Dear Editor,

Public controversies over the availability of foreign currency in Guyana’s financial system, although infrequent, tend to be unhelpful to market participants and the public in general, since shortages hint at a depreciation of our local currency which, if protracted, generally leads to higher prices for imported goods. Rumours, unfounded or not, therefore, tend to rattle public confidence and trigger the hoarding of foreign currency.

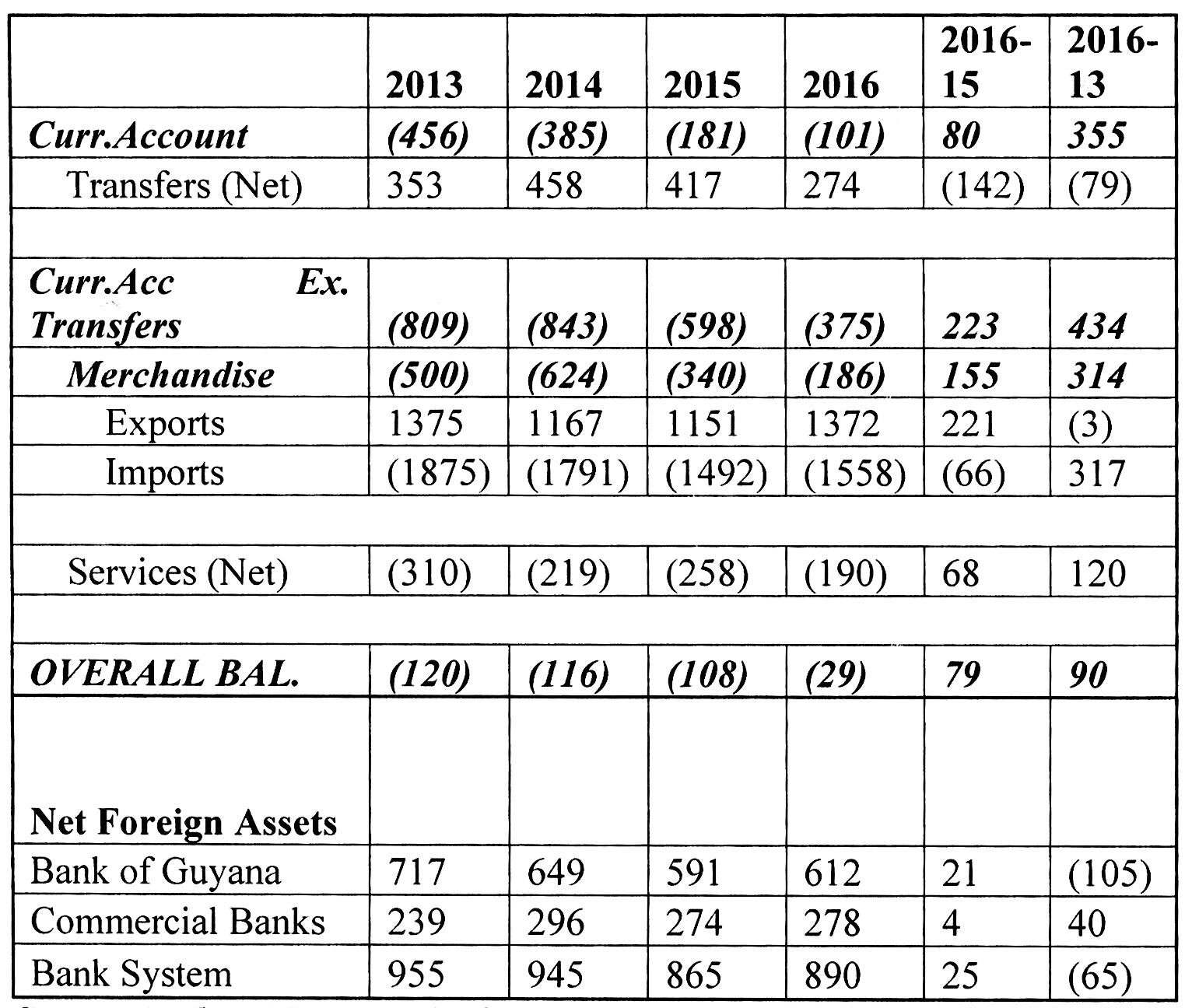

The table below presents selected statistics on Guyana’s balance of payments for the period 2013 through 2016, along with figures on the net foreign assets of the banking system. The year 2013 was chosen as a reference point since this was the most recent year that could be considered to be relatively free of the negative influences and uncertainty of the political climate which unfolded from the presentation of the 2014 budget through to the change of government in 2015.

The overall current account deficit improved by 44% or US$80 million to a deficit of US$101 million in 2016, when compared with 2015. The current account excluding transfers, which comprises the net positions of both merchandise trade and services, improved its deficit position by 37 per cent or US$223 million, to a deficit of US$375 million. This was due largely to the strengthening of the merchandise trade position, which reduced its deficit of US$340 million in 2015 by 45 per cent or US$155 million to a deficit of US$186 million at the close of 2016. The value of exports grew by 19 per cent or US$221 million to US$1,372 million, while imports increased by 4 per cent or US$66 million to US$1,558 million. The performance of the balance of payments in 2016 reflects a much stronger position when compared with 2013, with the deficit on the current account contracting by 78 per cent or US$355 million from US$456 million in 2013 to a deficit of US$101 million in 2016. This was due to the 54 per cent or US$434 million contraction in the current account deficit excluding transfers from US$809 million in 2013 to a deficit of US$375 million in 2016. The merchandise trade deficit contracted by 63 per cent or US$314 million, from US$500 million in 2013 to a deficit of US$186 million in 2016. The strengthening of the merchandise trade figures was due mainly to the 17 per cent or US$317 million contraction in imports over the three-year period. The net of trade in services also showed a 39 per cent or US$120 million improvement from a deficit of US$310 million in 2013 to a deficit of US$190 million at the close of 2016.

Transfers, which include remittances from abroad, played a significant role in bolstering the position of Guyana’s net external position over the years. These reduced the current account deficit by 73 per cent or US$274 million in 2016, and by 70 per cent or US$417 million in 2015. They totalled US$458 million in 2014, but registered a sharp contraction year-on-year in 2016, falling by 34 per cent or US$142 million to US$274 million. Although data for 2016 are best estimates, this sharp reduction in transfers may have been the source of consternation for the commercial banks, since these very probably fell out of line with their projections for the year.

Nevertheless, recent data showed that the net foreign assets of commercial banks improved modestly by 2 per cent or US$4 million in 2016 over the previous year to US$278 million, and were up 17 per cent or US$40 million from US$239 million in 2013. The net foreign assets of the Bank of Guyana increased by 4 per cent or US$21 million year-on-year in 2016, but had declined by nearly 15 per cent or US$105 million, from US$717 million in 2013, to US$612 million in 2016.

Although Guyana’s external position in 2016 is much stronger when compared with 2013, the marked decline in imports does support claims of slowing economic activity over the three-year period. Both exports and imports had declined in 2014, by 15 per cent and 4 per cent respectively, or US$208 million and US$84 million. Imports however recorded a sharper contraction in 2015, falling by 17 per cent or US$300 million, to US$1,492 million. They however recovered slightly in 2016, growing by 4 per cent or US$66 million to US$1,558 million.

The recent spat in the financial system over the availability of foreign currency has resurrected the spectre of the delicate balance Guyana continues to hold in its external position, and underlines the need for greater emphasis to be placed on strengthening our international reserve position. Among the benefits to be derived from this are improvements in the stability of the exchange rate, larger incomes and higher tax revenues which can be used to fund our infrastructural needs. This necessarily requires greater public/private collaboration and cooperation to address the issues and constraints to private sector growth, and thus facilitate the development of appropriate strategies and solutions.

Yours faithfully,

Craig Sylvester