The Minister of Finance made it clear that a reduction in the VAT rate would require that the list of taxable items be expanded. I sympathize with the difficult choice set available to Minister Jordan. The political types played big politics with the VAT, which I have argued before, during and after the seminal 2011 election should not be reduced since it is the only way to tax the underground economy. I argued that reductions should go instead towards income taxes – particularly towards the poor, those doing legitimate work, and those filing returns and pursuing production consistent with a national industrial policy framework. Minister Jordan decided to levy the VAT on private education, several health services and water.

While the desire to expand the tax base is understandable, the timing is not the best given the perceptions of a weak

Education at the primary, secondary and university levels has important positive spillovers (positive externalities) in a society. When one person achieves an education, he or she is not the sole beneficiary. The family, neighbourhood, church and society as a whole as well as the individual will benefit. Democracy is likely to be more stable and effective, also. One standard recipe of economic policy suggests that these spillovers should be subsidized, not taxed.

This does not mean, however, that government should not tax a for-profit university, which must be distinguished from private and public non-profit colleges and universities. The City University of New York (CUNY), University of West Indies and the State University System of Florida are examples of public university systems. New York University, Harvard University, The New School, Swarthmore College, Vassar College and many more are examples of private higher education centres of learning. Both categories are non-profit and funding comes from private donations and government. There are however several for-profit colleges that have been misleading students. These for-profit colleges maximize shareholder wealth and skimp on education content. As a result, a significantly higher percent of their students are unemployed after graduation.

Therefore, I would impose a 14% VAT (preferably 16%) on the proposed for-profit law school since Guyana already has a relative surplus of lawyers. It is interesting to note that the government proposed to contribute about US$30 million (a subsidy) to the school. Private investors will make up the rest of the US$70 million. This is yet another curious policy decision by this government, subsidizing an activity that has less positive spillovers compared with, for instance, an engineering school or programmes in quantitative social sciences at UG.

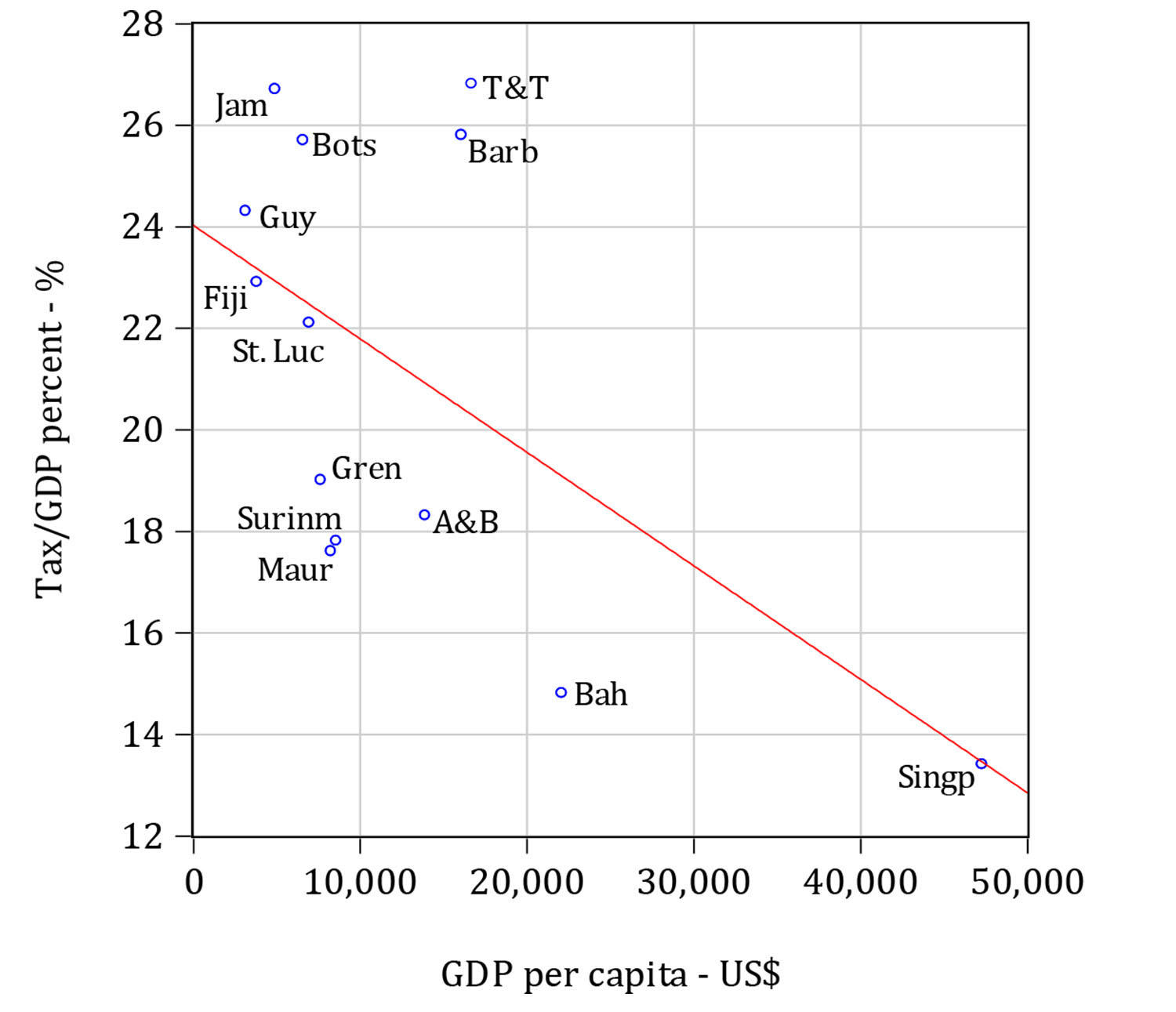

Let us examine the extent to which the Guyanese society is taxed given its relative level of development, as measured by the average or per capita GDP. I prefer using constant per capita GDP in US$ instead of the purchasing power parity (PPP) data, which is fraught with technical problems.

Context is sought by comparing Guyana with 12 peer economies: Antigua and Barbuda, The Bahamas, Barbados, Botswana, Fiji, Grenada, Jamaica, Mauritius, Singapore, St. Lucia, Suriname and Trinidad and Tobago. By peer economies, I mean countries that were former colonies, had a fairly similar level of development by the late 1960s, and are small economies susceptible to the same global shocks. These countries, like Guyana, are all price takers instead of price makers in the global arena. They may differ mainly in policy choice, governance, natural resource endowments and geography.

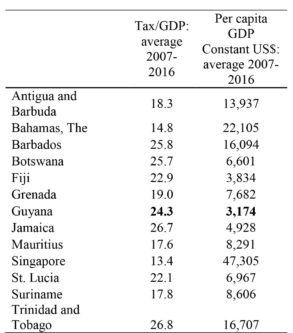

The table summarizes the main findings. Using World Bank and other sources, it reports the average amount of taxes collected as a percent of GDP. This is the average of all taxes: income, profit and consumption-based taxes like the VAT. The average is calculated for the period 2007 to 2016. The analysis starts from 2007 because that is the year Guyana implemented the VAT.

When one considers the 24.3% with respect to the country’s level of development – as measured by per capita GDP, the proxy for average income – it is clear that Guyana is a relatively high tax country compared with most of its peers. Moreover, there is a clear pattern in the comparison. Those with relatively higher average income have lower overall tax intake as a percent of GDP. Those that are relatively poorer tend to be high tax countries.

This pattern can be better observed by looking at a scatter plot with a fitted red trend line. On the upper left (lower income, higher tax) there is a cluster of countries close to the red trend line. These include Botswana, Guyana, Fiji, Jamaica and St. Lucia. On the lower left we can see Singapore and The Bahamas with higher income and lower tax intake. The rest can be seen as middling economies.

In conclusion, the government should remove the VAT on private education at the primary and secondary levels given that Guyana is a relatively high tax country, as the data indicate. On the other hand, a 16% VAT on for-profit post-secondary degree mills should be levied.

Comments: tkhemraj@ncf.edu