Policy issues

The Minister of Finance Mr. Winston Jordan presented the second budget of the APNU/AFC Coalition – with the theme “Stimulating Growth, Restoring Confidence: The Good Life Beckons”and anchored on five pillars: National Unity, National Infrastructure, National Institutions, National Security and Public Services.

The Minister dealt at length with the Government’s Agenda for 2016. The following principal issues were discussed:

- Macroeconomic Stability: The government will continue to maintain macroeconomic stability.

- National Unity: Focus on reviewing, enhancing and implementing a National Cultural Policy.

- Social Cohesion: National institutions to be empowered to address issues of diversity.

- Gender Equality- Equal Rights for All: The Government intends to launch “The National Gender Policy” in 2016.

- Hinterland Development & Preservation of Indigenous Culture: The Government intends to bridge the divide between the hinterland and coastland and will invest over $4 billion to support the Plan of Action for Hinterland Development.

- 50th Anniversary of Independence: A sum of $300 million has been budgeted to support activities in celebration of this Golden Jubilee year.

- National Infrastructure: Investment of $3.1 billion for the ICT Access and E-Services for Hinterland, Poor and Remote Communities Project.

- Passage of legislation to liberalise the telecommunication sector.

- Managing the Extractive Sector: Completing the framework for a Sovereign Wealth Fund.

- Production Transformation and Agricultural Diversification: Creating an economic environment in which farming and agro-processing operations can grow the economy and create employment; injecting $9 billion in the recovery and modernisation programme of sugar; and assisting the rice sector

- Energy: Review with Norway the climate change agreement between the two countries, including the Amaila Falls Hydro Project.

- National Insurance Scheme: Exploring options to repay $5.24 billion owed by CLICO.

- Tax Reform: Review and consider the report submitted by four-person Committee.

- Public Administration and Public Financial Management: Amend the Regulations to the Procurement Act to require the posting on NPTAB’s website of all contracts exceeding $1.5 million. .

- Data for Decision Making: Completion and release by second quarter 2016 the 2012 Census results.

- Producing a Well-Rounded Life Long Learner: Substantial increase in expenditure in education and the provision of the necessary resources, over time, to upgrade the entire University of Guyana (UG) system.

- Health for Human Development: Mount a commission of inquiry and develop an emergency suicide prevention plan of action.

- In the financial sector, implement deposit insurance in Guyana, license cambios located outside of Georgetown, and examine the feasibility of agency banking.

Targets

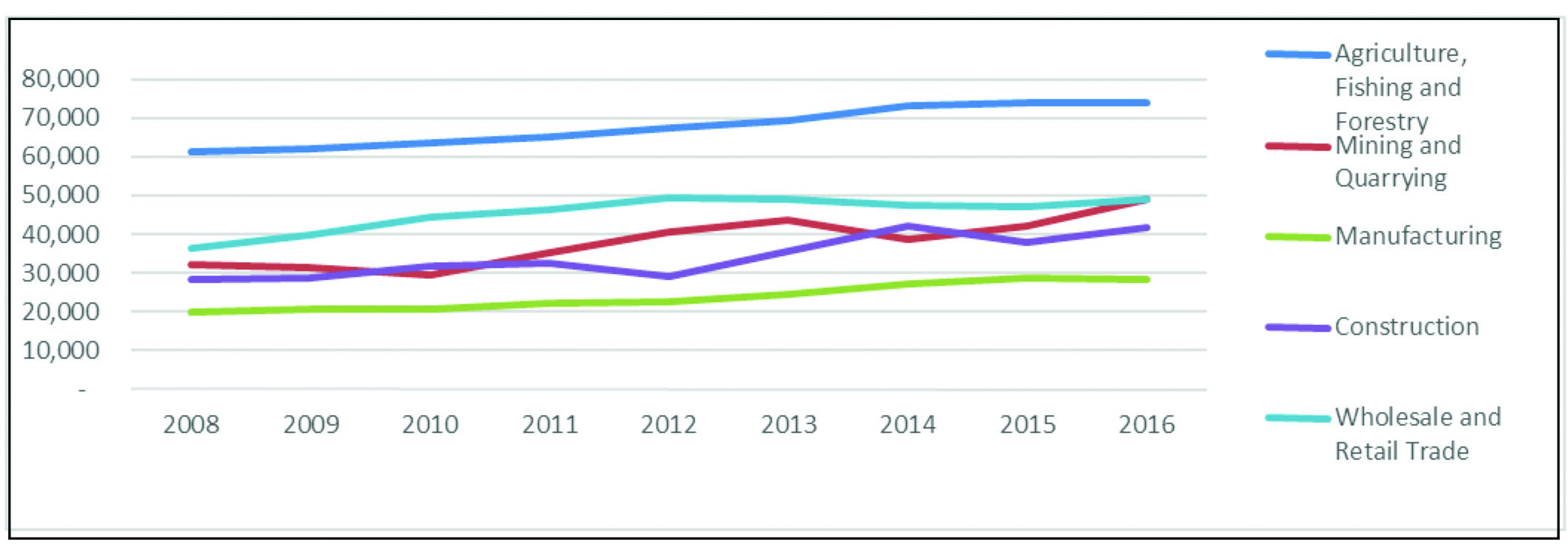

Overall real growth is projected at 4.4% in 2016 with the non-sugar economy and the sugar economy projected to grow by 4.3% and 4.8% respectively. The following graph presents contribution to GDP at 2006 prices by various sectors:

Source: Estimates of the Public Sector

The primary industry groups are addressed separately below. In the other sectors, Transportation and Storage Activity recorded the highest average growth of 12.76% over the five years to 2015. Growth in this sector for 2016 is expected to decrease to 2.8% from the 13.6% growth seen in 2015. The Construction sector recorded average growth of 3.6% for the five years to 2015 and a significant 10.5% growth in 2016 is anticipated. Growth in other areas is expected at 2.8% in 2016.

Source: Estimates of the Public Sector

A 2.4% growth is projected for 2016 in Other Manufacturing while a 4.8% growth is expected in Sugar Manufacturing. Overall however, manufacturing is expected to decline by 0.7%.

Monetary Policy & Inflation

The rate of inflation (Urban Consumer Price Index – Georgetown) for 2016 is projected at 2% compared to the revised for 2015 of negative 1.8%. Food inflation in 2015 was 1.1% with the four years to 2014 registering 3.50%. Prices for Transport and communication decreased in 2015 to a rate of 3.3%. Medical and Personal Care inflation in 2015 was 0.4%. Footwear and repairs registered a 0.1% decrease.

Balance of Payments

The Minister projects the overall balance on the balance of payments to increase to a surplus US$46.26 million from a deficit of US$107.68 million in 2015. On the trade side, merchandise exports are projected to increase by 2.5% to US$1.2 billion. Merchandise imports are expected to rise by 2.7% to 1.5 billion. With net imports of services at US$237.26 million, and private transfers of US$437.06 million, a net deficit of US$116.86 million is projected on the current account.

The capital account is projected to have a surplus of US$163.12 million in 2016 (US$61.22 million in 2015). In this account, a net inflow of US$216.68 million is expected from medium and long term capital while a net outflow of US$65 million is expected on short term capital.

Ram & McRae’s comments Show percentage where applicable.

- The Five Pillars are incontrovertible but the challenge will be in the execution. The gap between the Government and the Opposition in terms of votes at the elections was razor thin and political relations since then have hardly improved. Social cohesion has been an elusive concept even before Independence and unless steps are taken to identify and address the underlying problems at every level of society, the situation will continue.

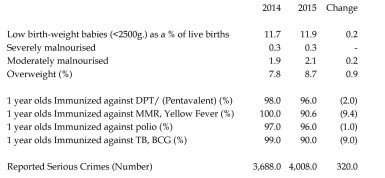

- While an influx of persons for the Golden Jubilee celebrations is expected, the spread of the mosquito-borne Zika Virus and adverse weather conditions causes expectations to be tempered. In health care, we are concerned by the following negative changes in the socio-economic indicators (see Appendix B):

- The negative inflation described by the Minister as deflation may be a reflection of the slowing down of economic activities. However, if productive capacity has increased, the negative implications are less severe

- It is unclear from the language used by the Minister whether the repayment of $5.24 billion to the NIS is to be made by the Government of Guyana. However, it is good news for the Scheme and will help to restore to it some financial balance.

- With the large and increasing number of commercial banks operating in Guyana and the availability of Mobile Money, the logic for encouraging additional non-bank cambios is not clear and the idea should be revisited. The deposit insurance scheme idea has been discussed since the commencement of the ERP and the setting of a date should help to advance this matter.

- Gold production by Guyana Goldfields and Troy Resources are expected to be the main source of growth in 2016, with overall growth being at 2.9% in non-gold sectors.

- The decline in Rice projected for 2016 may be further affected by adverse weather conditions and irrigation.

- Lower oil prices on the international market may have helped to push the growth seen in 2015 and the fall in the Urban consumer price index – Georgetown.

- The list of Policy Issues is long and reflects an extensive agenda. The Minister should consider a Policy Implementation Unit to coordinate execution and ensure delivery.