In an effort to reduce inequality and tax avoidance as well as increase disposable income, the government plans to increase the income tax threshold from January 1, 2017.

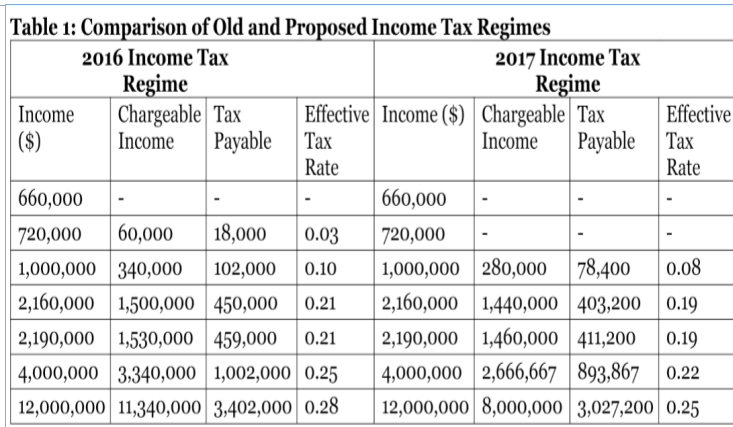

Finance Minister Winston Jordan, during his 2017 budget presentation yesterday, noted that the threshold, which stands at $660,000 per annum, will move to $720,000 or one-third of an employee’s gross salary next year.

He also announced that the Personal Income Tax Rate will be reduced from 30 per cent to 28 per cent for those earning less than $2,160,000 per annum or $180,000 per month.

He said a new rate of 40% will be applied to those earning an income in excess of $2,160,000 per annum.

“These measures will allow for an annual increase in take home pay to persons earning under $720,000 of $18,000, and for persons earning $2,160,000 to benefit from an additional annual take home pay of $46,800,” he said.

Further, Jordan stressed, in the case of the higher paid employees, by allowing for one-third of their income to be tax free, the incidence of tax will not exceed 25 per cent, thereby allowing for a higher “take home” pay. “This would reduce the need for tax free benefits, in kind, now being paid to employees in the private sector in lieu of salaries, and claimed by self-employed persons in lieu of income.

The loss from the implementation of these tax measures is $3.9 billion, which can used to boost personal savings and consumerism,” he said.