An indication

As indicated in last week’s article, one can take a look at the current account and understand many things that affect our economy. It was pointed out therein that the current account has three parts, namely the trade account, the primary income account and the secondary income account. Implicit in the presentation was that the current account balance provided an indication as to whether Guyana was saving money or overspending. A positive balance suggests that the country was saving money while a negative balance suggests that there was a gap between the current level of savings and that needed to satisfy investment needs. On a more positive note, investments can grow once the balance is favourable. The greater concern arises when the balance is unfavourable or dissaving is occurring.

Interpretation

The interpretation that is often given to the foreign trade aspect of the current account is linked to the production structure of the economy. In international political economy, trade and investment represent two important aspects of the production structure. It should be noted that when domestic investments are made, some of the output can remain unused. In other words, the items could remain in inventory until they are eventually sold. Inventory can carry over from one year to the next. Similarly, through trade, Guyana transfers some of its savings or unused output to the rest of the world in the form of exports and collects resources from the rest of the world via its imports. The exchange of these resources represents claims by Guyana and its trading partners against each other. In other words, they translate into financial resources or money and when set-off against each other reveals something else which could be understood as follows. When Guyana transfers resources for use by the rest of the world, it receives financial resources. Similarly, when Guyana receives resources from the rest of the world, it transfers financial resources to it. The country with the larger positive balance not only would have transferred resources with greater value, but could be regarded as having extended some credit to the country with the negative balance. With its current account balance consistently negative, Guyana seems to be in the position of borrower from the rest of the world.

The issue becomes how does one fix that problem? There could be a domestic response; there could be a foreign response or there could be a combination of the two. More often than not, there would be a combination of the two. At the domestic level, one could shift around one’s priorities and attempt to increase savings. Households and government could spend less and make more goods and services available for investment and for transfer abroad. This could therefore result in a reallocation of resources between spending and savings or put another way, between consuming and investing. One could try to ensure that a greater amount of resources from Guyana is used by the rest of the world by consuming less of its domestic output and sending more of it overseas. Since this article is focusing on the items in the current account, attention is directed to the foreign sector.

A country like Guyana is limited in what it can do with the external account. There is the option of increasing exports and reducing imports. Guyana depends heavily on eight products to improve its trade balance, but depends even more heavily on a large range of imports to keep its economy going. Most of the exports consist of primary commodities whose prices can be volatile and whose value-added is often less than that of manufactured goods, the type that Guyana tends to import plenty of. In other words, if Guyana could get better prices for its exports, then it would not have to send a higher portion of its output or resources abroad to attract high levels of foreign earnings.

Option

An option is to pursue a policy of import substitution. This course of action is an attempt to limit the foreign resources that it depends on for its production process. But, such a policy could have a harmful impact since 75 per cent of the value of Guyana’s imports is for use in the production process of the country. One runs the risk therefore of cutting off one’s nose to spite one’s face. This is not a particularly good course of action, especially when one recalls how ineffective the use of the policy of import substitution was in stimulating domestic production in a past era. The foreign trade portion of the current account limits the extent to which foreign trade could be used to improve the savings and investment situation.

Inadequacy

The limited use that could be made of adjusting the balance of trade gives rise to the need to focus on a different aspect of the foreign transaction. The inadequacy of the transactions in the current account to satisfy the investment needs of the country leads one to look at investment as another option. Here, the emphasis is on foreign investment. Before focusing on foreign investment, it should be pointed out that capital transfers are a part of the savings/investment focus of a country. It covers all transactions that involve the receipt or payment of capital transfers and the acquisition or disposal of certain types of assets. So, in the same way that current transfers are ignored in the discussion of the current account, capital transfers are ignored in the capital account. The reason for doing so is to focus on the foreign investment option.

Foreign investment is of two types. One is known as portfolio investment and the other is known as direct investment. Both types of investment involve the reallocation of resources from a foreign jurisdiction to Guyana. While the arrival of the new money reflects claims on assets of Guyana, they add to the level of investment. However, portfolio investment tends to be of a short-term nature and is usually not counted in the production structure. The investment of greater interest is direct foreign investment.

Long-term commitment

Direct foreign investment is defined as an investment that is made to acquire a lasting interest in enterprises operating outside of the economy of the investor. This long-term commitment is demonstrated when the foreign investment is not intended to be for a short period of time in the host country and is aimed at producing real goods and services. Direct investment enterprises can be subsidiaries, associates or branches. A subsidiary is an incorporated enterprise in which the direct investor controls directly or indirectly more than 50 per cent of the shareholders’ voting power. An associate is an enterprise where the direct investor and its subsidiaries hold between 10 and 50 per cent of the voting shares. A branch is a wholly or jointly owned unincorporated business. Because these investments involve cross-border movement of resources, they are tracked in the Balance-of-Payments (BOP). For BOP purposes, an investment of 10 per cent or more is sufficient to qualify as foreign direct investment.

New money

More often than not, people tend to focus on the arrival of new money from foreign investment. In other words, the tendency is to look to see the number of new investors arriving in the country. This is an important sign that the economy is doing well. While foreign direct investment is often associated with the arrival of new money as would come with a Greenfield investment or a merger and acquisition or even a joint venture, it can also come from the operations of an existing foreign company. The impact of this type of investment is shown in the financial account of the BOP.

Re-investments

The Table above shows the behaviour of foreign direct investment in Guyana from 2012 to 2016. It should be noted that foreign companies sometimes reinvest the earnings that they receive from doing business in Guyana. These reinvested earnings tend to increase the value of the stock of foreign assets of the direct investor. However, it should be noted too that the reinvested earnings are also shown in the current account and help to determine the savings/investment gap as in the case of Guyana. It should be pointed out further that the dividends paid and received also impact the current account and therefore influence what happens to savings and investment. The level of foreign investment shown above is an indication that the level of savings continues to be inadequate to meet the investment needs of the country when compared to what is in the current account.

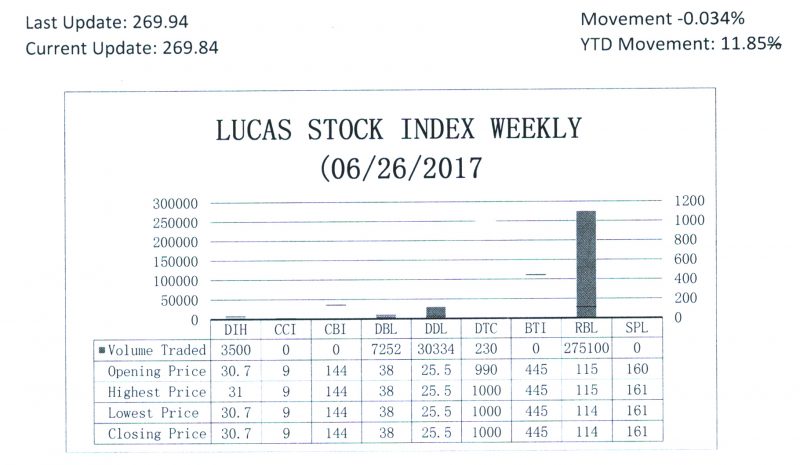

The Lucas Stock Index (LSI) declined 0.034 percent during the final period of trading in June 2017. The stocks of five companies were traded with 316,416 shares changing hands. There was one Climber and one Tumbler. The stocks of the Demerara Tobacco Company (DTC) rose 1.01 percent on the sale of 230 shares while the stocks of Republic Bank Limited (RBL) fell 0.87 percent on the sale of 275,100. In the meanwhile, the stocks of Banks DIH (DIH), Demerara Bank Limited (DBL) and Demerara Bank Limited (DBL) remained unchanged on the sale of 3,500; 7,252 and 30,334 shares respectively.