Broad categories

Rising consumption levels

The stage for undertaking this analysis was set in the earlier part of the article where the earned income of Guyanese consumers was identified. At that time, it was observed that all the money that Guyanese earned from work was spent on the goods and services that they consumed. This situation was thought to be highly unlikely given the rising deposit levels at the commercial banks during the period 2007 to 2015. The growing balances in private sector deposits reveal that, despite spending all of their earned income, Guyanese were finding money from somewhere else to enjoy rising consumption levels. It is interesting too that total spending peaked in 2013 at which time Guyanese could only cover 30 per cent of the consumption spending with their earned income. The rise in earned income in 2014 and 2015 was also insufficient to explain the gap between income and consumption.

Under-reporting

That reality leaves open the question of where the balance of the money that is spent comes from. This writer, in previous articles, has referred to possible causes of the gap between spending by Guyanese consumers and the income that they earn. However, those possible causes are worth repeating here since the financial gap is not easily closed by other factors. It was observed that large quantities of gold leave Guyana weekly without the knowledge of officials who ought to know. Another cause was associated with the underreporting of income. This latter factor has its genesis somewhere between tax avoidance and tax evasion. One theory is that a substantial portion of the income of some managers and high-level executives is received in the form of allowances. Even though the allowances could be deemed constructive income, in some instances, these allowances enable them to avoid paying taxes.

There is another activity that might be causing income of Guyanese not to match the money that they spend. Many persons rent their property or part of their property and collect rental income from doing so. It is possible that this income is not being reported in all instances and therefore escapes the direct tax net. In addition, recipients of rental income and other persons might also be collecting other forms of passive income such as dividends which itself is not taxable, but is available for spending. One could also add the likelihood that many self-employed persons are escaping the direct tax net also.

Brief digression

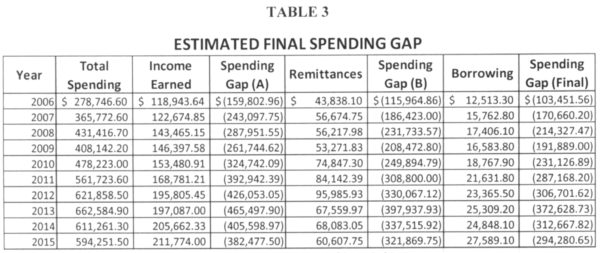

The brief digression into the possible causes of the spending gap reveals that much more money could have come from both work and passive income. It also reveals that, in the case of passive income, much of it is not being captured in the direct tax statistics since income was quite likely evading taxation. Be that as it may, the money becomes part of the spending profile of Guyanese consumers. If it is true that Guyanese spend all of their earned income with a spending gap remaining, then it follows that any increase in wages and salaries that does not match the spending gap will be inadequate for their needs. Table 3 below reveals the estimated final spending gap that Guyanese consumers have when remittances and borrowing from commercial banks are taken into account. In considering the figure that represents the final spending gap, it ought to be quite clear from that scenario that any wage increase short of 100 per cent would leave Guyanese workers dissatisfied. Even any reasonable level of increase would always leave them feeling underpaid.

Their situation brings the reasoning of the Pareto optimality theory into play where the excess undisclosed income is concerned. This writer does not know where the excess money resides, but one might think that an allocation of an additional 30 per cent of the undisclosed income might go a long way towards helping the government to satisfy justifiable wage increases for police, nurses and other public servants. This might be done in the belief that it would not make any other consumers worse off. The benefits that could be had from better police services and better nursing services would be common and special to all Guyanese households.

By hiding the income from taxation, Guyanese are ‘cutting off their nose to spite their face’.

Categories of consumer goods

As one ponders the source of the excess income of Guyanese, it is possible to identify some of the things that they spend money on. That kind of information is useful to persons who are responsible for marketing activities at companies. A person with an interest in marketing would want to know more than how much money consumers have. As noted earlier, they would also want to know why they buy the products that they purchase and how often they buy the products of choice. This article will not be as specific as marketing needs warrant or demand. It will nonetheless point to categories of consumer goods and services that Guyanese acquire. The data being used only provide annual figures and as such that is the time period to which consumption behaviour in this article is limited.

Household consumption varies, but could be broken down into food, clothing and footwear, and durable goods. The identifiable services are electricity and water, transportation, telecommunications, health and education. These can be regarded as essential services since they are important to life or aid in making living possible. Other

services such as home improvement and travel are also bought by Guyanese households. Import data gives an indication of the spending on food, clothing and footwear. Loan data from the banks gives an indication of the spending on home improvement, motor cars and other durable products. These data will be used to identify the things that people spend money on.

Own pockets

A fair amount of earned income is spent on necessary services. From estimates calculated from available GPL annual reports and import data from the Bank of Guyana reports, Guyanese spend at least 40 per cent of their earned income on food, clothing, health, education and electricity services. It should be pointed out though that Guyanese spend a small portion of their money on health and education. This might be the case because government spends a substantial amount on education and health. Despite the presence of private hospitals and private insurance programmes, it is estimated that two per cent of the spending of Guyanese come out of their own pockets for consuming health and educational services. However, when earned income alone is considered, they use five per cent of their money to meet their needs in the areas of health and education.

The loan activities of the commercial banks give an indication of the things that Guyanese spend money on. About 52 per cent of the borrowed money is spent on improving their homes and acquiring a motor vehicle and other durable goods like refrigerators and washing machines that are used in the home. At the same time, Guyanese spend about 41 per cent of the money that they borrow on travel and other unspecified items.

Product lifecycle

No doubt the rest of the money is spent on entertainment and other luxury or special services. This could only be determined if more information about specific products and services is made available. Otherwise, it would be necessary to conduct a consumer survey to find out how often people buy the things that they buy. Such a survey would be needed too, to understand the lifecycle of some of the products purchased.

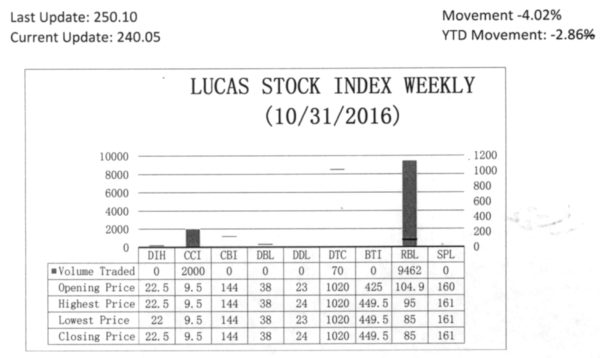

The Lucas Stock Index (LSI) fell 4.02 percent during the final period of trading in October 2016. The stocks of three companies were traded with only 11,532 shares changing hands. There were no Climbers and one Tumbler. The stocks of Republic Bank Limited (RBL) plummeted 18.97 percent on the sale of 9,462 shares. In the meanwhile, the stocks of Caribbean Container Inc. and Demerara Tobacco Company (DTC) remained unchanged on the sale of 2,000 and 70 shares respectively.