Dear Editor,

Both the government and Bank of Guyana say that the economy is doing well. The business community, on the other hand, holds the opposite view. Both, I think, are correct, only that the economic lens deployed to gauge the extent of wellness is different. The government is talking about the entire economy, which is being pumped up by gold and probably remittances. The view of the business community is focused on a smaller slice of the economy: manufacturing, retailing, including bottom-house “cake shops,” real estate, construction; more broadly, the domestic private sector. By relying on the large view, the government sees the forest but misses the trees, which the domestic private sector sees; the difference in perspective is a function of each group’s self-interest. Investment might be booming in the “golden sector,” which is driving total private investment (mostly foreign capital mainly invested in gold mining). On the other hand, investment in the domestic private sector is experiencing a drought that is likely to be dryer, but this will not be known until the data for 2015 and 2106 are published.

The issue I wish to address in this letter is essentially an extension of the excellent analysis by Prof. Tarron Khemraj, “Government spending and the economy” (SN, 29 June 2016). Tarron has a rare talent among economists: his ability to render a complex issue readily understandable to non-economists. My twist is to move away from a “closed” to an “open” economy by factoring the country’s current account into analysis. The data cover the twenty-three years from 1992 to 2014.

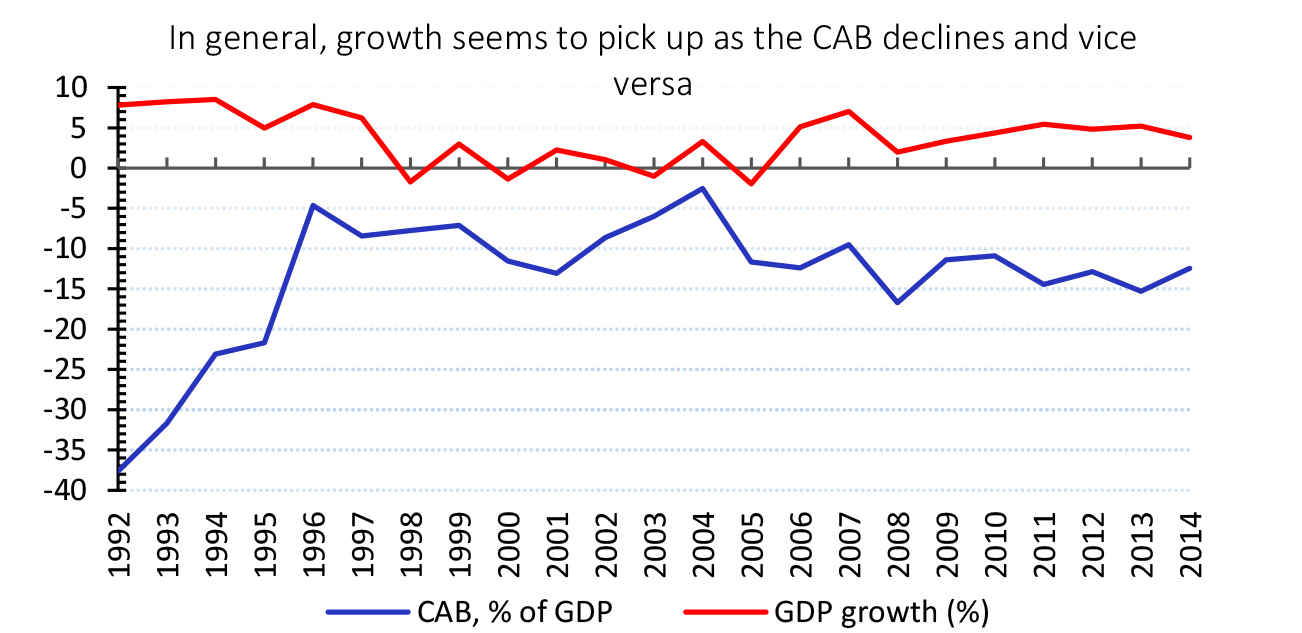

Consider the accompanying chart. A close scrutiny reveals that economic growth (upper line) increases as the current account balance (CAB, lower line) rises (as deficits rises). The economy expanded by 8 percent annually during the three years from 1992-1994, but these were also years when the CAB exceeded 23 percent of GDP. Thereafter, the CAB narrows and the speed of economic growth declined. When the CAB rose again from 2005-6, growth exceeded 5 percent. In general, it seems that current account deficits and growth are correlated; and they are albeit not very strongly (corr. coefficient = 0.5). Further, it appears that a current account deficit of 20 percent or more is good for growth in that it powers up economic speed to around 5 percent or more – at least in the short-run. The question is: what drives the current account deficit?

Now is a good time to be a little more specific about the current account. The current account (CA) may be defined as the difference between the value of goods and services exported and the value of of of goods and services imported. A positive CAB means that a portion of a country’s saving is invested abroad, since the county is unable to consume all that it produces. A negative CAB means that a portion of domestic investment (or consumption) is financed by foreigners’ savings since the country is investing/consuming more than it produces. A deficit on the CAB most likely reflects a low level of national savings relative to investment; a situation where the rate of investment exceeds the rate of saving, which has historically been the case with Guyana.

For capital-poor developing countries, which have more investment opportunities than they can afford to undertake because of the low rate of domestic savings, a current account deficit may be natural. While Guyana is a developing (underdeveloped) country, it does not conform to this generalized pattern, at least during the last decade or so. The country has a liquidity glut even though there are many viable investment opportunities; this fact alone should cause grave concern among policy-makers, if they are genuinely interested in the development of Guyana. Indeed, the rate of investment (fixed capital formation) has declined, falling from 25 percent of GDP in 2005 to 19 percent in 2104, reflecting the dampened “animal spirits” of the private sector, as Prof. Khemraj, borrowing from Keynes, so graphically puts it. Clearly, something is fundamentally wrong with the investment climate, which is why people are not investing in the domestic economy.

While investment is trending downward, consumption is soaring (a large portion is probably conspicuous consumption). In fact, the country has been eating more than it produces for some time now. Thankfully, total consumption expenditure has remained more or less unchanged at around 110 percent of GDP from 2011 to 2014. Private consumption expenditure fell by 8.3 percent in 2014 and by 2.8 percent in 2015. On the other hand, public consumption surged by 10 percent in 2014 and by a further 3.5 percent in 2015. We now have the answer to the question posed above: Guyana’s current account deficit is driven more by consumption than investment spending. More than investment, it is consumption that is fueling economic growth.

That the growth rate of a poor, underdeveloped country is buoyed up by consumption spending is another grave cause for concern. To put it bluntly, it is an unsustainable situation. In economics, there is a saying that no gain can be achieved without pain. The equivalent in the desperately poor rural area where I grew up is: “wah sweet goat a ‘e mouth goh bitter a ‘e behind.” Unless gold continues to boom and oil comes on stream soon or manna begins to fall in Guyana from heaven, the pain – austerity – cannot be far behind. Sadly, I read somewhere that God has cursed Guyana.

So how long can a country continue to pile up a current account deficit? To put it differently, a CA deficit means that a country increases its liabilities to the rest of the world that are funded by flows in the financial account (grants, loans, FDI, portfolio investment). One day, sometime into the future, borrowed money will have to be paid back. If a country wastes borrowed foreign funds on projects that have no long-term productive gains, are poorly constructed and maintained, become white elephants, fail altogether, or are riddled with corruption, the ability of the country to repay – its basic solvency – may come into question, as was Guyana’s in 1981. Basic solvency requires a country to generate sufficient current account surpluses to repay borrowed funds, short of the generosity of borrowers (as happened during the last PPP regime). Both cases, wasting capital and inability to run a surplus on the current account, characterize Guyana. The PPP inherited a US$2.0 billion total external debt stock from the PNC. And guess what? It bequeathed the Coalition Government a total external debt stock of US$ 2.4 billion (as of 2014)!

Ok, those absolute numbers are deceiving. Looked at in relative terms, Guyana’s external debt stock was 680 percent of its Gross National Income (GNI) in 1992, but only 73 percent in 2014. For this relatively happy situation, we praise gold (not God). But a very heavy dependence upon the precious metal is not good for the economy, especially if the price of gold declines or rises only slowly, or if, God forbids, an environmental catastrophe strikes. The point is that the government needs to provide incentives to enable the domestic private sector to flourish; build reputable and reliable public infrastructure; invest in health, nutrition and education; stem the economic haemorrhage from corruption and the brain-drain; ensure adequate security for all as well as the investment by the private sector (domestic and foreign); and make it easy to do business in Guyana.

Yours faithfully,

Ramesh Gampat