In the last article, an assessment was made of the comparative size of four commercial banks in Guyana and their growth performance. In doing so, two principal issues were observed. One was the highly concentrated nature of the industry and the other was the highly profitable nature of the industry. The article this week will look at the market focus of the banks and the allocation of resources. In this instance, cognizance would be taken of the participation of all the banks in the banking industry in Guyana.

Source of deposits

Before looking at the lending preferences of the commercial banks in Guyana, it would be interesting to see from where the deposits of the banks are coming. As at the end of December 2015, the commercial banks had G$356 billion in deposits. The commercial banks got the bulk of their deposits from the private sector. This group in the economy provided 78 percent of the deposits that commercial banks in Guyana held at the end of last year. The government supplied 18 percent of the money while foreigners provided the remaining four percent. Thus, the group with the most influence on the commercial banks is the private sector. Households contributed 62 percent of the savings that commercial banks in Guyana hold while businesses contributed 16 percent to the deposit levels of the banks. The make-up of the contribution of this group to savings differs from the make-up of the benefits of the group from borrowing as will be seen during the course of the rest of the article.

Big role

Using a tax model to estimate wages and salaries, it would appear as though Guyanese households had disposable income of between G$280 to G$300 billion from earned income alone. The deposit amounts in the banks imply also that Guyanese saved 76 percent of their disposable income last year, even though one must accept that bank balances accumulate over time. In contrast, the consumption model suggests that Guyanese spent around 84 percent more than the disposable income available to them. The gap between savings and consumption could probably be explained by the failure of the tax model to capture all earned income. Some of the earned income might be reported differently thus causing the tax model to under estimate the level of wages and salaries. The spending level does not take account also of remittances either. Whatever the cause, the loan programmes of the banks play a big role in the consumption and investment spending by the private sector.

Private sector

Setting aside the impact of the external sector, the national economy is made up of spending by consumers or households, investors or businesses and the government. The greater proportion of spending is done by households and businesses and this behaviour is reflected in the lending pattern of the commercial banks in Guyana. The Bank of Guyana (BOG) usually classifies the loans to households and businesses as loans to the private sector.

In its report on financial indicators, the BOG indicated that the bulk of the loans issued by commercial banks in 2015 continued to go to the business and household sectors.

A combined total of 63.4 percent of the loans from the industry went to the two private sector groups in 2015. At the same time, the government sector took less than two percent of the money. An examination of the distribution of the loans between the household and business sectors shows that an estimated 51 percent of all loans were for business purposes while 13 percent were for household activities. The loans made by the commercial banks are usually classified as either business loans or household loans.

Business loans

The bank that favours the business community most is the Guyana Bank for Trade and Industry (BTI). Over 70 percent of its portfolio consisted of business loans.

The Bank of Baroda (BOB), Demerara Bank Limited (DBL) and Citizens Bank Inc. (CBI) also placed heavy emphasis on lending to the business community. The BOB had over 68 percent of its loan portfolio with the business community while DBL had an estimated 63 percent of its loans with the businesses. CBI held 58 percent of its loans as business loans.

The behaviour of the four aforementioned banks contrasts sharply with that of Republic Bank Limited (RBL) and the Bank of Nova Scotia (BNS). While the portfolio of business loans of the four banks mentioned previously is above the industry average, the ones for RBL and BNS were below the average of 51 percent. RBL had 39 percent of its portfolio in business loans while BNS had 26 percent in the same category. It is not clear what might be driving this reluctance of two of the three foreign banks to increase their business portfolio to higher levels.

Sectoral breakdown

The business loans in the BOG report are grouped according to the sectoral breakdown of the output of the economy. The gross domestic product (GDP) of the country is distributed among the following four sectors, namely agriculture, manufacturing, mining and quarrying, and services.

The data reveals that the mining and quarrying sector receives the smallest amount of loans. It received an average of two percent of the loans issued by the commercial banks. The agricultural sector was the next with about six percent of bank loans going to it in 2015. The remainder of the business loans was split between the manufacturing and services sectors. The manufacturing sector obtained 15 percent of the loans while the services sector received 28 percent.

Services sector

It should come as no surprise to anyone that the services sector gets the lion’s share of the loans. After all, the services sector is the largest sector in the economy. It accounts for two-thirds of the economy and is made up of a miscellaneous set of industries.

These industries include the wholesale and retail businesses, transportation, information and communication, the utilities, financial services, tourism, health, education and others.

Many of these industries are very competitive and cash can move very slowly causing some to rely on the banking system. There are also growth industries in the sector such as information technology and transportation which also cause businesses to approach the banks for financing.

All the banks are highly active in the services sector. The bank with the largest footprint in the services sector is the Bank of Baroda with in excess of 47 percent of its own loan portfolio in the sector. The Guyana Bank for Trade and Industry (BTI) also has a large footprint in the services sector, accounting for more than 36 percent of the business loan portfolio that it holds.

Demerara Bank Limited (DBL) and Citizens Bank Inc. (CBI) also have significantly large holdings of outstanding balances in the services sector. DBL holds over 32 percent of its portfolio in loans from the services sector while CBI has an estimated 31 percent of its outstanding balances in this form of income-generating portfolio. Republic Bank Limited (RBL) has 24 percent of its total business portfolio in loans to the services sector while the Bank of Nova Scotia (BNS) has a business portfolio size of 14 percent in the same sector.

Manufacturing sector

Though the loan portfolio in the manufacturing sector is less substantial than that in the services sector, the majority of banks also display much more faith in the manufacturing sector than in the agricultural and mining sectors. The companies with the largest portfolio in the manufacturing sector are CBI and BTI which hold an average 23 percent of their income-generating portfolio in that type of loan. The next is BOB which held a 16 percent portfolio in the manufacturing sector. This was a few points higher than the 14 percent portfolio held by DBL. Again, it is worth noting that RBL and BNS carry significantly smaller shares of their loan portfolio in loans to the manufacturing sector. RBL has an eight percent share while BNS has a seven percent share. Both banks are majority foreign owned and one must wonder if its lending policies are influenced by other factors exogenous to the local market.

Overall distribution

The overall distribution of loans between businesses and households by individual banks provides an indication of the lending preference of each bank. Without a doubt, all banks show a preference for lending to the business sector. It is likely that this preference hinges on the awareness that businesses generate higher levels of cash flows and at a faster rate than households. Collectively, they also generate the cash flows much more consistently than the households. The fixed income of households and the commitment of a large portion to consumption spending do not always make households the best candidates for bank lending. In addition, many companies in Guyana, particularly large ones, pull money from overseas as a result of their export activities. The business community therefore is a much more attractive destination for bank lending than households. The make-up of bank lending contrasts significantly with the make-up of bank deposits.

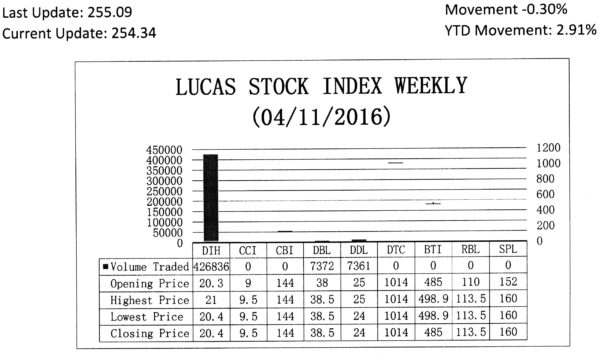

The Lucas Stock Index (LSI) declined 0.30 per cent during the second period of trading in April 2016. The stocks of three companies were traded with 441,569 shares changing hands. There were two Climbers and one Tumbler. The stocks of Banks DIH (DIH) rose 0.49 per cent on the sale of 426,836 shares while the stocks of Demerara Bank Limited (RBL) rose 1.32 per cent also on the sale of 7,372 shares. On the other hand, the stocks of Demerara Distillers Limited (DDL) fell 4.0 per cent on the sale of 7,361 shares.