Financial wilderness

Guyanese farmers continue to lament the lack of adequate access to commercial financing for their agricultural activities. A review of Bank of Guyana data reveals that loans for agricultural

Short wait periods

The clear answer to the first question is no. Agricultural production is like any other business. It depends on customer financing for its survival. Farmers need money to carry on business and life while waiting to make a sale. They hedge their bets by planting crops with both short and long durations. The crops that are called cash crops have relatively short gestation periods and can turnover in a matter of weeks. Farmers have short wait periods to make a sale of cash crops. On the other hand, there are crops such as fruits that have long gestation periods and can leave a farmer waiting long periods of time before receiving money from the sale. The cash flow needs of a farmer are just as important as those of investors in any other type of business. Farmers have additional problems.

Farmers face risk that is unique to their own industry. Crops could be affected adversely by drought or excessive rain. They have little control over the mood and attitude of nature. Pest infestation, another fact of nature, can be a thorn in the flesh of farmers. Pests can destroy substantial portions of crops. The storability of farmers’ produce is virtually non-existent. The produce is left to the vagaries of the market. Once the produce is harvested, the farmer must get rid of it before it spoils. Whatever is unsold must be dumped unless there is a means of processing the unsold items in a manner that could extend its life beyond one day. As with other industries, pilfering affects the situation of farmers as well. Further, the price that farmers get for their produce is determined by demand and supply. Periods of excess supply could lead to lower average revenues and higher average costs. The converse is true when there is a shortage of supply. Many farmers are reluctant to rely on the average and prefer to abandon the enterprise than live by the law of averages.

Uncontrollable variables

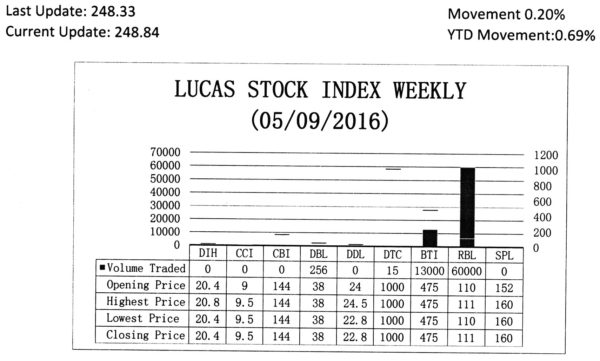

The Lucas Stock Index (LSI) rose 0.20 percent during the second period of trading in May 2016. The stocks of four companies were traded with 73,271 shares changing hands. There was one Climber and no Tumblers. The stocks of Republic Bank Limited (RBL) rose 0.91 per cent on the sale of 60,000 shares. In the meanwhile, the stocks of Demerara Bank Limited (DBL), Demerara Tobacco Company (DTC) and Guyana Bank for Trade and Industry (BTI) remained unchanged on the sale of 256; 15 and 13,000 shares respectively.

With so many uncontrollable variables, farmers need to have adequate cash flow to remain engaged in the industry. From the trend in financing in Guyana, it appears easy for some industries to access financing compared to that of agriculture. Banks are reluctant to lend to an obviously risky sector. Agriculture received about 13 per cent of the loans that were made to the business sector in 2014. Loans to the ‘other’ crop part of agriculture have increased in recent years. In total, ‘other’ crops as a group contribute more to Guyana’s domestic output than rice or sugar individually. But, this output group receives nowhere near the amount of financing needed by the investors to enjoy some level of comfort and for this sector of the industry to assert itself as a major contributor to Guyana’s agricultural output. Other crops receive just about one half of one per cent of the business loans. At that rate of financing, the agricultural sector was unlikely to realize its full potential.

The alternative

For Guyana, the issue is really what is the alternative to bank financing that could offer farmers some measure of comfort to stay the course or even increase output in agriculture? The answer might lie in the use of the longstanding commodity exchange. The support for this approach to Guyana’s agricultural production starts from the perspective that the market is the best determinant of price and resource allocation. Government intervention and offering of facilities that do not inspire or induce efficiency in production should be kept to a minimum so that the market, colloquially speaking, can do its thing.

One might wonder what is so special about the commodity exchange that it could be thought of as a saviour to agriculture in Guyana. If it could be a panacea for agriculture, why are so many countries without it? These are valid questions whose answers deserve study beyond the purpose of this article. However, that does not mean thought about the commodity exchange should be dismissed out of hand and the information that follows might just make Guyana realize that the solution to large-scale investment in agriculture and greater access to financing could reside in the establishment and operation of a commodity exchange. A perennial problem faced by rice farmers is the timely receipt of payment from rice millers. It might be worth examining if the commodity exchange could not solve that problem.

Special type of market

The commodity exchange is a marketplace that enables buyers and sellers of commodities to transact business. Unlike a physical market or cash market, a commodity exchange trades in futures contract for various commodities. It is therefore a market that determines and enforces the rules and procedures for the trading of commodities through standardized contracts. They can trade in other types of instruments such as options and warehouse receipts. The commodity exchange is therefore a special type of market.

Commodity exchanges have been around for a long time. Those who are interested in the history of commodity exchanges point out that they were around since the 18th century with evidence that Japan had one since 1730. Commodity exchanges appeared in Egypt, the USA and Europe in the 19th century. Today, there are in excess of 80 commodity exchanges around the world. There are about 11 commodity exchanges in Africa, 16 each in the American and European regions and two in the Pacific area. The largest number of commodity exchanges (43) can be found in Asia. The commodity exchanges trade in both agricultural and mining products.

Guarantees delivery

According to the United Nations Conference on Trade and Development (UNCTAD), commodity exchanges facilitate financing for production and enable commodity sector investment. In other words, two of the things that plague agricultural production in Guyana could be addressed by a commodity exchange. But the commodity exchange does more than that. It also provides a solution to an issue of major concern to farmers, pricing or, as those more in tune with the industry’s lingo would say, price discovery and payment. For Guyana as a whole, a commodity exchange could finally see it achieve the goal of large-scale commercial farming. A commodity exchange also provides security on the quantity and quality of the commodity traded. A fully developed and properly functioning exchange guarantees delivery of the goods.

The UNCTAD study also reveals that with the kind of information that could come out of having the commodity exchange, farmers will have greater flexibility and can better plan their operations; agro-processors can reduce the impact of price fluctuations on the profit margins that they receive; traders can enhance their procurement and better manage their risks; banks will find lending to each of these groups much safer; and government entities can buy and sell more easily and more transparently. The existence of a commodity exchange enables derivative trading to take place. A futures exchange would make it possible for farmers to operate freely in the market place without necessarily having to rely on government for subsidies or other handouts.

Worth examining

It is something that Guyana might want to think seriously about considering the many difficulties it has had in expanding and sustaining production of various agricultural commodities. There is an opportunity to do it for rice, perhaps coconut and even other types of produce. Control of the production of these commodities is in local hands which make the decision about the exchange easier. It would be important to develop the infrastructure to support movement of farm products. Guyana would need also to strengthen its regulatory institutions to give the exchange a chance to succeed. This approach is worth examining notwithstanding the experience with the stock exchange.