Economic black hole

The amount of work that Guyana has to do to clean up itself against domestic and international charges of corruption is phenomenal, and it is not going to be easy. When one studies the issue of corruption and its links to money laundering, which has taken on extraordinary global proportions, he or she would realize rather quickly that the nonchalant attitude and behaviour of Guyanese towards economic crime are drawing the country closer and closer to an economic black hole. The future prospects for the economy are good, but they hinge on legitimate investments and efficient production. None of that would matter if Guyana does not rid itself of the criminal activities that supported the economy for many years. To avoid being swallowed by the undesirable economic condition, Guyana needs to tackle crime seriously, including seeking to be a FATF-compliant country. This article examines the threat that the economy faces from money laundering and the financing of terrorism and what should be done to prevent the country from being swallowed by the black hole of the underworld.

Normal part of business

The focus is often on the financial institutions and the central role that they must play in fighting money laundering and the financing of terrorism. The financial institutions provide financial intermediation services, but on account of their obligations to help stave off the illicit entry of ill-gotten gains into the domestic and international financial system, they are also being made to vouchsafe for their customers’ economic probity. It was something that they did routinely by offering payment facilities such as letters of credit or bankers’ acceptance to their customers who engaged in foreign trade without having to think about the risks of economic or criminal penalty. It was a normal part of business. They did this by working with correspondent banks abroad that knew them and which were prepared to accept their word on behalf of the importing customer. The ready availability of that foreign trade service made life easier for importers and exporters.

Dancing at the edge

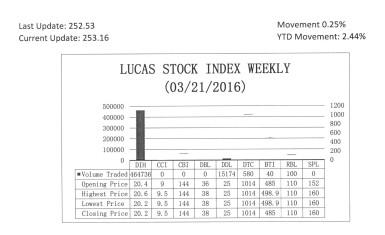

The Lucas Stock Index (LSI) increased 0.25 percent during the third period of trading in March 2016. The stocks of five companies were traded with 480,630 shares changing hands. There was one Climber and one Tumbler. The stocks of Guyana Bank for Trade and Industry (BTI) rose 2.87 percent on the sale of 40 shares while the stocks of Banks DIH (DIH) fell 0.98 percent on the sale of 464,736 shares. In the meanwhile the stocks of Demerara Distillers Limited (DDL), Demerara Tobacco Company (DTC) and Republic Bank Limited (RBL) remained unchanged on the sale of 15,174; 580 and 100 shares respectively.

But the world of money and the financing of international trade have changed as a result of the risks caused by money laundering and the financing of terrorism. Suddenly, it appears as if banks that knew each other for years did not know or trust each other at all. Because of the risks of money laundering and the financing of terrorism, it is no longer business as usual. Guyanese must realize that the successful operation of an economy on ‘runnings’ is a myth. It is a message that they must get if they do not want to risk undermining their own economy and forcing it down the economic black hole. Guyana is dancing at the edge and with very little influence in the global economy, it needs to be careful.

Countries have to be certified as FATF-compliant and the integrity of the banks plays a big role in a country achieving that status. Too much illegality in the system is not going to make it happen. Enforcement of the anti-money laundering and countering the financing of terrorism laws is the best mechanism to create a more transparent and realistic economy. In order to achieve compliant status, banks and other financial institutions are required to know their customers and to evaluate the risk of doing business with them before forming or continuing a relationship with them.

Need for confidence

Given the FATF obligations, banks need to feel confident about, and comfortable with, their customers. The financial institutions would have a particularly hard time representing the interests of their customers without their co-operation and help. In requesting information from their customers, they are actually asking customers to join the fight to prevent the financial system from being used by unscrupulous persons to launder money and promote terrorism. Customers will have to give up some private information. In their relationship with the banks, the trade-off is between liberty and economic security. With the pressures from the international community, it is a trade-off that is increasingly becoming mandatory.

The burden is not on the local financial institutions alone. It has hit non-financial businesses and professions as well. The wider business community has to be just as alert as the commercial banks to increase Guyana’s chances of becoming a highly respectable FATF-compliant country. The broader dimension of this problem is the unfair competition that enters the market and the suppression of legitimate businesses.

Story about money laundering

The story about money laundering started 27 years ago when 15 countries and the European Commission met to consider the effects of money laundering on their economies and the international financial system. While the preoccupation with money laundering dates back further, the 16 participants propelled the issue forward with the formation of the Financial Action Task Force (FATF) in 1989. Their purpose at that time was to identify techniques and trends in money laundering engendered by the drug trade. This intergovernmental group also wanted to know what anti-money laundering measures were working and those which were not working in what the US calls the drug war. That embryonic effort disturbed nothing in the global economy but placed the world on notice with 40 recommendations which the group felt could protect the international financial system from money laundering.

FATF became energized twelve years later from the dramatic events of September 11, 2011 in the United States of America (USA) and broadened the focus of its work and quickened the pace of the application of the recommendations. In addition, to concerns about money laundering, FATF became concerned also about the financial conduct of officials and institutions around the world towards terrorism and the financing of terrorism. That led to the addition of eight more recommendations to counter the financing of terrorism. Soon after, the additional concern of preventing the proliferation of weapons of mass destruction was added to the already long list of concerns.

The membership of FATF consists of 35 countries and two institutions, namely the European Commission and the Gulf Cooperation Council. Despite its limited membership, the rest of the world has been pulled into the FATF struggle against money laundering and the financing of terrorism through the use of Observer and Associate membership. The IMF regards the associate member countries and institutions as FATF-style regional bodies. These regional bodies are required to ensure that non-member countries comply with the standards and legal, regulatory and operational obligations set by the FATF. There are nine such groupings that are required to ensure that their member states tow the FATF line. Four of the groups are found in Africa while the remainder are found in Asia, the Caribbean, Europe, the Pacific and Latin America. In the case of Guyana, the Caribbean regional body that oversees its compliance with the FATF

standards and obligations is the Caribbean Financial Action Task Force or CFATF.

Due diligence

The CFATF takes direction from the FATF and deputizes for the global body in assuring that compliance takes place within the member states over which it has jurisdiction. The FATF has 49 recommendations that touch the lives of every Guyanese in their personal and business dealings. While all businesses must be careful when dealing with customers, the FATF targets certain types of businesses. The financial institutions are at the top of the list. It targets banks, credit unions, insurance companies, and money service businesses such as cambios and money transfer agencies. No type of business has been spared the need to practice due diligence on their customers.

Some of the other businesses that are of particular interest to FATF are gold producers, car dealerships, construction companies, pawnbrokers and nightclubs. As a consequence, the personal and private affairs of each Guyanese have to be exposed to one or several institutions in the country at one time or another. However, the commercial banks have been the most targeted so far. Part of the reason is that the banks represent the best place in which illicit money gains legitimacy. There is a requirement that banks know where customers are getting their money from because the crime of money laundering is not a standalone crime.

Source of money

In fact, money laundering only arises and becomes a crime if any of the crimes shown below was committed before and attempts were made subsequently to hide the proceeds. The bank or any business only sees the money when a transaction involving the ill-gotten gains takes place. Given that any party could be deemed complicit in the crime of money laundering, banks and other businesses need to know the source of the money. (To be continued)