The decision by the Minister to practically eliminate the long list of zero-rated items, making most of them exempt, has raised some basic questions about Value-Added Tax. It also shows how impermanent, and uncertain taxes can be, even though certainty and predictability are considered necessary features of a good tax system.

This principle applies to VAT as it does to any other issue or tax but for now we look at the principle which underlies VAT and which makes it so attractive. The first principle is that VAT should be broad-based with few exemptions and a single, low, positive rate.

This means that from both theoretical and practical viewpoints, exemptions are to be kept to a minimum. Indeed, in Europe where VAT was practically invented, the EC Commission, in a preamble to the Second Directive, expressed the conviction that granting exemptions would create difficulties. That remains the studied view of the IMF, the Caribbean Regional Technical Assistance Center (CARTAC) and academics and tax experts. They all agree that it is most desirable to restrict the number and scope of exemptions.

Many felt that the Minister of Finance shared that view particularly since in his first two budgets he zero-rated some twenty items. Yet, one year later he practically abolishes almost the entire list of zero-rated items and with one stroke makes them exempt, taking them outside of the VAT arrangement.

There is a myth that by making a product VAT-exempt prices will reduce. In fact, an exemption for VAT means that the tax on inputs is borne by the trader, and if that trader sells to the public, he must pass on the tax on inputs to the public in his price or cut payments to his factors of production (capital and labor).

In a simple example, the bread manufacturer would have been able to recover input VAT since his output was zero-rated. Now that his output is exempt from the tax, he must absorb the input VAT and could only maintain his profitability by passing on the cost to consumers.

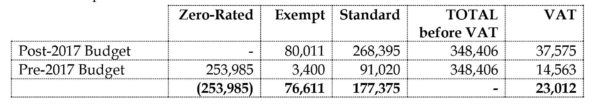

Following the announcement of the changes, the staff at Ram & McRae have applied the new arrangements to a most recent actual shopping list. Please see table below showing a summary and how the VAT is impacted.

VAT expenditure has increased by some 225% of which a main contributing factor is the introduction of VAT on water and electricity. In any case, the increase in the price for that basket will go up by 7.84%.

Our respectful recommendation is that the Minister should rethink his position and take such action as he thinks appropriate.