Focus

There are six commercial banks in Guyana competing for the business of banking consumers. The banks vary in size and performance. They also use differing strategies to conduct business and grow their income. The article this week provides a comparison of four of the six banks and their performance over the past year. The four banks that will

Market valuation

The first measure of interest is that of the market value of the companies. Only four of the six commercial banks are identified on the Guyana Stock Exchange. The entities whose stocks are traded on the secondary market in Guyana are Citizens Bank Inc., Demerara Bank Limited (DBL), Guyana Bank for Trade and Industry (BTI) and Republic Bank Limited (RBL). The banks whose shares are not traded in Guyana are Bank of Baroda and the Bank of Nova Scotia. As a consequence, the discussion on market valuation and the other metrics would only take account of the four participating banks.

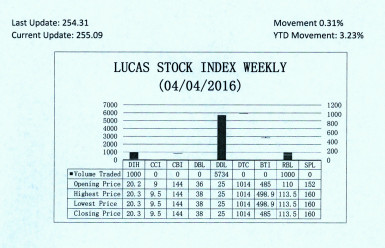

The Lucas Stock Index (LSI) increased 0.31 percent during the first period of trading in April 2016. The stocks of three companies were traded with only 7,734 shares changing hands. There were two Climbers and no Tumblers. The stocks of Banks DIH (DIH) rose 1.50 percent on the sale of 1,000 shares while the stocks of Republic Bank Limited (RBL) rose 0.44 percent also on the sale of 1,000 shares. In the meanwhile the stocks of Demerara Distillers Limited (DDL) remained unchanged on the sale of 5,734 shares.

The largest of the four banks is Republic Bank with a market capitalization of G$33 billion as at April 4, 2016. RBL (Guyana) has as its majority shareholder Republic Bank which has its headquarters in Trinidad and Tobago. The next in line is BTI which has a market capitalization of G$20 billion. BTI is owned by Secure International which is a company that is registered in Guyana. The third of the banks with activity on the stock exchange is DBL with G$17 billion. DBL is also a bank that is owned in the majority by persons of Guyanese nationality. The fourth is Citizens Bank with a capitalization of G$9 billion. The majority shareholder of CBI is Banks DIH. The four banks make up 55 percent of the value of the Lucas Stock Index (LSI). They are therefore important contributors to the Guyana economy. The significance of RBL stands out when one considers that its market value is greater than that of at least two banks combined. It is larger than BTI and CBI at G$29 billion combined and CBI and DBL at G$26 billion combined.

Deposit size

The size of the banks could also be measured by the size of deposits, the size of their assets and the size of their income-generating portfolio. These various measures give an idea of how concentrated the resources of the financial industry are. As at December 2015, the commercial banks had G$356 billion in total deposits. Of that G$356 billion, the four banks discussed herein account for about 80 percent of the deposits. It is to be expected that RBL would have the largest share and that is the case. RBL had 35 percent of the total deposits for which the commercial banks are responsible. The next largest bank in terms of deposits is BTI which has an estimated 24 percent of the deposits that government, households and businesses place in the commercial banks. The pecking order continues with DBL holding 13 percent of the money and CBI holding 9 percent.

Market concentration

One thing that the deposit percentage raises is how competitive the banking industry is. Competition could be measured by the concentration of market share with the use of the Concentration Ratio (CR) or it could be measured with the use of the Herfindahl-Hirschman Index (HHI). The CR reveals that the four banks discussed herein account for 80 percent of the deposits of the industry. This level of market share is an indication that the banking industry could be described as an oligopoly. This conclusion is backed up by the Herfindahl-Hirschman Index (HHI), a preferred measure of industry concentration. The rule of thumb about the HHI is that any measure that exceeds 1800 suggests an uncompetitive industry. Utilizing available data, the HHI for the banking industry is 2,051 and confirms the highly concentrated nature of commercial banking in Guyana. While the clear lack of competition in the banking industry is a concern, there are other industries in Guyana where the problem is even worse.

Measure of asset size

The trend observed so far about size repeats itself in the measure of the assets owned by the various banks being discussed in this article. The four banks own about 76 percent of the assets in the banking industry. While RBL continues to be the industry leader, it does exhibit relatively smaller holdings of assets vis-à-vis the other banks. RBL owns an estimated 32 percent of the assets while BTI owns 22 percent of the beneficial resources of the banking industry. CBI owns 10 percent of the assets of the industry while DBL owns 13 percent. While the three smaller banks have assets that match the share of their deposits, RBL has assets that are slightly lower than its share of deposits.

The more important asset measure is the loan size. This is the part of the portfolio that is supposed to bring in the largest share of income for the four financial entities and it has a story to tell. RBL continues to lead the industry in the loans category as well. However, it does not exhibit the same dominance as it has in the other categories discussed so far. The gap is much tighter between the first and second place company in the sample being discussed. RBL holds 24 percent of the loan portfolio while BTI, its closest rival, holds 21 percent of the value of the outstanding loans. What is interesting here too is that there has been a shift in position between CBI and DBL. CBI holds 12 percent of the loan portfolio while DBL has control over 10 percent of the portfolio.

Conservative

This data illuminates clearly a major challenge with respect to lending in Guyana. It indicates that the commercial banks remain very conservative enterprises in Guyana. That is understandable behaviour because most of the deposits that they hold are of a short-term nature. The Bank of Guyana data confirms the very cautious manner of lending by some of the banks. It shows that the average gross loan-to-deposit ratio is 60.18 percent. This means that banks lend out 60 cents out of every dollar of deposits that they have. The behaviour of individual banks varies significantly from the average. RBL lends 49 cents of every dollar of deposit. BTI lends 66.85 cents of every dollar of deposit while CBI lends 80 cents and DBL lends 49 cents of every dollar. The industry leader is the worst performer in this regard while the largest ratio comes from CBI.

The profitability of the financial entities under discussion is reported in the BOG prudential ratios and that too provides some indication of how the resources of the companies are being managed. The first profitability ratio given is the return on assets. The average for the banking industry is reported as 2.73. This means that for every dollar of asset under the control of management, the company earned G$2.73. Again, the performance among the four banks is very uneven. In fact, three of the four banks performed below the industry average in 2015. The lowest profit was earned by BTI which brought in G$2.16 for every dollar of asset under its control. RBL, the largest of the banks, brought in G$2.22 and CBI brought in G$2.52 in the same period. The best performer was DBL which recorded a G$4.49 return on its assets. Notwithstanding its size, DBL did twice as good as both RBL and BTI, the two larger banks in the fraternity.

The other measure of profitability is that of return on equity. The industry average is reported by the BOG as G$21.14 and the highest return once again comes from DBL with G$32.66. The second ranked in this category is RBL with G$26.17 whereas the third ranked is BTI with G$16.49 while CBI rounds out the group with G$16.38. This profitability measure does not follow the pattern for other measures of size. In this instance, CBI recorded the lowest value as against BTI. A shift was also seen in rank between RBL and CBI wherein CBI fell behind RBL in contrast to the situation under the return on assets scenario.

Several outcomes

The comparison, though limited to a few variables, shows that the banking industry reveals several outcomes about the industry. It shows that RBL remains the largest bank when measured by deposit, asset and loan size. It also shows that at least one of the banks has little room to grow at this stage. In addition, the companies achieved different results as a consequence of how they deployed and managed their assets.