board of the Guyana Revenue Authority.