Current Non-Interest Expenditure

In this section we consider how the budgeted expenditure is allocated among the principal Ministries, Departments, Regions and Programmes. As in 2015, in view of the reorganisation of Government when the APNU/AFC Coalition assumed office and subsequent changes, we combined agencies as necessary to allow for a meaningful comparison.

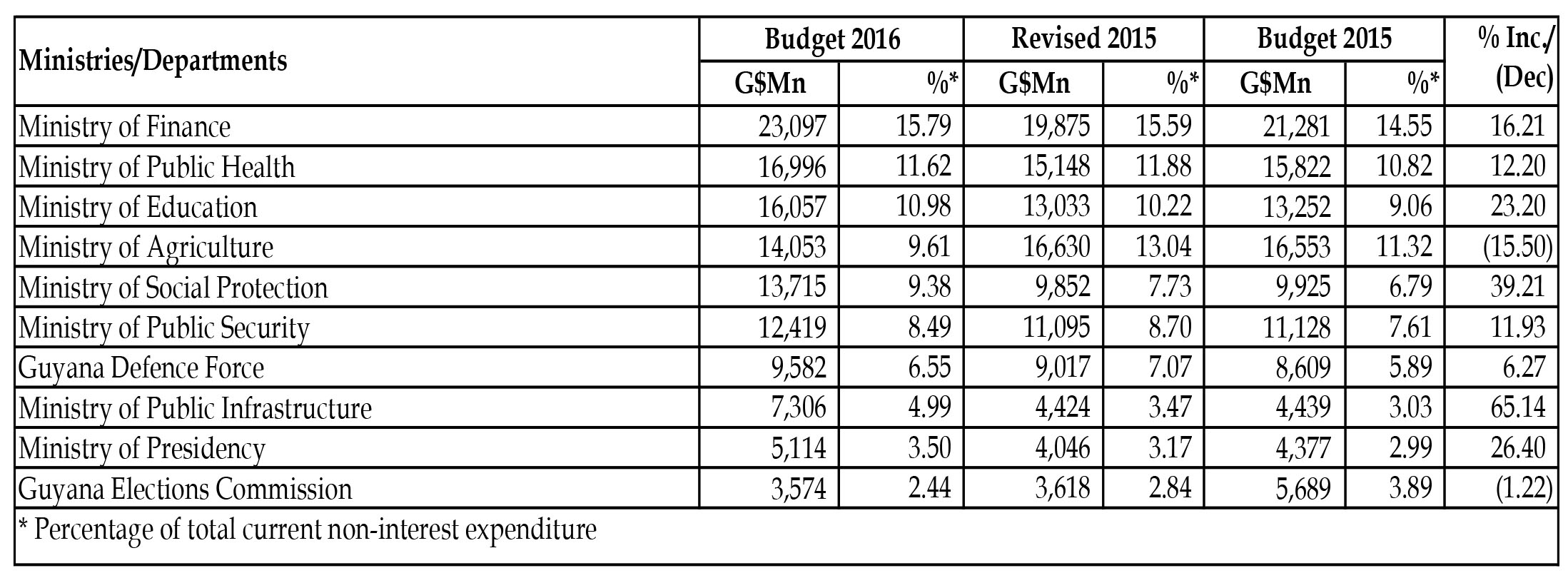

Central Government’s non-interest current expenditure (employment costs, statutory expenditure and other charges) for the year is budgeted at $164.3 billion which is 16.36% more than the revised 2015. The Ministries/ Departments with the most significant allocations and the largest changes between 2015 and 2016 are:

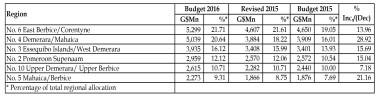

The regions with the most significant allocations are:

Capital Expenditure

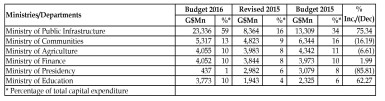

Central Government’s capital expenditure for the year is budgeted at $52.2 billion which is 32.4% above the revised 2015 and 22.7% of total 2016 expenditure. The Ministries/Departments with the most significant capital expenditure allocations are:

Highlights from Minister’s Speech

The Minister in his speech highlighted the following allocations:

Educational facilities $40.3Bn

Health facilities $28.0Bn

Public safety and security $24.6Bn

Roads and bridges $14.4Bn

Water supply system $11.6Bn

Sugar $9.0Bn

Sea defence structures $6.0Bn

Housing $4.2Bn

Information technology $3.1Bn

Ram & McRae’s Comments

- Employments costs under the Ministry of Finance are expected to increase from $3,959 million to $7,390 million by 86.7%. This increase is shown as arising in Policy and Administration from nil to $6,987 million in 2015 and 2016 respectively and a movement in allocation for Public Financial Management from $3,475 million to $403 million in 2015 and 2016 respectively.

- The allocation for the Public Procurement Commission (PPC) is $1,000 suggesting that the Minister is not optimistic that the PPC will be in operation in 2016.

- The sum of $300 million was allocated to fund activities relating to the 50th Anniversary Golden Jubilee celebrations.

- In the Ministers Budget 2015 speech, it was mentioned that “over $23 billion has been allocated to support further payments to over 7,000 rice farmers, due to the inability of the Petro Caribe Fund to meet those payments”. This was essentially a replenishment of funds used by the Government and during the 2016 budget speech, “support (for) the industry to access new trade partners” was the only offering for the rice industry.

- The Minister announced an allocation of $9 billion for the sugar industry, as compared to a sum of $8.2 billion budgeted in the year 2015.

- The sum of $14.4 billion is allocated to continue the upgrade, expansion and rehabilitation of the network of roads and bridges. The Minister also mentioned that over $5.0 billion will be invested in the reconstruction of Sheriff Street and $2.3 billion to upgrade the West Coast Demerara Road, from Parika to Vreed-en-Hoop.

- No mention was made of the proposed closure of the Wales Estate or support to or infrastructure projects in the West Demerara area in anticipation of this closure. The lack of a comprehensive report on the proposed closure including an impact assessment on residents in the West Demerara area is regrettable.

- The budget fails to provide for the transfers to local authorities under the Fiscal Transfers Act 2013, which seeks to give effect to article 77 (A) of the Constitution. The explanatory memorandum to the Fiscal Transfers Bill (No. 20 of 2012) states that “There is provision in clause 4 for the eligibility for fiscal transfers to a local authority governed by a set of conditions each of which has to be complied with in order to benefit from a fiscal transfer”. Prior to the Act and up to 2015, approximately $17 million was included in the budget as subventions to local authorities, and this has been increased to $21.7 million. The Fiscal Transfers Act requires 50% of the allocated amount to be distributed to Georgetown and the remainder shared by the 71 local authorities. The sums which appear to have been allocated are wholly inadequate, especially in view of local government elections in March 2016.