Recap

October’s focus has been on shedding light on the concept of competition. The articles this month covered a range of areas, which started with providing a comprehensive understanding of the concept of competition, providing explanations and painting pictures of the different types of market structures that exist. The effort included analyzing specific industries to determine whether or not competition

This week’s article will bring an end to discussions on the topic of competition. Having seen how concentrated many industries in Guyana are and the need for some consideration to be given to finding ways of expanding competition, focus will be placed on the regulator. To get to that point, one must consider the role of the Competition Commission of Guyana. This rather reticent institution holds the key to creating space in highly concentrated industries and expanding competition. As such, this article will also examine the role of the Competition Commission in implementing the Competition Act, particularly as it relates to enabling the country to achieve the benefits that competition brings and in promoting diversification in the Guyana economy.

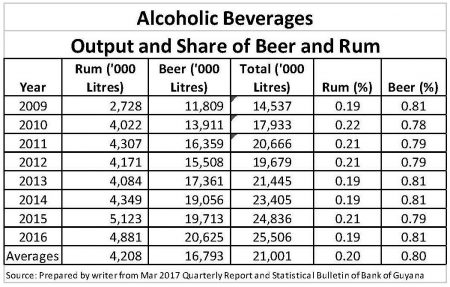

A man’s favourite- beer

Nothing could be more interesting than the situation of beer. Unlike that of rum and the other industries examined, Banks beer is the only locally produced beer and the primary market for Banks beer is the Guyana market. As such, where beer is concerned, Banks DIH is a monopoly. The focus on one product in the activities of a conglomerate might appear to be unfair, but the production tables suggest otherwise. As could be gleaned from the Table below, beer constitutes about 80 percent of the production of alcoholic beverages in Guyana and Banks DIH gets most of its revenues from alcohol and other beverages. Thus, a focus on beer is not unfair.

TABLE 3

Banks beer receives competition from Ansa McAl with its Stag brand. Other beers like Desperados, Red Stripe, Heineken, Carib and Corona are in the market and limit the dominance of Banks.

Governing body – Role

The discussion about competition is not intended to target any particular business or industry. It is true that the port operation industry is not competitive and so is the banking industry. It is intended to stimulate further consideration about competition. It is hoped that over time all of these industries will be examined to determine the risks associated with insufficient competition. It is to be remembered that what matters most is the welfare of the consumer and the ability of the country to hold its own in a globalized economy. US competition laws are over 100 years old and still have one goal in mind and that is to protect the process of competition for the benefit of consumers. More efficient production could lead to lower prices, greater consumer surplus and more exports. The people who could help to bring such favourable circumstances to Guyana are sitting in the office of the Competition and Consumer Affairs Commission. It is not possible to provide a comprehensive discourse about the Competition and Consumer Affairs Commission since its work covers a wide range of activities and offences. Yet, the importance of this institution requires an understanding of its defensive role in favour of consumers.

The Competition and Consumer Affairs Commission is a corporate body established under the Competition and Fair Trading Act of Guyana, which came into effect in 2006. This Act, like similar laws around the world, aims at promoting fair competition in local industries and sectors for the benefit of consumers. The Commission has been operational for about 6 years and is charged with administering and enforcing the Act. The Commission is the dominant authority in the country in addressing issues of competition.

The Commission is tasked with three primary functions. The first involves promoting competition – publicizing, advocating and conducting industry and sectoral studies to ensure that industries do not remain or become anticompetitive. The Commission has to be active in relation to the strategies and conduct of participants in the industry. It must remain aware of the situation in local industries and sectors. The Commission is therefore about encouraging competition while enhancing economic efficiency in production, trade and commerce. The second function involves the prohibition of anti-competitive business conduct that prevents, restricts or distorts competition or constitutes the abuse of a dominant position in the market. It is therefore about expanding business and not stopping it. This objective is often lost in the discourse of competition even though breaking up monopolies lead to additional market participants. The third function is the promotion of welfare and interests of consumers. Increased competition often means better products at better prices for consumers.

To pursue these functions, the Commission is vested with power to declare certain business practices as abusive of a dominant position. It can prohibit competitors from withholding supplies or services that a competitor might need from the dominant market participant. The Commission can order the termination of an agreement that restricts competition and prohibit companies from discriminating on the basis of price. Offending enterprises can be ordered to cease and desist from any conduct that has, and was likely to have, the effect of reducing competition. These actions are possible because the Commission has investigative powers that can enable it to act on allegations of anti-competitive conduct that might be reported to it.

However, in addition to these authoritative roles, the Commission is also tasked with the mandate of undertaking studies and publishing reports and information regarding matters affecting the interests of consumers. Educating consumers is of paramount importance to the Commission which it does through advocacy and other awareness initiatives. It is very proactive in this regard. But staffing issues might be holding it back from giving greater effect to its purpose.