This week we continue our review of the legislative framework for oil and gas exploration and development in Guyana with a focus on subsidiary legislation. However, before doing so, special attention is paid to the confidentiality provisions of the Act and those under petroleum agreements, and the taxation provisions contained in section 51 of the 1986 Petroleum (Exploration and Production) Act (Chapter 65:04).

Confidentiality under the Act applies to information supplied by a licensee whether separately or in any report submitted. Such information may not be disclosed to any person who is not a Minister, a public officer or an employee of the Guyana Geology and Mines Commission, except with the consent of the licensee. And under the standard petroleum agreement, confidentiality applies to petroleum data, information and reports obtained or prepared by the Contractor relating to the contract area.

It seems clear then that neither the exploration nor the production licence or agreement is protected from disclosure. Moreover, as noted in the next paragraph, Members of Parliament are required to give their approval to tax exemption Orders brought to the Assembly by the Minister and it would be almost irresponsible of any such member not to request that the agreement be presented when the approval is sought.

With respect to taxation, section 51 of the Act gives the Minister responsible for the sector the power and the authority to make an order, subject to affirmative resolution of the National Assembly, disapplying the following laws in respect of licensees:

(a) Income Tax Act;

(b) Income Tax (In Aid of Industry) Act;

(c) Corporation Tax Act; and

(d) Property Tax Act.

Combined with the production sharing contract, the template of which is offered to oil companies, and which provides for a division of oil produced between cost oil and profit oil, the effect was to make the income of the oil companies tax free while allowing them to obtain a tax credit in their home country as if their income was subject to tax in Guyana. In a later column, the question of taxation will be addressed in greater detail but for now we look briefly at some of the subsidiary legislation under the principal Act and some of the more tangential legislation relating to oil and gas with the notable exception of the Environmental Protection Act which will be addressed later as we look at challenges posed to the environment by the oil and gas sector.

The Petroleum (Exploration and Production) Regulations 1986 (Regulations 5 of 1986) is a surprisingly short piece of subsidiary legislation and consists of twenty-nine regulations and one Schedule. Matters addressed in these regulations include Competitive Bidding, the appointment and functions of a Chief Inspector, provision for any transfer of licences to be approved by the Minister, the payment of fees and annual charges, the keeping of records and the maintenance of accounts.

What is particularly noticeable is how the Regulations place the Minister at the centre of the petroleum universe. The Petroleum Commission Bill recently tabled in the National Assembly moves responsibility for petroleum from the Petroleum Division of the Geology and Mines Commission to a Petroleum Commission but there too, the Minister continues to have extensive and concentrated powers. The Minister has promised to take the Bill to a Select Committee which hopefully will disperse those powers.

Some of the other legislation are:

Maritime Boundaries Act 1977 [Act repealed but some subsidiary legislation still applicable.] This Act was passed in 1977 and its object was to provide for matters relating to the territorial sea, the internal waters, the continental shelf, the exclusive economic zone (EEZ), and the fishery zone of Guyana. This Act was repealed by the Maritime Zones Act, 2010 (MZA) but section 54 of the MZA saves Order 8 of 1992 which was made under the repealed Act. That Order makes a range of legislation applicable to the exclusive economic zone. Significantly because Value-Added Tax came after Order 8 of 1992, VAT is not a tax under that Order.

The Maritime Zones Act 2010. This Act incorporates certain provisions of the United Nations Convention on the Law of the Sea. Section 2 of the Act defines the territorial sea, internal waters, innocent passage, contiguous zone, continental shelf and exclusive economic zone. The exclusive economic zone is defined in the Act as an area of the sea beyond and adjacent to the territorial sea extending to two hundred miles.

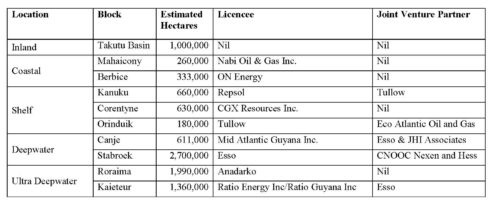

The Schedule of the licences granted is as follows: