Today’s column continues the presentation of lessons Guyana can learn from global experiences with oil and gas-based SWFs. Two further lessons (4 and 5) are added to the three which were presented last week. Lessons 4 and 5 focus respectively, on national objectives and design rules.

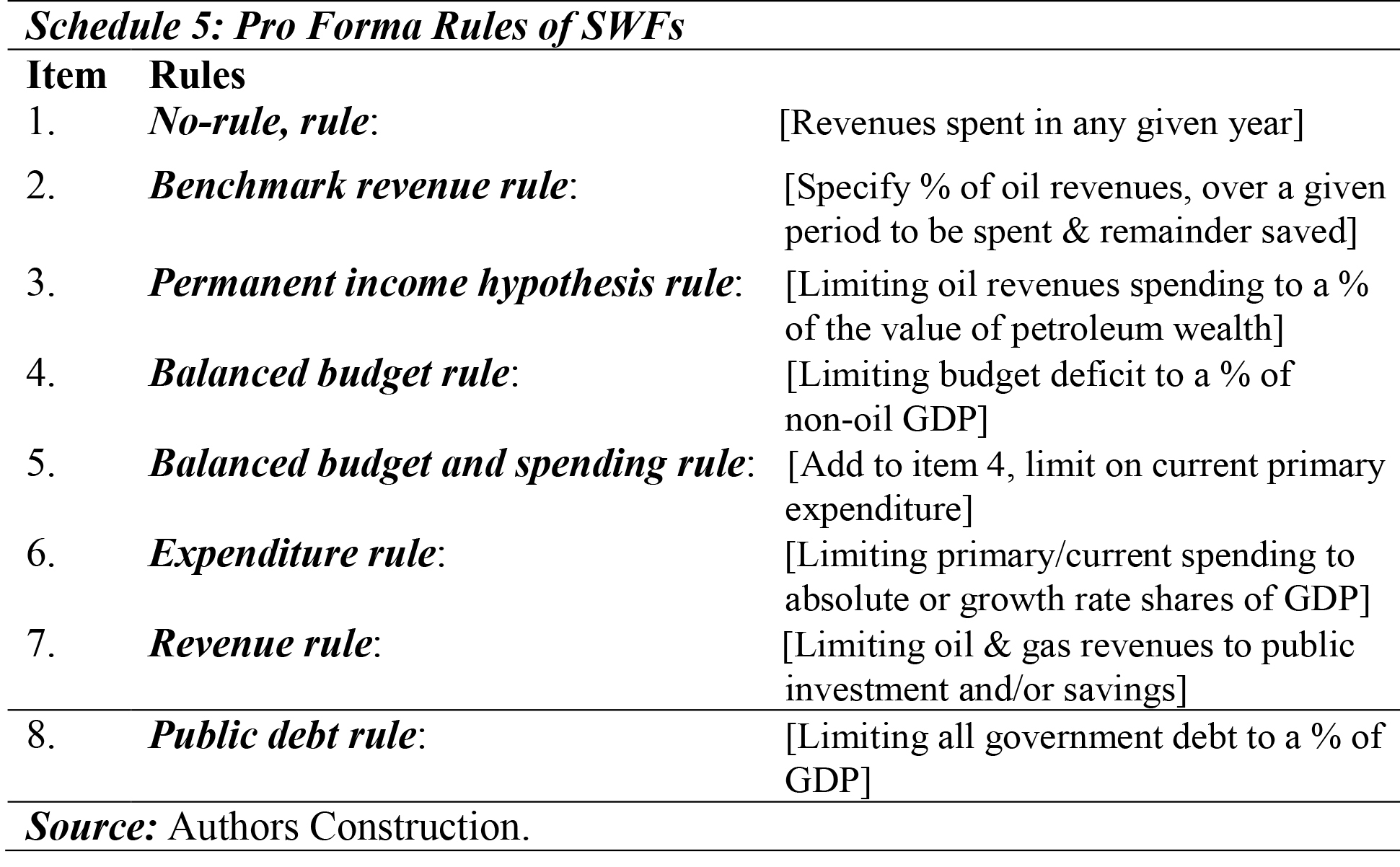

Lesson 4 (Schedule 4)

Schedule 4 lists seven national objectives commonly found among reputationally ‘well run’ SWFs. These objectives are immensely worthy of consideration for Guyana. One of these is targeting smoothing expenditures made necessary because of volatile, variable, and highly uncertain export revenue flows.

Such a sequence, I believe, is intuitively appreciated by most readers. However, the further reason why smoothing expenditures is a justifiable national objective for an SWF, is that the sequence I have described could be the precursor to the dreaded Dutch Disease, previously discussed.

Another objective is to promote national savings generated from expanding oil and gas export revenue flows. Such savings are important both for intergenerational equity and as a means of protection for the time when the oil and gas depletion rate signifies impending exhaustion of these resources.

Based on the foregoing analysis, some SWFs have indeed elevated countering Dutch Disease, to a separate national objective. This objective is then treated as a subset of a broader range of development priorities. These broader development priorities have embraced 1) targeting/earmarking the removal of social and economic inequalities; 2) environmental sustainability and ‘greening’ of the economy; 3) infrastructure enhancement; 4) diversification of the economy; and 5) structural transformation. Relatedly, also some Guyana-type economies have prioritized functional autonomy, reduced dependency, resiliency and enhanced capacity to develop in a sustainable manner, as legitimate objectives of SWFs.

Last, but by no means least, it has been observed also that great political opportunism can be found in some SWF objectives. Behind their lofty pronouncements of goals and objectives, lie cynical efforts to remove SWFs from the glare of public scrutiny of the sort that accompanies national budgets, and indeed to place them in spheres of opaqueness! Readers should be made aware of this deception.

Schedule 4 summarizes these observations.

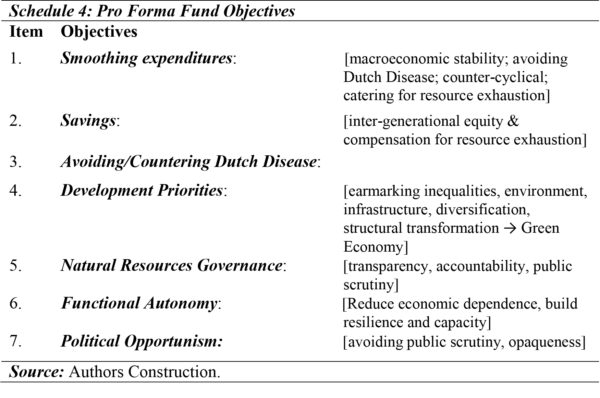

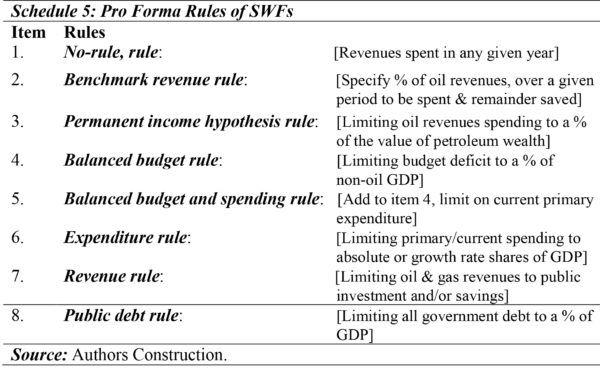

Lesson 5

Lesson 5 identifies eight pro forma rules, which, in my opinion, in one form or another, typify the operationalization of well-run SWFs. Rule 1 is important. It is in effect, a no-rule, which specifies oil and gas export revenue inflows/earnings can be spent in any given year. There is no regulation; full discretion is given to Fund managers, with authority to spend revenue receipts in any given year. Rule 2 is the benchmark revenue rule. This rule specifies the percentage of annual oil revenues over a given period, which can be spent by the government, with the remainder fully saved. Rule 3 is the permanent income hypothesis rule. This rule limits annual spending of oil revenues to a fixed percentage of the estimated total value of national oil wealth. Rule 4 is termed the balanced budget rule, because it limits the size of national budget deficits to a predetermined percentage share of the GDP generated by non-oil and gas sectors.

Rule 5 is the balanced budget rule combined with a spending rule. This combines Rule 4, and places a limit on current primary expenditures. Rule 6 is specifically designed as an expenditure rule. It limits primary or current government spending to fixed ratios of GDP. These ratios can be stipulated as absolute measures or in terms of GDP growth rates. Accompanying this rule on spending there is also a rule on revenue. Rule 7 specifies the spending of all oil and gas revenue inflows to public investment and/or savings. These revenues cannot be used for public consumption or transfers. Finally, Rule 8 is termed the public debt rule. Guyanese are very familiar with this rule, as during the recovery from our macroeconomic and structural adjustment crises of the 1970s, 1980s, 1990s and early 2000s, external assistance was conditional on limiting public debt to predetermined GDP ratios.

Next week I wrap-up this discussion.