Dear Editor,

It may be a while before the citizens of Guyana learn through cross-examination in the High Court what was and is a fair price for land at the Pradoville 2 luxury estate. It may also take a while to learn what ExxonMobil will actually pay in real income to Guyana in net payment per barrel of pumped oil.

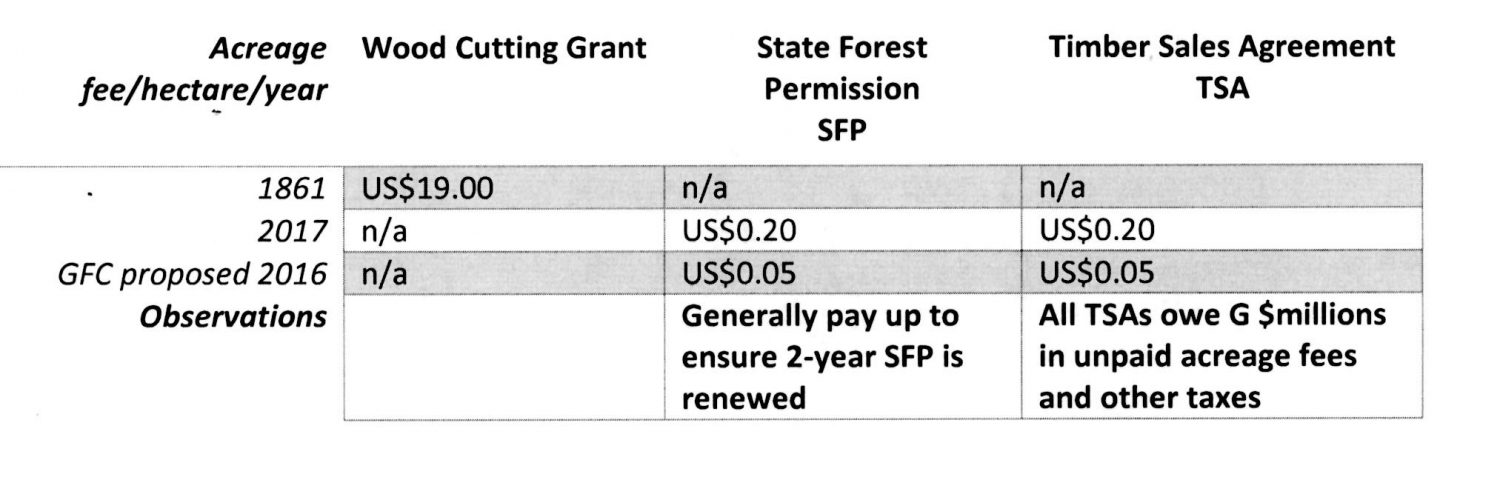

Meanwhile, here is a comparison between what Guyana earned from its forests in 1861 (156 years ago), what loggers pay now, and what the GFC estimated could be fair revenues in December 2016.

What does the GFC actually charge to holders of State Forest Permissions (SFPs, maximum 8000 ha renewable every two years)? It is only US$ 0.20 per hectare per year, plus a negligible royalty rate charged on declared log volumes of timber produced. So, amazingly, the government revenue from SFPs is 1/95 of what was earned 156 years ago, per hectare per year.

During the last 23 years, the GFC has received several consultancy reports which analyse this give-away of State-controlled resources and which make various recommendations for a more rational approach. In December 2016 the GFC proposed again the replacement of the artificial royalty rates, among the lowest in the world, by a stumpage system based on estimated harvest costs and declared prices.

This 2016 proposal was an update of a 2005 document. The GFC proposed a scheme which could have generated stumpage of US$ 22-25 per hectare per year, so much closer to the equivalent revenue in 1861 (US$19). This revenue would depend on the SFP holders declaring a production of 4.5-5.0 m3/ha/year, which is much higher than the current SFP average. But at the same time the GFC has proposed reducing even the abysmal US$ 0.20 acreage fee (per hectare per year) to US$0.05; in effect, treating the property value of the SFP lease as of negligible cost and value, and so encouraging the acquisition and retention of large areas of State forest without any productive use.

For comparison, the GFC acreage fee for long-term large-scale Timber Sales Agreements (TSAs, over 20000 ha, c.25 years renewable) should be US$ 0.37 per hectare per year but the TSA holders negotiated this back to the SFP level and, even more amazingly, are almost all in debt to the GFC because they simply do not pay the fees and the GFC makes little attempt to collect on these million dollar debts.

Contrast this leniency with the big companies with the treatment of the small-scale SFP holders: no up-to-date payment of all fees and taxes results in no renewal of the logging concession. The acreage fee for TSAs proposed by the GFC in 2016 would be the same as for SFPs, US$ 0.05/ha/year.

Let us hope that the government staff responsible for setting petroleum revenue rates in 2017 are as smart as the revenue men in 1861.

Yours faithfully,

Janette Bulkan