Alarm

In more recent times, there has been much discussion and expression of alarm about Guyana’s manufacturing sector. These discussions have primarily focused on the seemingly stagnant performance of the sector over the years and the perception of Guyanese that something other than itself was holding back the manufacturing sector from doing better. In bygone days, the manufacturing sector could identify, along with existing products, things like processed milk, refrigerators, stoves, matches, bicycles, radios, textiles, assembled motor vehicles and shoes as part of its sector. Back then, the attitude of the government was different and the environment was different.

One would have imagined that by now, 51 years after Independence, Guyana would have had a manufacturing sector that was much more robust and that was competing vigorously with regional and worldwide producers of many products. One would think too that it would be contributing much more than it has been to the gross domestic product (GDP) of the country.

Instead of expanding, the sector seems to have surrendered to producers from abroad whose products have crowded out local items from the domestic market place.

Some of the lamentable change no doubt would have come from the impulses and obligations of free trade which comes with being part of a regional and global trading system. With such awareness, this article seeks to discuss the scope for growing the manufacturing sector and factors that might be limiting that growth.

Layering of activities

The scope of the manufacturing opportunities in Guyana is enormous as one can tell from the United Nation’s International Standard Industrial Classification (ISIC) of All Economic Activities. The latest version of this classification system places 24 groups of activities in the manufacturing sector.

These activities are divided into several subcategories, depending on the specific products the production process yields. The descriptions change over time too as better information about the nature and process of products become available.

These revisions can impact the diversity of the sector which depends on the range of materials, substances or components which could be physically or chemically transformed into new products. The new products could be finished goods that are ready for final consumption or finished goods that are used as inputs into other manufacturing processes.

Flour is an example of the dual role that a product can play in the manufacturing process. Flour can be made by processing wheat and the flour produced could be used in the manufacture of bread and pastries. The layering of activities lends to the widening of manufacturing opportunities. The scope of the sector also depends on the extent to which goods can undergo substantial alteration, renovation or reconstruction.

In such cases, the rebuilding of machinery and equipment qualify as manufacturing. Repairs of machinery and equipment can also qualify as manufacturing, but this depends on the amount of value-added inputs that go into the repair activity.

Barely scratches the surface

Based on the current composition, Guyana’s manufacturing sector barely scratches the surface of possibilities.

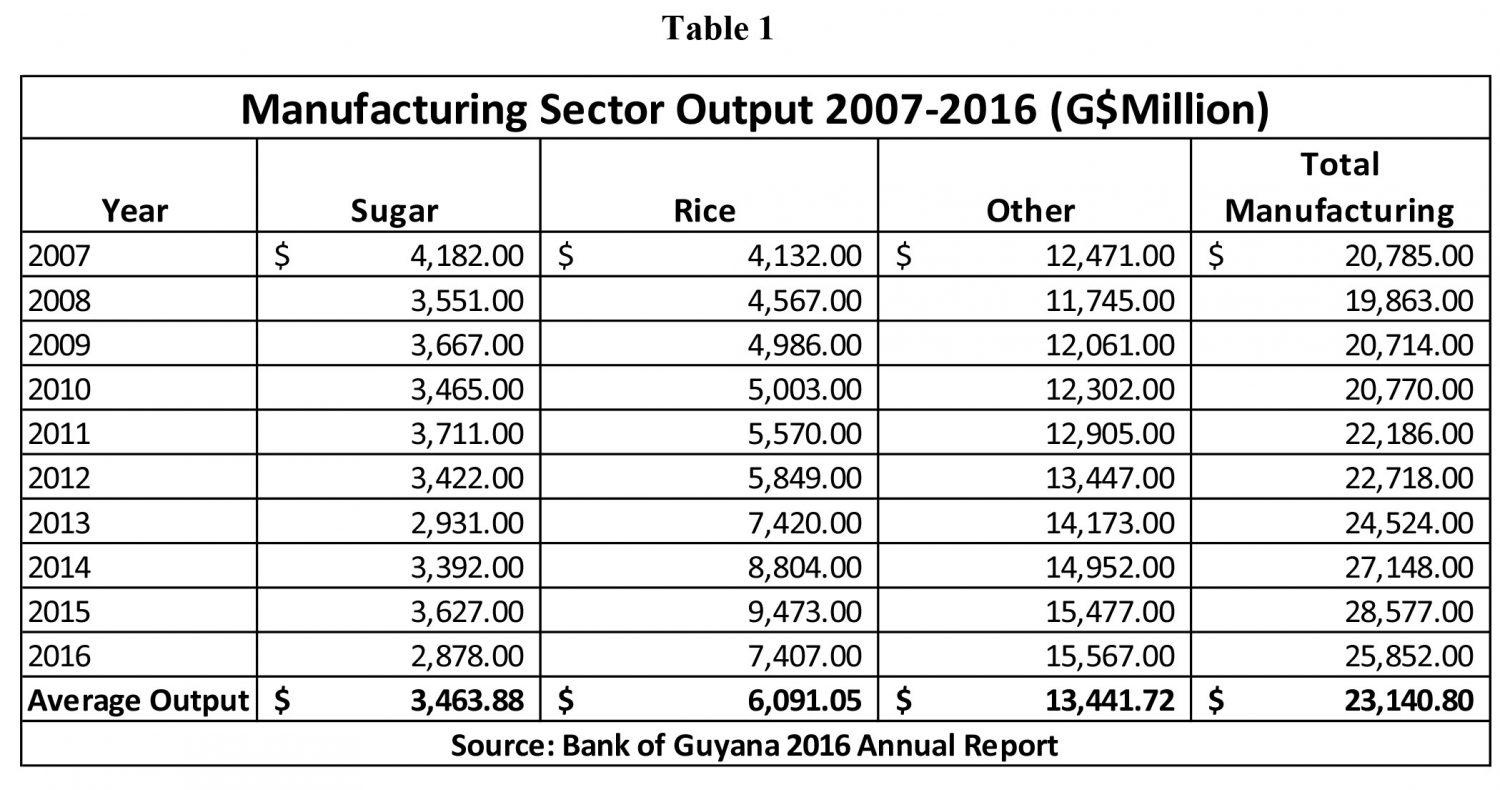

It should come as no surprise to anyone that the sector contributed an average of 3.9 per cent to the value-added outcomes of the country over the period 2007 to 2016. It is the sector that impacts the economy the least despite having producers with prominent brands operating in the market.

The sector recorded mixed performance in 2016 revealing how vulnerable it could be to factors exogenous to the sector. Notwithstanding its poor showing, on average, the sector employs more than 12 per cent of the labour force.

A further perusal of the items that qualify as manufactured items would reveal that Guyanese engage in several of the activities described as manufacturing.

The conversion of many agricultural raw materials into new products qualify as manufacturing. In its annual production of selected commodities, the Bureau of Statistics informed the country that eight of Guyana’s many agricultural products underwent transformation in a manufacturing process during the period 2007 to 2015.

However, four agricultural products have disappeared or have been severely cut from the manufacturing process during the same review period. Simultaneously, the processing of pepper into pepper sauce is a manufacturing item which does not make it onto the list of selected manufactured products. Similarly, the production of sweets does not make it in the league of selected commodities.

Invisible or too small

Some activities are considered manufacturing even though the sale of the activity takes place on the premises of the producers.

The processing of bakery products such as cakes, fresh pastries, roti and bread satisfies that condition and qualifies as manufactured goods. None of the items mentioned herein appears in the statistics about manufactured products in Guyana. Wines that are made in Guyana using local fruits also do not make it onto the selected commodities list.

This observation leads one to think that the activities in the manufacturing sector are much greater than is reported in the national statistics and that they contribute more to economic life and GDP than suggested. The problem might be that many of the producers are invisible or too small to make their contribution worth counting.

Hub of activities

Of Guyana’s eight principal exports, five of these are classified as manufacturing commodities.

These five commodities are sugar, rice, rum, molasses and shrimp. Over the period 2007 to 2016, rice and sugar have dominated our export earnings, contributing an average of 26.1 per cent. The largest contributor was rice, contributing an average of 15.6 per cent to export earnings, followed by sugar, contributing 10.5 per cent, shrimp contributing 5.8 per cent while rice and molasses contributed a combined average of 1.8 per cent as could be seen from Table 2 above.

The economic value-added generated in the economy by the manufacturing sector over the period in review averaged 5.4 per cent annually, increasing from an estimated $13.7 billion in 2007 to $22.2 billion in 2016. The value-added generated by this sector compared to other sectors is relatively small despite the hub of activity around manufacturing within the country.

Strategic vision

The potential for increasing the manufacturing sector is tremendous. Innovation in products and processes and better measurement of cost are critical to success.

But, it is generally accepted too that energy costs must come down by leaps and bounds to enable the manufacturing sector to assert itself in the Guyana economy and further afield. In a recent presentation, it was suggested that the industrial electricity costs in Guyana were slightly cheaper than in some parts of the Caribbean Region.

That knowledge is of little comfort for the spatial development of the sector when inadequate infrastructure also impedes its progress and diminishes or even erases export market advantages. The lack of a well developed and efficient transport system also acts as a deterrent to the growth and competitiveness of the manufacturing sector. But the biggest challenge to the sector might be getting industry players to demonstrate strategic vision and the will to move forward.

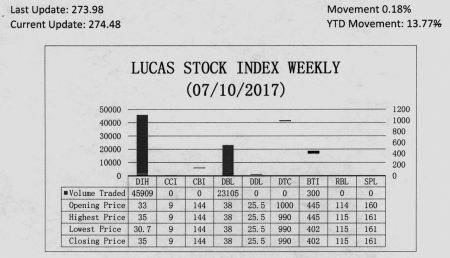

LUCAS STOCK INDEX

The Lucas Stock Index (LSI) rose by 0.18 percent during the second period of trading in July 2017. The stocks of three companies were traded with 69,314 shares changing hands. There was one Climber and one Tumbler. The stocks of Banks DIH (DIH) rose 6.06 percent on the sale of 45,909 shares. On the other hand, the stocks of the Guyana Bank for Trade and Industry Limited (BTI) fell 9.66 percent on the sale of 300 shares. In the meanwhile, the stocks of Demerara Bank Limited (DBL) remained unchanged on the sale of 23,105 shares.