Local Content

So far, these columns have taken a narrative approach and it was intended that once all the information was placed on the table, some analysis, both critical and policy directed, could be undertaken. However, it is not always possible to adhere strictly to this formula as current issues arise. For example, it was announced last week that ExxonMobil had been granted a production licence which moves closer to the day when Guyana will finally become an oil and gas producing country.

- the applicant’s proposals for the employment

and training of citizens of Guyana are

satisfactory; and

- the applicant’s proposals with respect to the

procurement of goods and services obtainable

within Guyana are satisfactory.

Section 36 (1) (vii) of the Act seems, with a stretch, to provide the Minister with some wiggle room by providing that if he determines that special circumstances exist which justify the granting of a production licence even where the applicant is in default, he may still proceed to issue a licence. On the other hand, the Act seems to contemplate a default in respect of the applicant, and not the application. In any case, it is hard to think what the Minister could consider more important to allowing an application to proceed than local content provisions. He has the right to refer the application back to the company to provide the information, or such additional information, as he may require.

Equity

The third point of note concerning licences goes back to a table in the third column of this series showing the company Mid Atlantic Guyana Inc. as a licence holder of 611,000 hectares in the deepwater off the Guyana coast. The annual returns and 2016 financial statements of the company filed at the Commercial Registry shows that the shares in the company are all held by a single individual – Edris Dookie and issued in 2015. The records for 2013 and 2014 state that an application for a prospecting licence had been made while the financial statements indicate that no shares had been taken up by any person, despite an application for a licence.

The 2015 financials state that the company had “not commenced exploration” and only that “Block ‘C’ Expenses” amounting to $9,263,252 had been incurred. The financial statements showed direct operating expenses of $3,411,240 of which Christmas hampers and postage made up a significant part. The statements raise a number of questions since an application for a petroleum exploration licence requires, among other things, the following:

(d) particulars of the applicant’s financial status, technical competence and experience including the record of petroleum exploration and production in Guyana and elsewhere;

(f) particulars of work and minimum expenditure proposed to be carried out or expended in respect of the block or blocks over which the licence is sought, and, in particular, details of the programme of the work to be performed in the first year of the period being applied for, and a statement of any significant adverse effect which is proposed prospecting operations would be likely to have on the environment and proposals for controlling or eliminating that effect;

(g) particulars of the applicant’s proposals with respect to the employment and training of citizens of Guyana.

It is a matter of public record that Esso & JHI Associates have been retained by the company as JV Partners although there is no note to the financial statements of the licence or the operator’s agreement. The expenditure incurred on the unstated number of blocks over 611,000 hectares in the company’s books is inconsequential and it is possible that the expenditure is being recorded elsewhere although it is not clear where. Such permissive situations only feed the belief that the entire oil sector is shrouded in secrecy, the guarantor of absence of accountability and transparency.

The need to revisit the country’s petroleum legislation after several decades is becoming vital, at least in so far as new terms for future licences, and the operating terms of past and future licences are concerned.

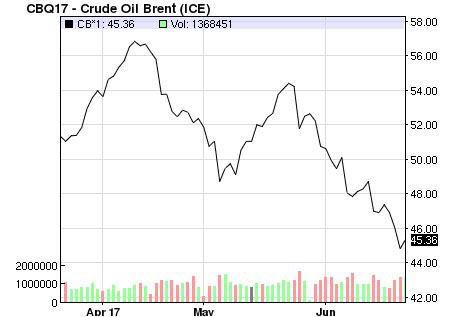

Oil Price

With oil price being such an important factor in the Government’s take or share in oil production when it does begin, this column will monitor one of the international benchmark prices for oil from Nasdaq, a North American stock exchange which features stock quotes, analyses, company information, etc. From time to time, we will also show the longer term price trend. Here is a chart of the price over the recent months.