Part 3

Overview

For the past two weeks, the articles have been focused on the issue of competition. Last week’s article sought to use the concept of market structure to determine competitiveness within industries in Guyana, with focus being placed on the bauxite and gold industries. It was established that most of the output of these industries is

The gold industry on the other hand has a different fate. It has a much larger number of producers and is much more complex, facing far greater competition than bauxite globally. But this industry has another dynamic to it. An issue that arises is whether the large number of rights being approved by GGMC, is spread across a large number of participants or if the rights are concentrated in the hands of a few holders. While the ownership of multiple rights is allowed, one needs to know if, as currently configured, it fosters competition.

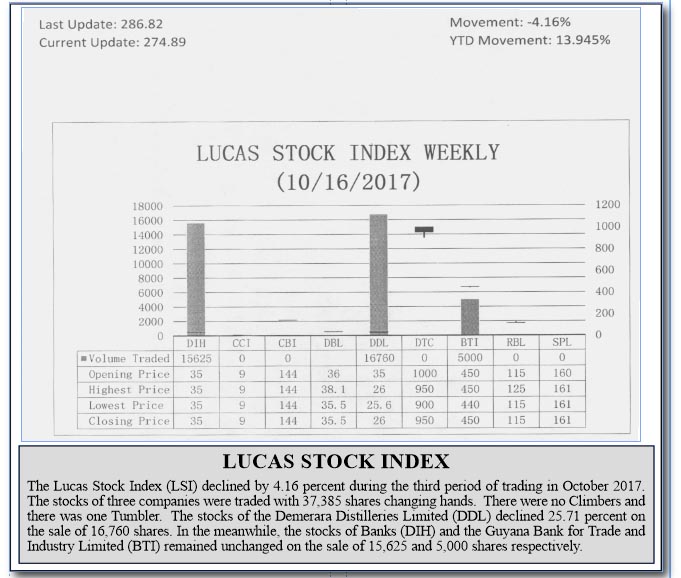

The article also highlighted the importance of the role of the Competition Commission in enabling the country to achieve the benefits that competition brings. This week’s article will look at competitiveness within the manufacturing sector in Guyana, specifically focusing on beverages ‒ aerated drinks, beer and rum. Attention will be paid to markets in which some of Guyana’s large companies operate. Banks DIH and DDL can be described as conglomerates since each company participates in several different markets. The strategy is a means of diversifying the business risk of the companies. Banks DIH is involved in four different lines of business which are beverages, financial services, food and restaurants and other services. DDL on the other hand is involved in three lines of business which are beverages, trading and services, including financial services.

Beverages

In measuring competition in the beverage industry, one must be careful and not end up comparing apples and oranges. Even though both Banks DIH and DDL are in the manufacturing sector and are known for blending and selling alcoholic products, they concentrate on different product lines that have clear implications for competition. Both companies produce rum and liqueurs. They produce soft drinks and bottled water. They also produce fruit juices. Even though they are consumed via drinking, the manufacture of fruit juices does not fall under the beverage line. It falls under food processing. Nonetheless, for the purpose of this article, it will be included in the discussion about beverages since it is an important part of the manufacturing operations of the two companies. Additionally, Banks DIH alone produces beer.

Largest producers

Banks DIH and DDL are Guyana’s largest beverage producers. Both companies obtain the lion’s share of their revenues from the sale of beverages. Unlike the bauxite and gold industries where the output is primarily exported, much of the beverages produced is consumed in the domestic market. In the local beverage market, these companies directly compete against each other with primarily aerated drinks, rum, fruit juices and water. They produce or distribute similar products under different brands: Coca Cola versus Pepsi, XM Rum versus El Dorado, Pinehill versus Topco, and Tropical Mist versus Diamond Mineral Water. The discussion of competition emphasizes the structure of the market for each product line. From this outlook, one could say that there is little to no competition and that the market for each product line was a duopoly. It is only when imports by companies like Ansa McAl and Massy are taken into account, the structure of the industry changes, but remains highly concentrated as an oligopoly.

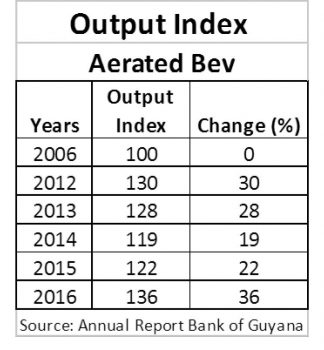

The change in the structure of the industry should have implications for each product line. However, output data presents an interesting story. One finds data in the Annual Report of the Bank of Guyana on the output of aerated beverages, rum, beer and malts. There is no data on bottled water and fruit juices. Table 1 below uses the output index for aerated beverages. This is essentially soft drinks. The data show the change in output with respect to the base year 2006.

TABLE 1

Behaviour of output

One can see that the output increased at a decreasing rate from 2012 to 2014 before picking up in 2015. The behaviour of output seems to suggest that there was some type of pressure on the market for soft drinks. Admittedly, this writer cannot say with certainty from where the pressure in those years was coming. Further, this writer would not use the significant uptick in output in 2016 as an indication of a likely sustainable trend in output that was started in 2015 given that 2016 was a special year in Guyana and demand for soft drinks might have been abnormal. As such, further work is needed to understand better the soft drinks market.

Table 2 below shows the situation with rum and it is very intriguing. By 2012, the amount of rum being produced in Guyana compared to 2006 had declined by 65 per cent and the decline peaked at 66 per cent in 2013. The market structure for rum is a duopoly, making it a highly uncompetitive market. Here again, one does not know if the significant decline in output was designed to keep prices artificially high or if Guyanese had reduced their consumption of rum in favour of other beverages and caused output to decline. There is also a challenge that is coming from smuggled alcohol which might have driven the price down and caused the two producers to limit production. It is clearly a phenomenon that needs to be better understood.

TABLE 2

Nothing however could be more interesting than the situation of beer. Banks and GT beer are the only locally produced beers, making Banks DIH a monopolist.

(To be continued)