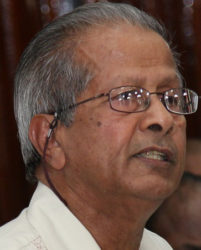

The Opposition People’s Progressive Party/Civic’s (PPP/C) Member of Parlia-ment (MP), Komal Chand has deemed the 2017 budget meaningless and delusional for sugar workers and asked for it to be recalled.

In his presentation at the budget debate in parliament on Tuesday, Chand said that the “promises of a bright future and a good life are now pushed down the drain by this Budget.”

He said that in the 2015 elections campaign APNU+AFC members had “promised the sugar workers 20 percent wage increases and other niceties. Today, we face the painful reality that sugar workers’ purchasing power has, in effect, been decreasing by no pay increases for two years now.”

He said such treatment demotivates and undermines a dedicated workforce critical for a turnaround of the industry and lashed out that the government as “unconscionable.”

He added that the government seems to want to condemn the sugar workers to even greater hardship and deprivation through the sale and closure of Estates.

Noting that government would soon make known its intentions for the industry, Chand said there are signs that the sugar industry’s re-privatisation or denationalisation is being pursued with great speed.

He sees the plan to do so as a “monumental mistake and one that will haunt us in the future,” pointing out that “re-privatisation can very likely do much harm to our people, our economy and our independence.”

He urged the government to “carefully consider the decisions of divestment and closure of estates. This will be condemning the affected workers to even greater distress and misery.”

Chand, who is also President of the Guyana Agricultural & General Workers’ Union, said too that from all appearances, the Skeldon Estate, the best and most valuable asset of the industry, is attracting an interested buyer or buyers.

“I wish to advise that the prized Skeldon factory and its rich cane lands along with the two co-generation turbines have the potential to make a major contribution to turnaround the sugar industry,” Chand stated.

He told the National Assembly that selling this estate, which might be at a cheap price, will be a grave blunder of the APNU+AFC Administration.

He said too that there is talk about the closure of the Rose Hall Estate in Canje, Berbice following plans to close Wales Estate.

He pointed out that, like Skeldon, “Rose Hall has become a liability” and that “going this way has several severe repercussions for the people and communities including those of Providence, East Bank Berbice.”

The Corporation, he said is touting non-sugar diversification at Providence as a means to offset the harsh consequences resulting from closure.

He noted that such a course would not only see the destruction of the sugar industry but that of the workers and their families who will be pushed into a life of poverty and despair.

He questioned whether the industry is being managed by the right persons and pointed out that this year the production target has been revised now to 188,000 tonnes from 242,000 tonnes projected in the 2016 Budget.

He lamented that the Minister of Finance, Winston Jordan said money invested in sugar is wasted and asked if the nearly $70B over the years paid as “sugar levy which went to support the country is also wasted money.”

Chand questioned too: “What about the nearly $30B received from the EU for sugar and not spent in the industry, is that a waste? What about employment created, directly and indirectly, is that a waste? What about the industry’s dependable foreign exchange earnings, is that a waste? What about the long-standing subsidy of the local sugar price, is that a waste?”

Fire sale

He told the House that the “sudden poor performance of the industry this year needs to be questioned especially as possibly a fire sale of the industry’s valuable and extensive assets is being pursued.”

He also urged the government to compensate the Corporation the $1.9B for the Ogle property it has taken over for the Public Service College.

He said too that workers are being deprived of their Annual Production Incentive and that only a small portion would be required for workers’ benefits.

Chand argued that sugar has a viable future and that the diversification into electricity production, specialty sugars, refined sugar and alcohol production offer us good prospects for the future.

“Comrade Speaker I cannot support the course being mapped out for sugar. Likewise, Budget 2017 brings added hardships on our working people and neither can I support it. I urge strongly that the Government withdraw the Budget, he concluded.

Nigel Dharamlall, PPP/C MP said: “Budget 2017 is a financial burden on the working class and the regular Joe in this country.”

He argued that because of the negative growth experienced over the last 17 to 18 months of this government, there is a decrease of real income and a massive decline in wholesale and retail sales.

Dharamlall said the budget does not have consistent economic policies and that nothing in the government can speak to positive achievement.

He called on the government to remove the burdensome taxes, enhance jobs, remove VAT from electricity and water, review the exempt list, return to the zero-rated list status quo and to conduct a forensic audit on the D’urban Park Project and the Drug bond.

Speaking after him, Junior Minister of Health, Dr. Karen Cummings, in her presentation, said: “The people of this nation will benefit comprehensively” from the budget.

According to her, “Workers will be taking home more money… Old age pension in 2014 was GUY$12,500. Budget 2017 has shown an almost 50% increase in Old Age Pension which takes it to GUY$19,000 and that VAT has been reduced as promised.”

“Mr. Speaker, we are aware that National Budgets do have complicated constructs that seek to itemize public expenditure for a specific period of time,” she said.

She added, “This catalogue is done in a strategic manner to ensure that funds are allocated where they are most needed, to ensure that maximum benefits are derived by those persons for whom particular national initiatives were undertaken.”

According to her, “The understanding of the national budget can be challenging. Careful attention must be taken to recognize where the benefits are situated within the National Budget.”

Meanwhile, she said that investing in children and youth is arguably one of the best and most valuable long-term investments a government can make.

“That is why our APNU+AFC government will continue to collaborate intersectorally and with stakeholders to engage in programmes that invest in early childhood and youth development. We recognize that this period in a person’s life is the most fitting time to work towards breaking the cycle of poverty, or better yet, preventing it from beginning.”