Sterling Products Limited (SPL) is a manufacturing company that produces a variety of products, including ice cream, margarine and laundry products.

It is part of the manufacturing sector of Guyana and even though it contributes less than half of one per cent of gross domestic product (GDP), it is regarded as important to the stability and growth of the economy.

SPL has been in existence for at least 63 years and therefore has much experience in the world of business. Its legal personality makes it a part of the Beharry Group of companies where it has been for the last 18 years. SPL has been turning in impressive returns for several years.

However, one must wonder if it is beginning to show its age for since 2013, the growth in pretax profits has fallen off steadily. Some might think that that was an accurate view of SPL’s potential since many other companies have had similar experiences and have seen their profits decline within the last few years.

In addition, the company is included in the stock index that this writer produces every week in the Stabroek News. The stock has not traded frequently on the exchange within the last year.

It last traded about four months ago on September 14, 2016, and prior to that date, the stock traded on the 20 July 2015. This has happened even though the company itself has been turning in an attractive performance over the past five years. This article will examine the performance of SPL from 2011 to 2015 to see if it could glean the disposition of the company’s management towards building shareholder value.

Not giving of its best

The profile of SPL reveals that at the end of 2015 it had $3.2 billion in assets and $2.61 billion in shareholders’ equity. By that time, SPL was generating $3.1 billion in revenues from its main operations and was spending about $363 million on its human capital.

The company’s management contends that a combination of hard work, new-age thinking, innovation and a commitment to quality has brought it the success that it has achieved and given it the ability to remain operational into the future.

There might be something of significance contained in the set of values embraced by management because SPL was able to grow its profits by an annual average of 18 per cent from 2011 to 2015 and to increase its earnings per share by 53 per cent during the same period.

The contradiction between its impressive profile and the sporadic trading of its stock suggests however that the company might not be giving of its best to its shareholders and the economy as a whole.

Linking pin

In an attempt to understand better SPL’s attitude towards increasing stakeholder value, an assessment will be needed of its business and long-term investment strategies.

The linking pin between its business and investment strategies is the financing received from customers now and in the future. A previous assessment of this company revealed that while it had done much to improve its competitive position, its business strategy might be questionable.

SPL has spent time improving the quality and appearance of the products that it produces by improving its production facilities. Not only has it upgraded plant facilities, it has also built new plants and acquired new machinery to improve the efficiency of its operations and the quality of its products. SPL also redesigned and repackaged its products for greater market appeal and improved the distribution of the company’s products. At that time too, it was pointed out that innovation was slow for a company which produced several commonplace products.

Based on currently available data, the management of SPL remains preoccupied with quality control and system improvements.

Product innovation might not be a top priority still for the company as it has not indicated if it was working on any new product lines or seeking to change any of the existing products. One must wonder therefore how this company intends to remain competitive in the future. The data on expenses incurred by the company indicate that close to half of its expenses are used for staff compensation.

Where revenues are concerned, SPL appears comfortable using as much as 12 per cent of it to finance staff costs. It appears as if this company is betting on the reliability of its staff to take it into the future. The staff, it hopes, would be able to fly on the wings of management’s ability to expand the internal equity of the company.

Investment strategy

Those desires must be brought together by something. The issue emerges as to the long-term investment strategy that the company must adopt if it wants to be able to continue relying on its human resource strategy.

From the data at hand, SPL grew its long-term investment base by 48 per cent. It is useful to know where the emphasis was being placed in the long-term investment strategy and how that could influence future prospects of the company. Such an analysis will also enable readers to understand how management is controlling the company and the future prospects for increased shareholder value.

The primary source of financing of a business is the patronage of its customers. As is probably well-known by now, sales revenue is the principal driver of a business.

But the business needs to be managed and controlled by someone. There is therefore a direct link between customer and management, even if management is not always visible.

That relationship is reflected in many ways in a business. For a business that has been around for a long time, the relationship between customers and management can be understood by studying the long-term investment strategy of the business.

Working capital

Over the period 2011 to 2015, SPL generated revenues of $16.4 billion from sales. SPL was able to take 28 cents of every dollar earned and finance the long-term investment of the company. The long-term investment focus of SPL was in three areas, namely working capital, gross productive assets and other assets. Working capital, as one knows, is the money needed to meet the needs of the current operating cycle. It is influenced by the speed with which the company collects money or is able to convert its inventory and receivables into cash.

It is also influenced by the short-term debt that a company can incur through credit from suppliers, overdraft from banks or loans obtained through the money market. The long-term investment by SPL in working capital has averaged 24 per cent over the period 2011 to 2015. During this period, one noticed that the investment in working capital declined from a high of 31 per cent in 2011 to a low of 22 per cent in 2015.

SPL improved the use of its cash. In 2011, it had 22 days net sales tied up in cash. It was able to improve that to 5.6 days net sales tied up in cash. The decrease in net days sales of cash has resulted in an efficiency gain of $143 million. This favourable movement in cash management was almost cancelled out by the decline in efficiency in receivables and inventory management. From the evidence at hand, SPL has been increasing its reliance on credit sales.

The management of its receivables is therefore very important to the success of the business. As a result of increasing the number of days sales that remained in inventory and uncollected revenues, SPL efficiency declined by $133 million.

Productive assets

Set in the context of the long-term investment of the company, the greater emphasis was placed on the productive assets. The long-term investment in gross productive assets grew 16 per cent between 2011 and 2016. The strategy relied on the use of the internal equity of SPL. SPL was able to grow its internal equity from $2.3 in 2011 to nearly $4 billion in 2015.

This increase in internal equity enabled SPL to put aside nine per cent of the revenues it earned over the five year period and keep it under its control. It was able to increase the money that it has under its control by 62 per cent while keeping its external financing constant. The growth in internal equity was helped no doubt by the ability of the company to control its direct production costs.

LUCAS STOCK INDEX

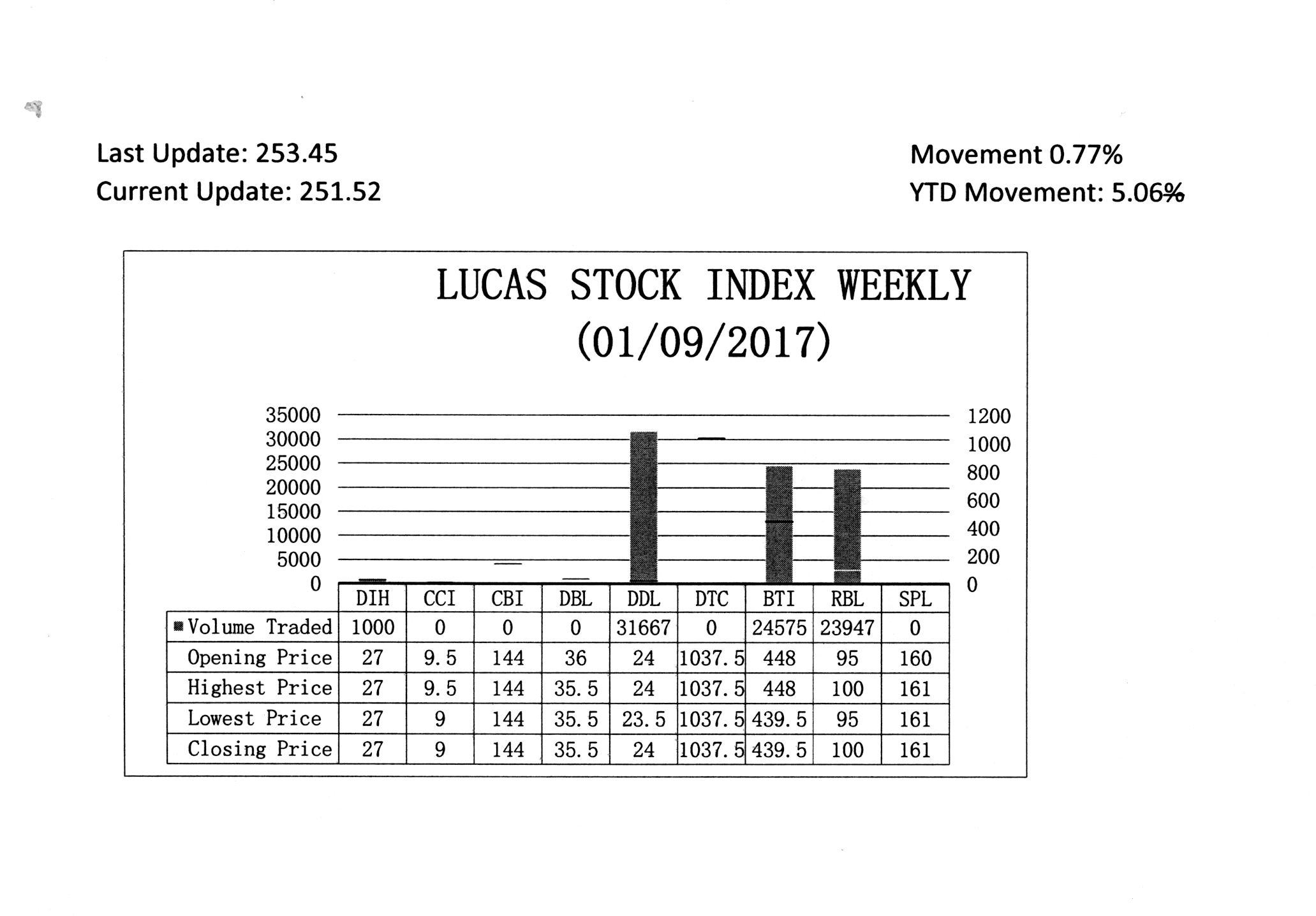

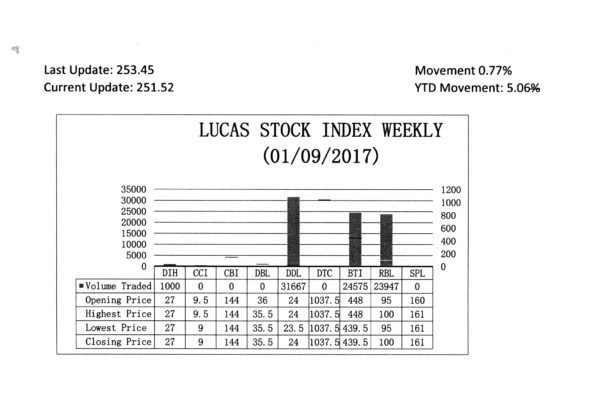

The Lucas Stock Index (LSI) rose 0.77 percent during the second period of trading in January 2017. The stocks of four companies were traded with 81,189 shares changing hands. There was one Climber and one Tumbler. The stocks of Republic Bank Limited (RBL) rose 5.26 percent on the sale of 23,947 shares and the stocks of Guyana Bank for Trade and Industry fell 1.90 percent on the sale of 24, 575 shares. In the meanwhile, the stocks of Banks DIH (DIH) and Demerara Distillers Limited (DDL) remained unchanged on the sale of 31,667 and 1,000 shares respectively.

In 2011, direct production costs consumed 77 per cent of revenues gotten from customers. SPL was able to reduce this share progressively to 67 per cent by 2015, thereby enabling it to retain a greater share of customer financing for itself. This effort might have also been aided by a lower fuel bill and slower growth in staff costs.

The remaining 91 per cent of internal equity was used to finance the operations of the business, pay its income taxes and give dividends to its shareholders.

No need

In considering the performance of the company, it becomes evident that the company does not feel the need to seek external financing outside of the ordinary course of business. The trade credits and overdraft can take care of its immediate cash flow needs.

It has enough equity to take care of the things that it wants to do now. As a consequence, SPL apparently sees no need to pursue external equity financing, with the result that its stock trades very slowly.