Routine

Sometimes people do not think of things that they see or do, especially when the occurrence becomes routine. This can also happen between countries. One aspect of the relationship between countries in the international community is the allocation of resources between them. Despite the vastness of the planet, resources remain scarce for a variety of reasons. For example, in Guyana, the resources to determine if oil existed and to extract it from the ground remain scarce since Guyana does not produce oil rigs and had no money to acquire them on its own.

The unavailability of oil exploration skill sets is an additional reason for the scarcity of oil in Guyana. In a global economy dominated by market participants, the allocation of resources between sovereign states takes place through official flows, financial markets, foreign direct investment and trade relations. Each set of financial flows can lead to changes in the economic welfare of countries and, at an aggregate level, increase the welfare of the global economy.

The amount of resources that a country gets depends as much on its needs as on the type of relationship it has with rich and influential donor countries. The importance of some of these relationships is measured by geopolitical interests, economic opportunities, factor endowments and security vulnerabilities. These factors do not carry the same weight for each country with the result that the allocation of resources could be uneven. The unevenness in the allocation of resources sets off a discourse about development financing, that element of international financial flows that are supposed to help poorer and weaker countries reach that magical phase of prosperity. One might wonder therefore amidst all the known types of financial flows which one is typically characterized as development financing and why. This article seeks to discuss that issue and other aspects of the relationship pertaining to development financing.

A gap

Development financing is a concept that refers to cash, services or in-kind contributions acquired and used to increase economic opportunities in a country. The need for financing develops when there is a gap between required and available resources.

The gap between investments and savings in developing countries is what gives rise to the need for external financing (development financing). It stands to reason that, in most cases, these countries do not have sufficient revenues to fill this gap. Guyana has benefited from such gap-filling flows, even though the amount received might not have met its total needs.

At one time, all types of flows, grants, loans, export credits, mixed credits, associated finance and private investment were thrown into the development assistance pot.

Early in the life of the provision of development assistance, this potpourri of assistance presented conceptual and operational problems. However, developed countries which provided large amounts of grant in their aid packages called for a new measure of development assistance. Emerging as well at the same time were calls by developing countries, many of whom were fostering a relationship from a new position of sovereignty, for more concessional aid. After some debate, especially among donors who are members of the Development Assistance Committee, a decision was taken to classify assistance provided by these countries into three categories. These categories are official flows, other official flows and private flows. This classification enabled the separation of official flows from private flows.

Particular identity

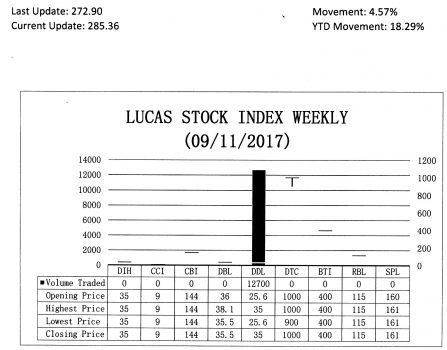

The Lucas Stock Index (LSI) rose by 4.57 per cent during the second period of trading in September 2017. The stocks of one company were traded with 12,700 shares changing hands. It was a Climber. The stocks of the Demerara Distillers Limited (DDL) increased 36.72 per cent on the sale of the 12,700 shares.

While it could apply to economic investments in any country, development financing has a particular identity, use and purpose. Development financing typically is associated with changing the economic conditions in developing countries through investment in public, private and philanthropic initiatives. It has economic growth as a goal, the lowering of the unemployment rate and lifting people out of poverty.

Development financing therefore carries with it an expectation that, if the resources received are invested properly, underdeveloped or poor communities will experience change in their productive capability and their access to basic services, including health, sanitation and educational services.

The focus of development financing then is both economic and social. It differs from other forms of cross-border resource flows which rely on markets to achieve the resource movement and which have profit as their motive. Foreign direct investment (FDI), for example, is achieved through the movement of equity capital across borders. It responds to opportunities that can increase the value of its shareholders’ investments.

FDI would lead to economic changes, but the distribution of its benefits could be very narrow since its main purpose is to reward those who are willing to take risks with their money. Other financial flows like bonds (loans) can occur through the use of capital markets. Access to such resources can come with a heavy debt-burden which could end up defeating the development objective.

Trade financing

Trade financing too is market oriented in that it seeks to ensure that market transactions for intermediate and final consumption goods can be completed. As such trade financing involves bridging the gap between the time exporters wish to be paid and the time importers are willing to pay. In essence, it facilitates the reallocation of resources between market participants using things like credit, payment guarantees and insurance to ensure that the transaction is fully consummated. In contrast, development financing, like flows through capital markets and FDI, focuses on helping countries with their capital formation, particularly that relating to the creation or strengthening of their infrastructure, including those for giving access to healthcare, sanitation, water and educational services.

ODA

For a very long time, one of the principal sources of development financing was official development assistance or ODA. ODA is defined by its participants as those flows that countries and territories receive from them directly or through their contributions to multilateral lending institutions.

To qualify as ODA, the money has to be provided by official agencies or through institutions used by governmental units of donor countries for the purpose of meeting the development needs of beneficiary countries. Such assistance must have a concessional component which must be either in the form of grants, or loans with very low interest rates and long repayment periods. Consequently, loans that are provided for a period of one year or less do not count as ODA.

Development financing through official channels has been taking place for about 56 years.

At the time that the issue of ODA emerged, the major desire of the international community was to have developed countries transfer 0.7 per cent of their gross domestic product (GDP) to developing countries to help with development.

That has not happened and was unlikely to happen anytime soon. Despite its long existence, there is much dissatisfaction with ODA flows. While the assistance targets developing countries, it provides benefits for donors. Donors are able to send products and experts from their country to beneficiary countries. It helps to expand market reach for their products and access to international jobs for their skilled human resources. This strategy does not favour capacity-building and technology transfer.

Face of development financing

It is not surprising that the face of development financing has changed over the years. More developing countries are offering technical assistance to each other through south-south cooperation. Countries like Brazil, Chile, Colombia and Mexico to mention a few, have increased official assistance to countries like Guyana in order to help address its development needs. China has also emerged as a major donor of development assistance. The areas of focus are not only infrastructure development. They include also capacity-building, human development, protection of revenue and improvement in public safety and security. The need to accelerate robust, resilient and sustainable development has forced the international community to reconsider development financing.

Intensity diminished

The topic of Financing for Development (FFD) is nothing new, but has been under the spotlight more today, following the rise of the Sustainable Development Goals (SDGs) in 2015 and the call for its incorporation into national development policies and plans to achieve the 17 agreed targets by 2030. The issues of poverty, hunger, education, health, access to potable water and sanitation have not gone away, even though their intensity might have diminished. It has become clear that after 56 years of development financing using official flows, the problems of the poor and undeveloped have not been solved and a new approach to financing development was required. This is being looked at but the early signs for change are not good.