The Government’s projected Financial Plan for 2016 is summarised and tabled on page ___ of this Publication. The current balance projects a surplus of $2,402 million, a decrease of $12,931 million or 84.3% over revised 2015. After capital receipts and expenditure, the plan projects an overall deficit of $40,909 million compared to a deficit of $24,042 million in 2015, 38.9% of which is expected to be financed by external borrowings.

The main elements of the 2016 Plan are:

Total current revenues are projected to increase by $11,615 million to $173,325 million or by 7.2%. Of this, the Guyana Revenue Authority is expected to bring in revenues of $150,407 million or 86.8% of total revenue, an increase of $7,510 million or 5.3% when compared to 2015.

Of the GRA’s collections, the Internal Revenue is projected to bring in $64,415 million compared with $60,933 million in 2015, a 5.7% increase, while Value-Added and Excise Taxes are expected to earn $72,539 million compared to $68,806 million in 2015, an increase of 5.4%. Collections by the Customs and Trade Administration are anticipated to be $13,453 million, an increase of $297 million or 2.3%.

Total Current non-interest expenditure is projected to increase by $23,156 million from $141,152 million to $164,308 million for 2016. Personal emoluments of $49,910 million represents an increase of 11.8% or $5,248 million over the revised figures for 2015.

Capital expenditure of $52,184 million represents a projected increase of $21,519 million or 70.2% over revised 2015 of $30,665 million. The big ticket items of capital expenditure include:

- $2,369 million for the upgrading of the West Demerara Highway from Vreed-en- Hoop to Parika;

- $2,000 million allocated to Power Utility Upgrade Programme for the provisionof institutional strengthening and upgrading;

- $1,400 million on National Drainage and Irrigation Authority for construction and rehabilitation of drainage, canals, pumps and other structures;

- $1,323.1 million on Amerindian Development Projects;

- $1,120 million on the Low Carbon Development Strategy programmes;

- $860 million on Basic Needs Trust Fund;

- $560 million has been allocated to the Georgetown Public Hospital Corporation for the provision of medical facilities, equipment and vehicles;

- $550 million has been allocated to the Electrification Programme for upgrades;

- $200 million on the completion and rehabilitation of Government Buildings and Benab;

- $150 million for rehabilitation works to the Demerara Harbour Bridge; and

- $110 million on upgrading the Office and Residence of the President.

Interest expenditure is projected to increase by 26.6% or $1,390 million. Domestic interest is projected to increase by $188 million or 10.9%, while interest on external debt is projected to increase by $1,202 million or 34.3%.

The principal element of debt repayments is projected at $6,930 million (2015: $15,039 million), made up of domestic debt repayments of a projected $35.7 million (2015: $35.5 million), while external debt repayments are projected to decrease to $6,894 million (2015: $15,003 million). During 2016, domestic and external debt service as a percentage of current revenue decreased to 4.0% in comparison with 9.3% in 2015 revised.

The projected overall deficit of $40,909 million is expected to be financed by external borrowings of $15,932 million and from domestic sources of $24,977 million.

Ram & McRae’s Comments

- The deficit projected is one of the highest in recent years. The financing will result in both external and domestic borrowings of an equivalent amount.

- In anticipation of growth of 4.4% in 2016, the projections anticipate a 7.2% increase in revenue with tax revenues contributing a significant portion of the increase. This will require significant effort on the part of The Guyana Revenue Authority. Should those revenues not be forthcoming and expenditure not reduced the deficit will be correspondingly high. The Minister also has the option of resorting to additional transfers from statutory bodies and balances held in the Dormant Accounts outside of the Consolidated Fund. While there are substantial funds still held by statutory and non-statutory bodies the budget already proposes an $8,700 million transfer.

3. Ram & McRae considers a 40% increase in tax revenues from the self-employed to be an ambitious if not unlikely target.

4. Expenditure on Personal Emoluments is expected to increase by 11.8% and represent approximately 30% of expenditure.

5. Capital expenditure of $52 billion will require strong implementation oversight, including coordination with the spending Ministries. As the Minister of Finance had predicted in his January 1 reported interview, substantial investments are being made in the development of the country’s infrastructure to improve the country’s roads, electricity and health services. The Government is committed to discharging a judgment for more than US$6 million to the Surinamese company RUDISA awarded by the Caribbean Court of Justice in a case arising from the Environmental Tax. It is believed that the APNU+AFC Government may have inherited other liabilities as well. The Minister did not address these and it is not clear from the Estimates that provision has been made for these debts.

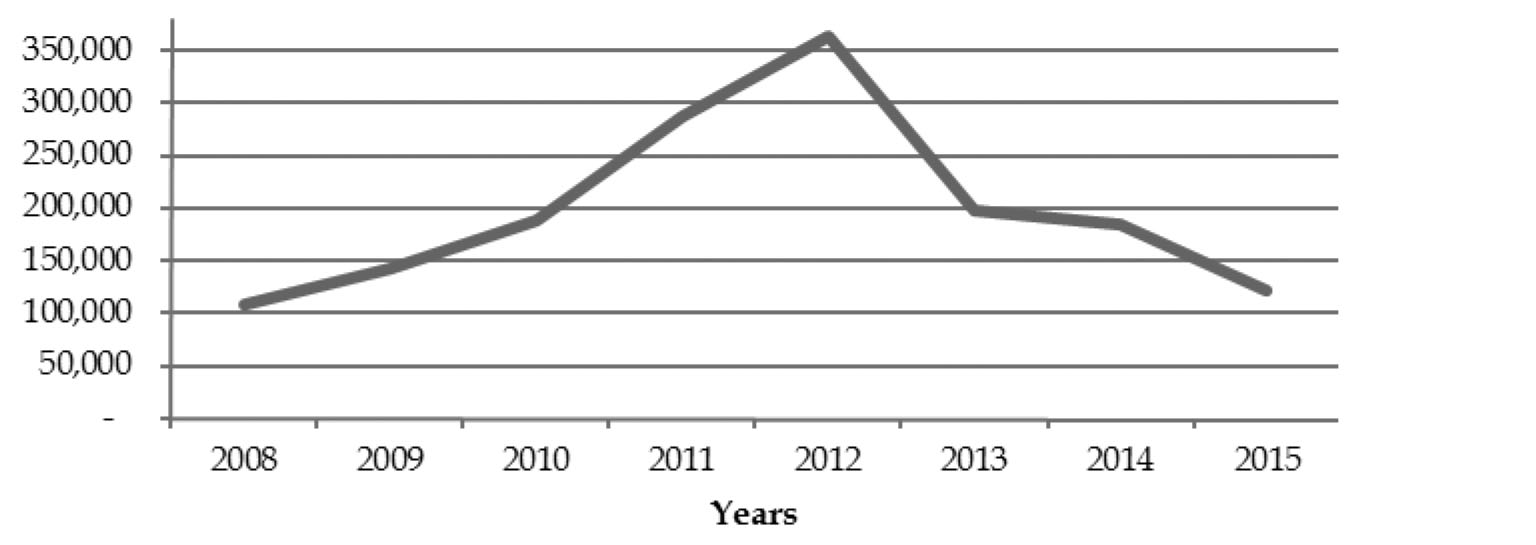

6. The Minister gave no comments on Guyana’s position in the PetroCaribe fund and plans to liquidate the balances owed to Venezuela. Historical balances owed to Venezuela under the Petro Caribe initiative are illustrated below:

Source: Bank of Guyana Annual Reports and Budget Speech 2016