Today is Budget Day. It is an important day since it is the first time in the history of Post-Independence Guyana, and perhaps earlier, that we are having a budget for the fiscal year before the beginning of the year begins. It is also history because it is the first time that we are having two budgets in one year. Prior to 2015, successive governments have utilized the relevant provisions of the Constitution to the fullest in that the Estimates were presented in the Assembly around the last week of March for the fiscal year in question.

Practice prior to 2016

A government budget sets the pace for economic activities for the entire country since funds are released for various purposes, including those for major infrastructure development works. When this happens, suppliers of goods and services and the execution of works are engaged, employment is created, money flows through the economy, and there is a trickle-down effect. The private sector takes the cue from Government, and economic activities are stimulated. It follows that an early government budget is beneficial to the economy and would have a positive and stimulating effect.

On 10 August 2015, this column had carried an article entitled “Today is Budget Day 2016”, in which we advocated the need to advance the timetable for the approval of the Estimates. In that column, we stated that it is desirable for future budgets to be presented to and approved by the Assembly before the fiscal year begins, rather than waiting until the constitutional deadline of 90 days into the fiscal year to do so. When the latter happens, budget agencies are given eight months within which to execute programmes and activities covering a 12-month period. By the time they could get their act together in terms of advertisement, receipt of tenders, assessment of bids and the award of contracts, the first half of the year would have been completed. It is therefore not surprising that the last quarter of the year would have arrived and significant amounts of the budget allocations remain unexpended. And so, there is a rush to accelerate expenditure in an attempt to exhaust budgetary allocations since all appropriations lapse on 31 December, and all unspent balances have to be returned to the Consolidated Fund.

Waiting for the constitutional deadline to be due before presenting of the Estimates to the Assembly provides a fertile ground for all sorts of irregularities to take place. Such irregularities include failure to observe the “cut-off” procedures; significant numbers of cheques being written and dated 31 December, for which value has yet to be obtained; the failure to return unspent funds to the Treasury; goods and services not being supplied or short supplied; works not executed or not satisfactorily performed; and overpayment to suppliers and contractors. Successive Auditor General’s reports are replete with these discrepancies.

Constitutional requirements

Article 218 of the Constitution requires the Minister to prepare and lay before the National Assembly, estimates of the revenues and expenditure of Guyana within 90 days of commencement of financial year. Once approved, an Appropriation Bill is introduced to provide for issues from the Consolidated Fund. An appropriation is any authority of Parliament to withdraw moneys from the Consolidated Fund to meet the expenditure of government services. It stipulates the specific purposes of the expenditure and the amounts of money representing the maximum that may be expended for such purposes.

By Article 219, the Minister is authorised to make withdrawals from the Consolidated Fund for up to four months pending the passing of the Appropriation Act to meet the cost of ongoing delivery of normal services of the Government. The amount to be withdrawn in each of the four months is restricted to one-twelfth of the amount expended by a budget agency in the preceding year, except to meet payment obligations relating to multi-year contracts. On the assumption that the budget for 2017 is approved before 31 December, this provision will no longer be applicable, and one hopes that for the foreseeable future, this practice will prevail.

Need for revision of the accountability timeframe

We have seen how the provisions of Article 219 were manipulated during the period 2012 to 2014 that caused unauthorized expenditure totalling $4.544 billion to be incurred in 2014. This column has consistently advocated the advancing of the entire accountability timeframe from: budget preparation, presentation and approval by the Assembly; budget execution; mid-year reporting; end-of-year reporting; ex post evaluation by the Audit Office; PAC examination and reporting; to the issuing of the Treasury Memorandum.

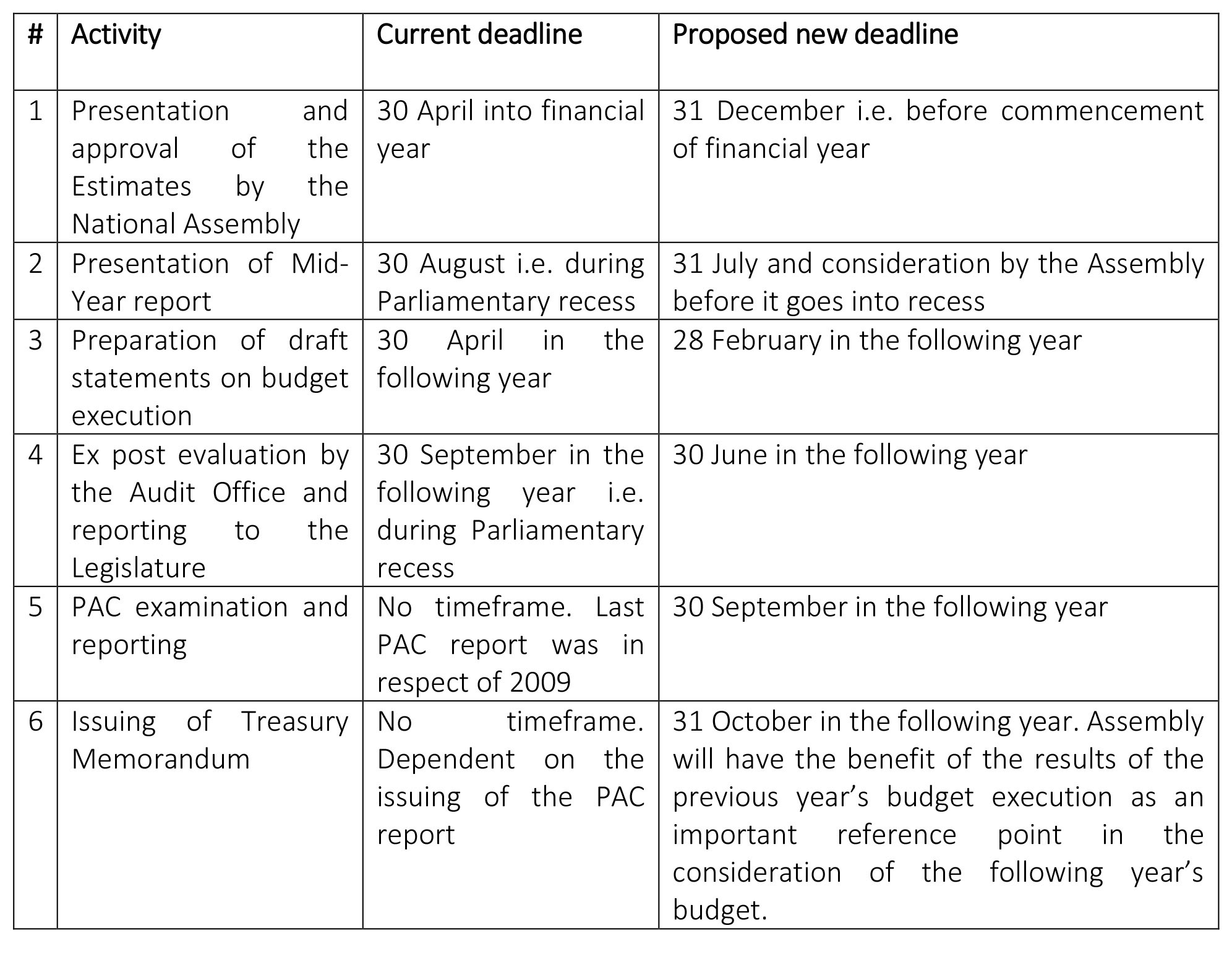

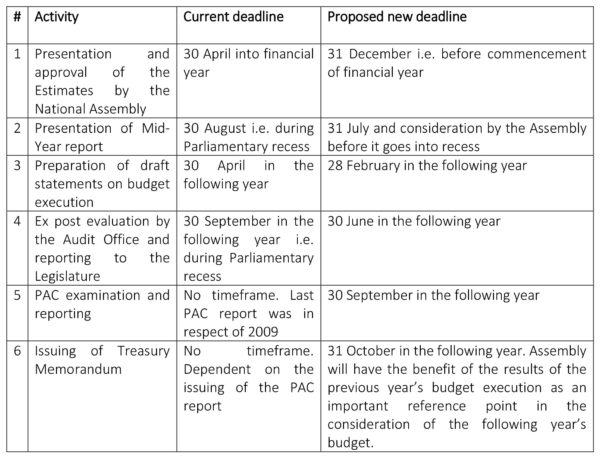

In the article referred to above, we had proposed the following revised deadlines for the accountability cycle. These proposals do not require any changes to legislation or constitutional amendments:

We are on track in terms of the first two items, that is, presentation of the 2017 Estimates, and the 2016 Mid-Year Report which was presented in the Assembly before Parliament went into recess. Unfortunately, there was no discussion or debate on the report.

In terms of preparation and presentation of the draft financial statements on the Public Accounts and the accounts of Ministries, Departments and Regions, one hopes that the Accountant General and Heads of budget agencies will get their act together and submit such statements and accounts for 2016 by the end of February 2017. Given that our accounting and financial reporting system has been automated under the Integrated Financial Management System (IFMAS), with dedicated effort, this task is not rendered too difficult. The Auditor General also needs to get his act together to re-organise his work in such a manner that, once he receives the draft financial statements and accounts by 28 February 2017, he would be in a position to deliver on his report by 30 June 2017.

Challenge for the Public Accounts Committee

At the moment, the work of the PAC is several years in arrears. Its major challenge is the ability to accelerate its work in such a manner that it can begin its examination of the Public Accounts and the related report of the Auditor General for 2016 by 1 July 2017. One of the PAC’s setbacks is the examination of the voluminous report of the Auditor General. The latter needs to report on the “exception principle”, instead of full reporting on all expenditures that have been incurred. If the Auditor General adopts this approach, his report could be reduced considerably to about half its size without any consequential loss in terms of his findings and recommendations. Indeed, a shorter report is more than likely to provide a greater impact. In 1992, when we restarted the process, it was necessary for Parliament and the public to be informed on how every cent to public moneys has been expended. However, times have changed, and we have a more settled arrangement in terms of annual financial reporting and audit. My last report to Parliament, that is, on the 2003 Public Accounts, reflected reporting on the exception principle. However, for some strange reason, this was not followed through by the Audit Office.

Issuing of Treasury Memorandum and end of accountability cycle

Once the PAC completes its examination of the Public Accounts and reports back to the Assembly, this will facilitate the issue of the Treasury Memorandum setting out what actions the Government has taken or intends to take in relation to the findings and recommendations of the PAC. Once the Memorandum is tabled in the Assembly, the accountability cycle is completed. If it is issued by 31 October, the Assembly will have an important source of reference and indeed a basis for its examination and approval of the Estimates for the following year by 31 December. In other words, the accountability will be completed within 12 months of the close of the fiscal year, which is a most desirable and welcome development in public financial management.