Last week’s article identified some of the characteristics of competition and the role that it plays in making an economy better. It was seen that competition removed the inefficiencies in production and improved the poor performance of economies; it was a driver of innovation and productivity; it acted as a defence against trade restrictions and as a facilitator for greater equality of opportunity. Competition also helped to alter the social structure of society. The article also focused on the concept of market structures and the spectrum of market structures, which stretched from one extreme to another, from purely competitive to non-competitive industries. In a perfectly competitive market, many buyers and sellers exist, there was perfect information and firms were price takers. At the other extreme was a pure monopoly, the firm was the sole source of the product, and was a price maker which leads to a distortion of prices. In between the two extremes of market structures were duopolists and oligopolists. These investors represent varying degrees of market imperfection with risks to competition. Even though duopolists and oligopolists can compete with each other, there was greater fear that collusion could occur between them. This week’s article seeks to use the concept of market structure to determine competitiveness within industries in Guyana.

Disconnect

A discussion about competition in the Guyana economy could take a long time since there were many sectors and industries in the country. This article intended to limit its focus to a few industries in the country. However, the apparent disconnect between competition and the aspirations of the private sector in Guyana that was so obvious during last week’s business summit mandates a deeper assessment of the competitive environment.

This assessment is required additionally since a discourse about innovation and competition did not seem to be relevant solutions to the private sector for achieving growth and diversification of the economy. Further, Guyana has set up a Competition Commission which has a crucial role to play in ensuring that the Guyana market becomes and remains a very competitive place. With the Guyana economy structured the way it is, the Competition Commission is perhaps the single most important body that could enable this country to achieve the benefits that competition brings. Before getting to a fuller discussion of the two preceding points, the article will continue with an examination of the industry structure of the economy. It will start with the bauxite and gold industries.

Bauxite

At first glance, the bauxite industry would appear very uncompetitive in Guyana. There are only two firms, BOSAI, which operates out of Linden and RUSAL, which operates out of the Kwakwani area. The Government of Guyana also has shares in both companies.

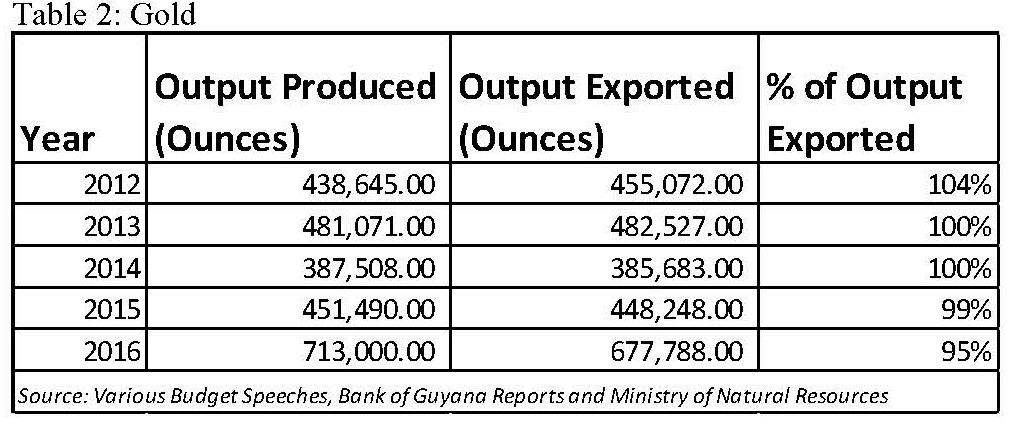

It has a 10 per cent stake in the RUSAL-dominated operations and a 30 per cent stake in the BOSAI-dominated entity. From the production side, one would classify this industry as duopolistic in nature. The amount of bauxite produced by the two companies is shown in Table 1 below. It should be noted that in cases where the export percentage exceeded 100, there was enough ending inventory from the prior year to make that possible.

However, the two companies do not sell their output in the Guyana market. It is sold in the foreign market. Consequently, any discussion about bauxite regarding Guyana ought to be about what happens outside of the country. At the global level, the industry is highly oligopolistic and Guyana is not part of that structure. There are approximately 25 big producers of bauxite in the world, with the top 5 producers controlling over 85 per cent of the global output. Recent data has identified the top five producers as Australia, China, Brazil, Guinea and India. Guyana’s share of the global output is less than one per cent.

In 2007, the industry contributed about three per cent to Guyana’s gross domestic product (GDP) and nearly 15 per cent of the country’s foreign earnings. By 2016, bauxite was contributing one per cent to Guyana’s GDP and about six per cent of its foreign earnings. The importance of bauxite to the Guyana economy could change with access to cheaper sources of energy. This could lead to the emergence of value-added activities in the domestic economy and bring the uncompetitive nature of the industry into sharper focus.

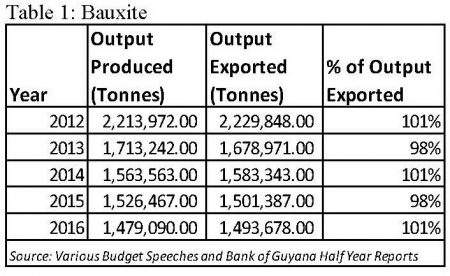

In contrast to bauxite, the gold industry in Guyana has a much larger number of producers and is much more complex. First, the industry is made up of two companies that operate on a very large-scale. It is anticipated that these two foreign investors, Guyana Goldfields and Troy Resources, would have collectively an annual production in the vicinity of 284,000 ounces of gold at full throttle.

At 2016 output levels that would represent between 35 to 40 per cent of annual declarations. Second, the industry differs from the bauxite industry in that it has a large number of small-scale producers. According to the Ministry of Natural Resources, small miners were responsible for 70 per cent of the industry’s declarations in 2016. Yet, its competitive character remains in question.

Like bauxite, the bulk of the declared gold is sold in the foreign market as shown in the Table below. Currently, most of the exported gold is produced by small-scale miners. Given the maximum annual production expected from the two large-scale miners over the life of their operations, the output of the smaller miners was likely to dominate export sales for the foreseeable future. The foreign market is relevant to an assessment of the gold industry. The top five producers of gold only account for 44 per cent of the global gold production which makes the global market much more competitive than that of bauxite. With Guyana’s output equivalent to 22 metric tonnes of gold, its global market share like that of bauxite is less than one per cent.

(To be continued)

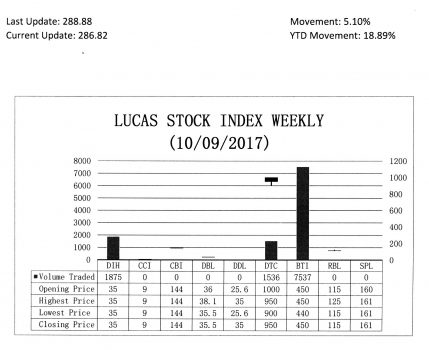

The Lucas Stock Index (LSI) declined by 0.71 per cent during the second period of trading in October 2017. The stocks of three companies were traded with 10,948 shares changing hands. There were no Climbers and there was one Tumbler. The stocks of the Demerara Tobacco Companies (DTC) declined five per cent on the sale of 1,536 shares. In the meanwhile, the stocks of the Guyana Bank for Trade and Industry Limited (BTI) and Banks (DIH) remained unchanged on the sale of 7,537 and 1,875 shares respectively.