Pension costs are rising in Guyana. The NIS was driven to near crisis as pension costs kept soaring. In the private sector many pension schemes have been converted from defined benefits under which pension benefits are guaranteed to defined contributions plan under which benefits are based on contributions and the investment income thereon. Now it is the turn of the State to feel the effect of pension costs as employers.

The Government of course bears special responsibility to take care of its citizens and is often judged by how it takes care of its pensioners. Always with an eye on elections, the Government has to confront is the sheer numbers so that even a small increase in a pension can result in tens of millions of dollars to be paid out monthly.

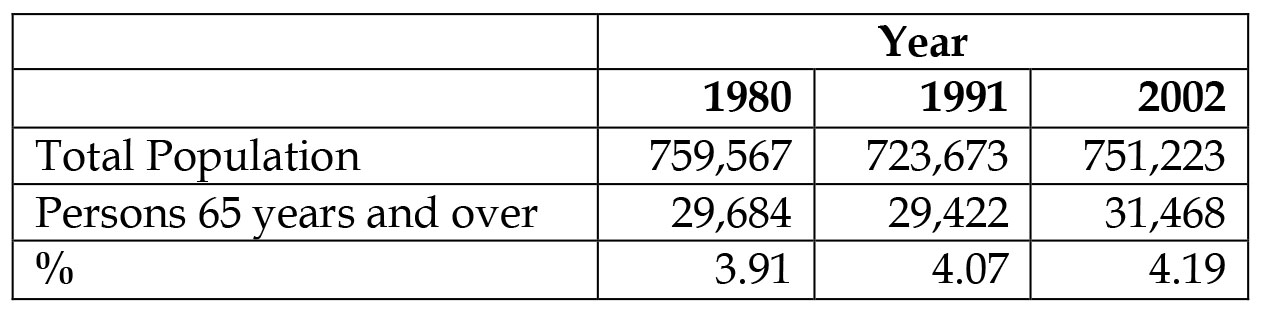

In Budget 2016, Mr. Jordan announced that the number of persons now claiming the Old Age pension has climbed to 50,000, or 6.6 percent of the population. Thirteen years ago the over 65 percentage of the population was 4.19%. This is a staggering increase and it defies all demographic logic or reality.

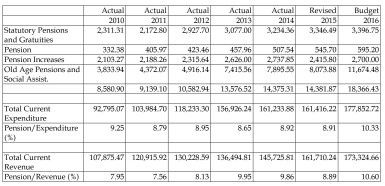

The Minister also announced that effective April 1, 2016 Old Age Pension will increase from $17,000 to $18,200. The increase alone will cost the country $720 million dollars while the total cost will be $3,985 million dollars. So let us look at the total cost of pensions reflected in the 2016 Estimates (amounts in G$ millions):

Source: Expenditure – Estimates of the Public Sector / Ministry of Finance (table 9)

Revenue – Estimates of the Public Sector / Ministry of Finance (table 4)

High as the numbers are, they do not reflect the sum total of pension costs borne by the Government. Contract employees are paid a gratuity of 22.5% of their salary every six months in lieu of pension. Those costs are not separately disclosed but are included in the line item Contract Employees. With wages and salaries paid to contract employees in 2016 budgeted at $$11,230 million, the gratuity works out at over $2,000 million.

The Government is also a major employer and pays to the NIS employer’s contribution for its employees, whether pensionable or on contract. In 2015, that payment was $1,962 million and in 2016 it is projected at $2,085 million. This is an enormous sum to bear. It is unclear whether the Government is fully aware of the financial costs even as it continues to discharge its obligations to its elderly citizens.

With pension costs rising inexorably the Government may wish to examine those costs and whether they can be better managed, even as pension is constitutionally rightly treated property. A useful starting point is the Old Age Pensions Act Cap. 27:02 which sets out the qualifying requirement as: (a) attainment of the age of sixty-five years; (b) been a citizen for ten years; (c) been ordinarily resident in Guyana during the last twenty years; and (d) passed a means test based on income and assets. Therefore any returnee to Guyana before 1995 is not entitled to a pension because of condition (c).

Yet, I know of persons who lived abroad for decades, paying their taxes and earning pensions outside, who are encouraged to apply for pension under the Act. That is unlawful and constitutes a fraud. Something surely needs to be done. But the generosity goes beyond payment. The country’s tax laws are no less generous. Under the tax laws all pensions and gratuities are tax exempt, regardless of the amount.

Many public sector retirees are in receipt of considerable pensions which are exempt from tax, return to the workforce on special contract and are paid a gratuity that is also tax free. The generosity does not end there. The payment of contributions to the NIS and to any other pension fund is fully deductible against the employer’s income.

Even the Scandinavian countries known for their generous social programmes do not go that far. It is time for some serious pension reform. And also to reform employment practices in the public sector and the tax rules governing those payments.