Section 6 of the 2016 Budget Speech contains thirty paragraphs of Budget measures, some of which are regulatory rather than fiscal. Only some of these carry an estimated cost and a number of them have not inconsequential compensating savings. We now look at those measures and offer our comments.

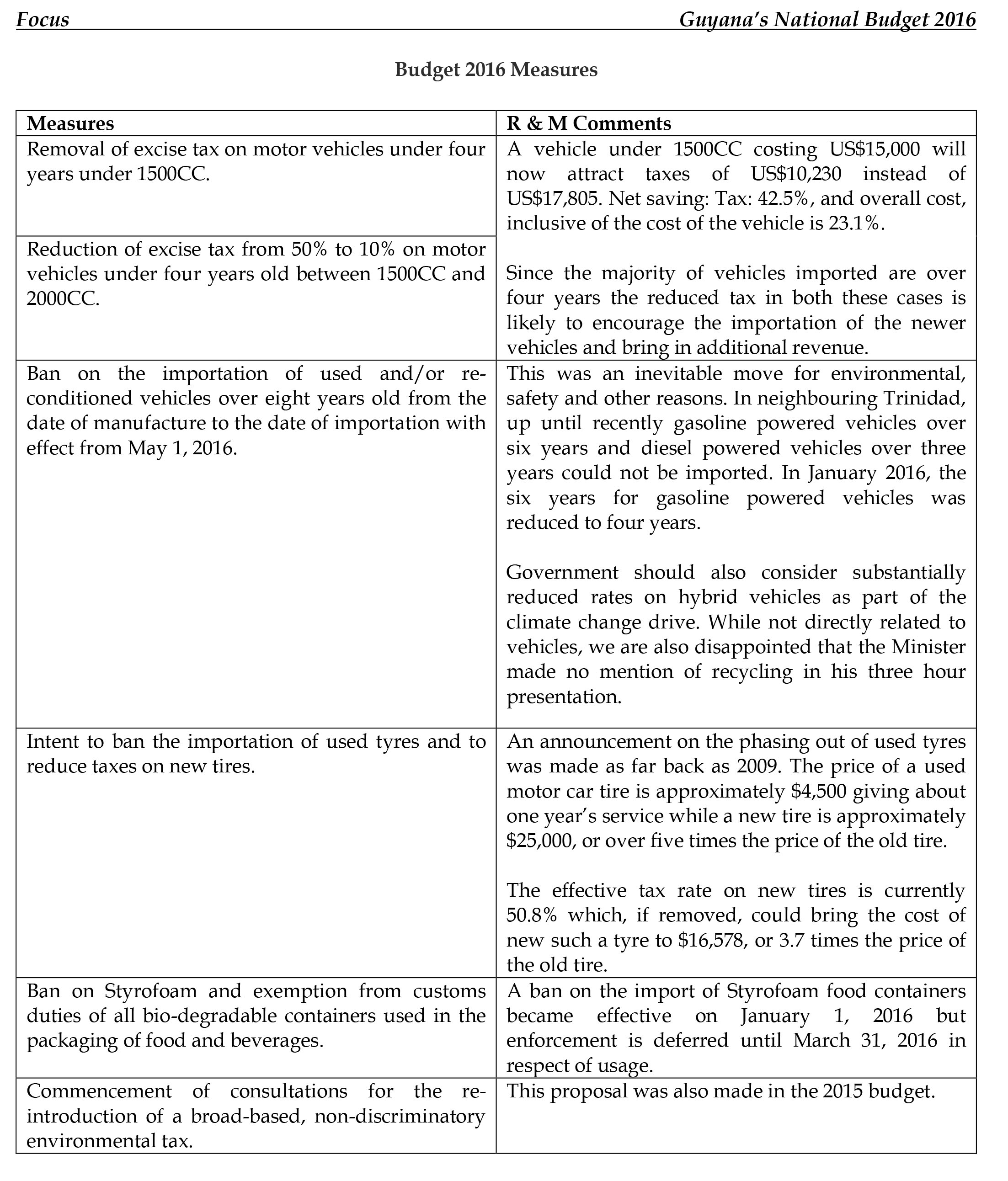

Measures in support of programme of ‘greening’ the economy and protecting the environment

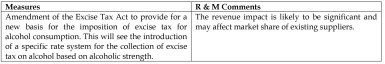

Measure to bring equity to the charging of excise tax on alcoholic beverages

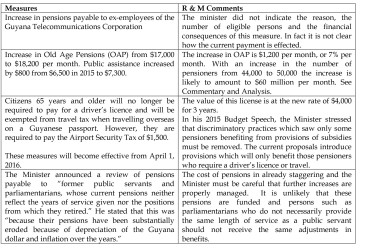

Measures to remove arbitrary, discretionary or undefined remissions

Measures in Support of the Elderly

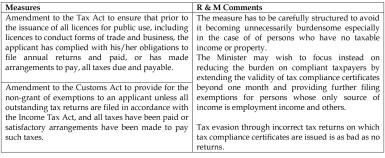

Measures to Improve Tax Administration

Measures to Enhance Revenue

Other Measures

Overall comments

We would have liked to see the revenue or expenditure implication of each of the proposed measures. The measures with the greatest financial implications are the increases in the pension and the increase in the threshold. Each personal income taxpayer currently earning above the personal threshold will save $1,500 per month or $18,000 per year. Assuming that there are 75,000 such persons, the cost of the measure in 2016 will be $1,350,000.

The measures on old vehicles and tyres, though eminently sensible, are likely to be unpopular. The Minister and his colleagues will have to sell these to the public.

The Minister has indicated that the recommendations of the Tax Reform Committee are to be considered by Cabinet. It is not unlikely therefore that there will be other tax measures in 2016.

Sugar or Wales

One month into the work a ten member Commission of Inquiry into the Guyana Sugar Corporation, the Minister of Finance told the nation that, “The economic wellbeing of the sugar industry is critical to the protection of jobs and growth of the economy, as well as the contribution it makes to GDP, exports and foreign exchange. ….. Whatever path the industry takes, it is vital for the sake of the national economy that it remains viable and able to compete in an increasingly competitive and volatile global market. Time is of the essence! We anxiously await the report of the Commission of Inquiry before deciding on the next steps.”

The Corporation too was telling the workers’ representatives that matters relating to their wages and salaries would also have to await the Report. The Report was eventually submitted to the Minister of Agriculture and considered by Cabinet. But before any serious discussion had begun, the Ministry of Agriculture issued a statement that the Government would close the Wales Sugar Estate by next year. What makes the decision even more difficult to understand is that the Report expressly states that while the possibility of closure of some estates had received much attention, by an 8 to 2 majority the Commissioners opposed any recommendation for closure.

Collectively of course the decision is that of the Government but it is unclear who made the decision and whether the Corporation was in agreement given that its Chairman Dr. Clive Thomas was a lead member of the Commission and contributed a significant segment to its report. The question now is what would be the fate of the Report given that its initial reception includes a rejection of a major recommendation.

Not unexpectedly, the PPP/C which enjoys overwhelming support among sugar workers opposed the closure. But they were not alone. Indeed, even persons who may have otherwise supported closure were dissatisfied with the manner in which the Government communicated the decision. TUC General Secretary complained that the unilateral decision appears to be a clear violation of the constitutional right of persons to participate in decisions affecting their wellbeing and of the Termination of Employment and Severance Pay Act which requires the workers’ union to be notified of the proposed termination and provided with specific information on reasons, dates, persons to be affected etc.

The result of this decision is that it has detracted from the broader report and recommendations which run to three volumes, the preparation of which must have been a particularly formidable exercise. The central recommendation is against closure and privatisation in not more than three years. Managing Partner of this firm who was among the scores of persons who appeared before the Commission has shared the Paper he presented to the Commission. He did not favour closure.

Mr. Ram sought in his presentation to address four questions:

Whether Guyana can become competitive in sugar given that its current cost of production is approximately US$0.40 per pound while the world sugar price is approximately $0.14 per pound;

- Whether, how much, and for how long taxpayers should be asked to sustain GuySuCo with subsidies;

- Whether, and to what extent, GuySuCo and Guyana should remain in sugar; and

- If so, whether GuySuCo should remain in state ownership, alone or with private investors.

He also sought to address two misconceptions about the local industry.

In summary, Ram recommended that the estates be grouped and their problems addressed separately with a view to creating the Courantyne Corridor as the heart of the industry. The full presentation can be found on chrisram.net.

Another approach or variant proposed by a leading individual with close ties to the industry and business is the creation of a new company to take over the Wales operation.

The shareholders of the new company will be pension funds, sugar workers, cane farmers, Demerara Distillers Limited, the public and investors from abroad. TT and USA will provide equipment for the production of white and invert sugar. Ram & McRae has read the proposal and spoken with the individual. Ram & McRae considers that the proposal has sufficient merit to warrant consideration.

There is nothing sacred about any one estate. Indeed, the history of sugar is about closure, amalgamation and reorganisation of estates. But even the announcement of closure makes it inevitable. There is a very brief window for reconsideration. Let us at least consider all the reasonable ideas before de facto, irreversible closure is set in motion.

And so far as the wider report is concerned, a national dialogue needs to take place led by the National Assembly.

Let that discussion begin now.